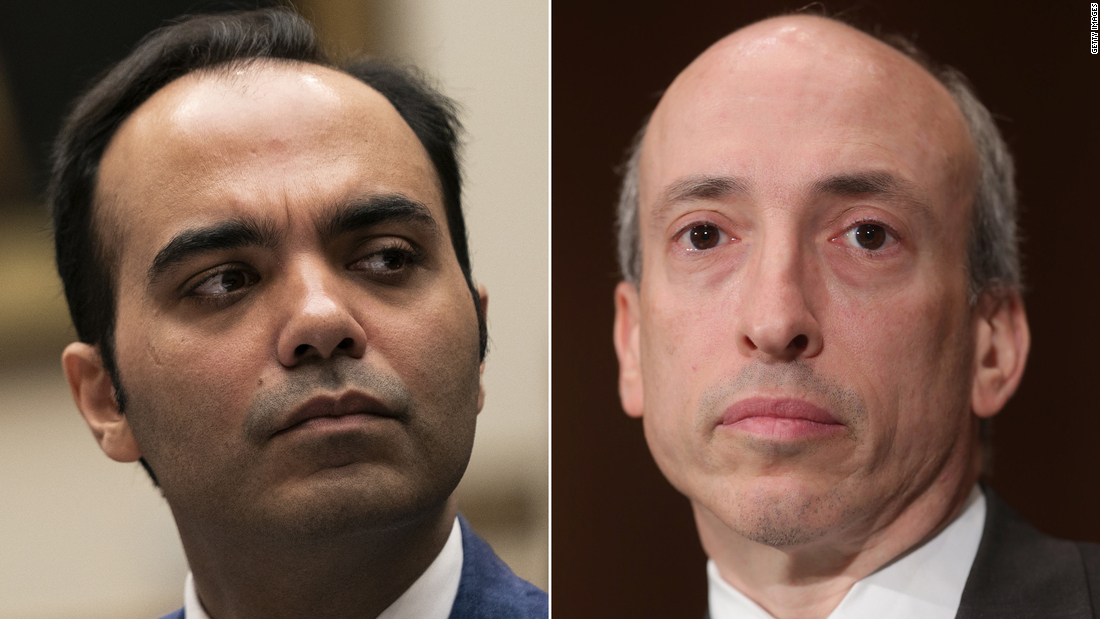

Gensler and Chopra are allies of Senator Elizabeth Warren from Massachusetts. Currently a member of the Federal Trade Commission, Chopra will – if confirmed – return to the CFPB, where he previously served as its primary student loan oversight body. The appointment of Gensler, a former Goldman Sachs executive who has become a fierce advocate of stricter regulations for big banks, is a sign that Biden’s team is positioned to take a tougher stance with Wall Street than previous administrations.

The choices are a victory for the progressive wing of the Democratic Party, which led the attack for more aggressive supervision of the financial sector. Chopra was on the ground floor with Warren, who built the CFPB as part of the Dodd-Frank law passed in response to the 2008 financial crisis. Gensler worked in the Obama administration for a time as chairman of the Commodity Futures Trading Commission, where he earned a reputation for online. tough on regulatory issues.

When news of the choices came on Sunday night, progressive groups and others committed to lessening the influence of Wall Street in Washington cheered.

“There are many financiers who get incredibly rich by taking advantage of relaxed ‘regulators’ on both sides to essentially defraud the American people. These people are nervously conducting Zooms with expensive lawyers now,” said Jeff Hauser, head of the Revolving Door Project . “Biden’s financial regulatory regime is now exactly what he needs to produce tangible and positive results for everyone who is not disgusting bankers.”

Chopra was among the names of the preferred potential candidates listed at the beginning of the transition by the Progressive Change Institute, which was founded by the same duo who formed the Progressive Change Campaign Committee, a group aligned with Warren.

“If Biden selects someone with the seriousness of Rohit Chopra to lead the CFPB, that would be a great victory for consumers and a sign that the executive branch will be used to achieve tangible results for the American people,” Sunday. “Rohit has a proven record of challenging corporate abuse on behalf of ordinary families who don’t want to be deceived.”

Chopra’s choice, who held the Student Loan Ombudsman title during his time at the CFPB, will also increase confidence among progressive leaders who have been pressing Biden to act quickly and ambitiously to deal with the student debt crisis.

Warren and future Senate Majority Leader Chuck Schumer of New York asked Biden to use his executive authority to cancel up to $ 50,000 in student debt per borrower. Biden, however, seems reluctant to meet that figure or to bypass Congress with his more limited proposal of $ 10,000 per person.

But he asked lawmakers to act and plan, through his Department of Education, to extend the current pause in student loan payments.

This story has been updated with additional reports.