According to Elon Musk, Tesla (TSLA) will end 2020, delivering 500,000 electric cars to its customers. According to Wall Street, however, Tesla will miss that target – and perhaps by much.

Cowen & Co. predicts that Tesla will lose its brand by more than 30,000 cars, while RBC Capital projects that Tesla will drop only about 10,000 cars below the brand, and JMP Securities believes that 9,000. Wedbush, Needham & Co. and Tiger Securities – all of these investment banks are also publicly predicting that Tesla will fall short of its target of 500,000 cars in a single year, albeit by smaller margins.

But “Tesla Bear” Gordon Johnson of GLJ Research? He thinks Tesla will reach his number, and a few more.

Johnson sets out his thesis, first dismissing his fellow analyst’s predictions of a sales failure (“the sandbags on the seller’s side in these forward deliveries, making it easier for TSLA to” win “) and then explaining why, in his opinion, Tesla will indeed exceed delivery estimates this quarter – and why it doesn’t matter.

Basically, Johnson’s thinking goes like this: Distance commercial transactions between Tesla’s electric cars and its consumer car buyers in the fourth quarter of 2020 will in fact be only about 174,000, explains Johnson. But if Musk left things like that, he would have 8,000 cars short of his 500,000 promised deliveries for the year – a big disappointment. So to get the 182,000 deliveries he needs in the fourth quarter, to complete his 500,000 promised cars delivered for the year, Musk will have Tesla supplement sales “in the real world” with a combination of sales for corporate fleets and car rentals, for car leasing companies, car salespeople and “related parties”.

With those additional sales accounted for, Johnson projects that Tesla will easily pass the 182,000 car mark in the fourth quarter, selling perhaps as many as 184,000 Teslas and thus “exceeding estimates” of 500,000 deliveries for the year.

And yet, in Johnson’s view, “500,000” isn’t really the right number to focus on – first because it’s an artificial goal line that will be crossed artificially, but second because 500,000 is already a lowball number. As the analyst recalls, “in 2018 the TSLA directed deliveries from 2020 to 750 thousand to 1 million” of cars delivered and, before that, Musk directed “deliveries from 2020 to 1 million in 2016”. Johnson predicts (and history suggests he’s right about that) that “most media outlets [will nevertheless] forget TSLA’s 2018 guidance for deliveries in 2020 of 750,000 to 1 million cars and praise the coming [500,000+] deliveries were considered a “big win” for the company. “

And that brings us to the heart of the matter: would 500,000 deliveries in a single year really be a “big win” for Tesla? When you consider that the Ford automaker sells 500,000 cars every 34 days, General Motors sells 500,000 cars in 24 days and Volkswagen needs just 17 days to sell 500,000 cars, while Tesla currently boasts a market capitalization of more than three times the market value of Ford, GM and Volkswagen combined, Johnson continues to insist that Tesla’s valuation remains seriously out of step.

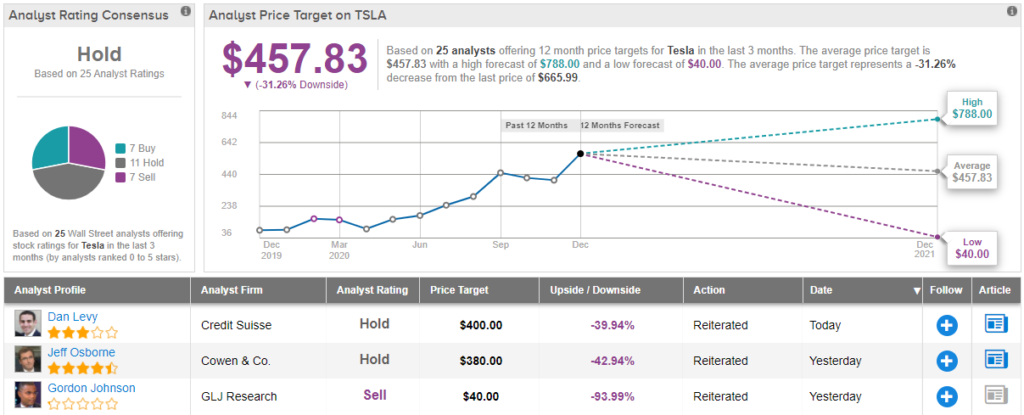

In short, Johnson classifies the stock as a “sale” and sets a $ 40 price target for the $ 666 price. This number implies a 94% drop from current levels. (To look at Johnson’s history, click here)

Overall, Wall Street is equally divided between a battle of bulls against bears in this giant electric car. Of the 25 analysts surveyed in the past 3 months, 7 are optimistic, 11 remain paralyzed and 7 are pessimistic on the TSLA – all add up to a Hold consensus rating. With a potential downside of ~ 31%, the target consensus price for the stock is $ 457.83. (See TSLA stock analysis at TipRanks)

To find good ideas for trading EV shares at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that brings together all TipRanks stock insights.

Disclaimer: The opinions expressed in this article are exclusively those of the analyst presented. The content should be used for informational purposes only. It is very important to do your own analysis before making any investments.