After President Donald Trump signed the Congressionally approved $ 900 billion coronavirus relief package, the Internal Revenue Service (IRS) and the Treasury Department began sending the second round of stimulus checks.

Payments are generally $ 600 for singles who earn less than $ 75,000 and $ 1,200 for couples who have filed taxes together and earn less than $ 150,000. Those who earn more will receive reduced payments.

People with qualified children will also receive $ 600 for each child. Dependents over 17, however, are not eligible for the additional payment.

Treasury Secretary Steven Mnuchin said on Tuesday that direct deposits for every eligible man, woman and child had started. He also said that paper checks would be sent as of December 30.

In the $ 900 billion stimulus bill, Congress set a cutoff date on January 15 for the IRS to send stimulus payments, leaving just 17 days to process more than 100 million payments since the first payment was launched in December 29th.

Although direct deposit payments are sent, the IRS said those payments can be marked as “pending” or “provisional” until January 4, according to CNET.

If the IRS does not have your current direct deposit information on file, you will receive a check in the mail, which may take longer to reach your pocket compared to direct deposit.

Paper checks accounted for 22% of payments for the first round of stimulus checks, according to the Treasury Department.

The IRS said people can track the first and second payments through the “Get My Payments” portal. However, as of Sunday afternoon, the portal was offline.

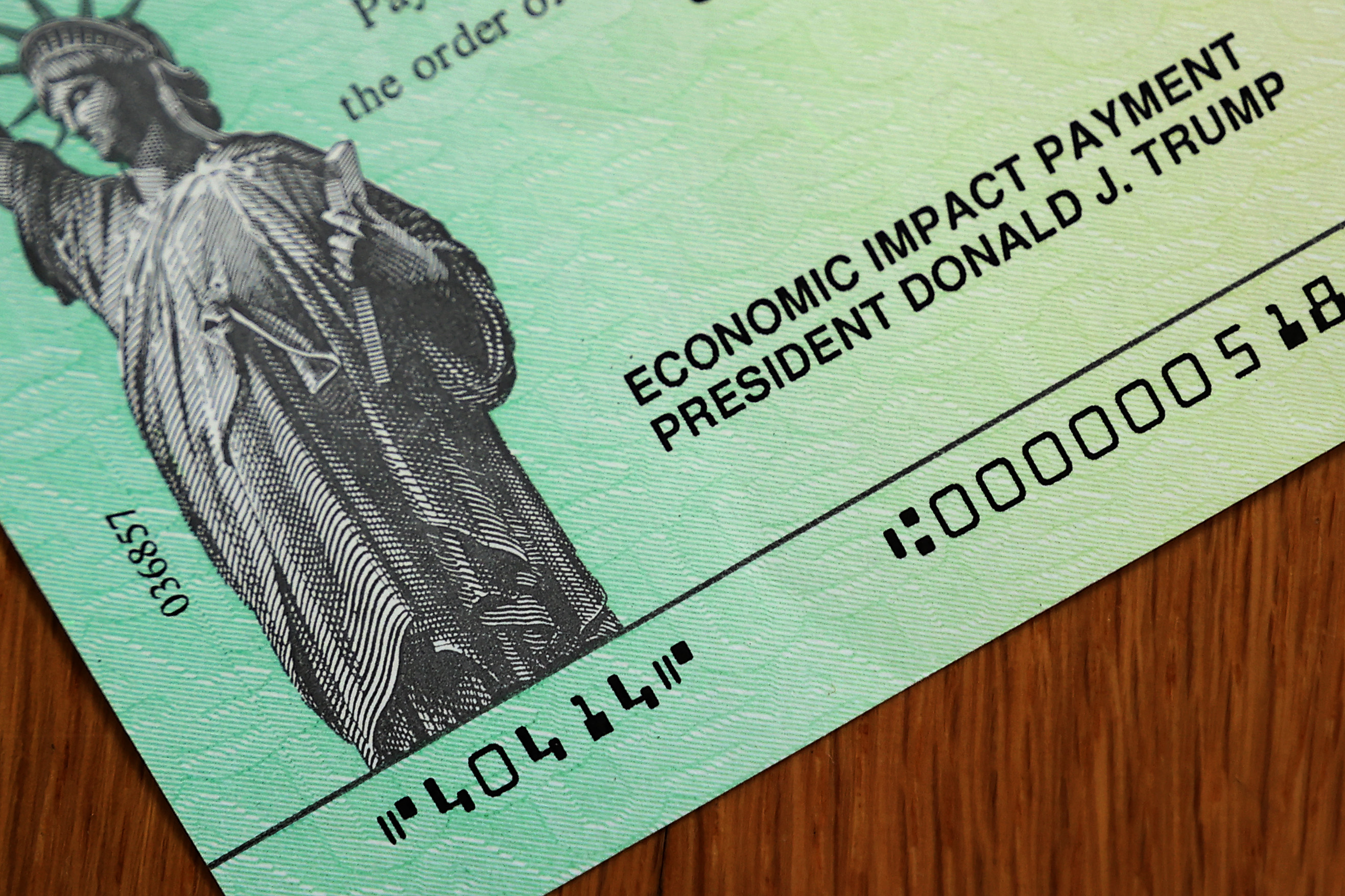

Photo by Chip Somodevilla / Getty Images

“We are working quickly to distribute this second round of payments as quickly as possible. This work continues through the holidays and into the new year as we prepare for the next filing season. We ask everyone to visit IRS.gov in the coming days for latest information on these payments and for important information and assistance with filing your 2021 taxes, “said the IRS in a statement published on December 29.

If you do not receive your stimulus check in full by January 15, you will need to claim the missing amount when filing your 2021 federal tax returns using the IRS recovery discount credit. You can also claim any money the IRS owes you from the first stimulus package through Discount Credit.

In addition, Americans awaiting direct deposit payments or paper checks sent by mail should be advised of fraud.

The Federal Trade Commission (FTC) has issued notices that the government will not call, send text messages or e-mail requesting your Social Security number, bank account or credit card details. The FTC also warned that the government will not ask for any advance payment to receive its stimulus check.

“Anyone who does is a scammer,” the FTC said in a December 22 statement.

Newsweek contacted the IRS, but received no response in time for publication.