Jeff Sica of Circle Squared Alternative Investments on possible cinematic treatments for the GameStop stock frenzy and Disney profits.

In all the craziness of Sunday night’s Super Bowl, viewers in some of America’s biggest cities may have missed a Reddit ad.

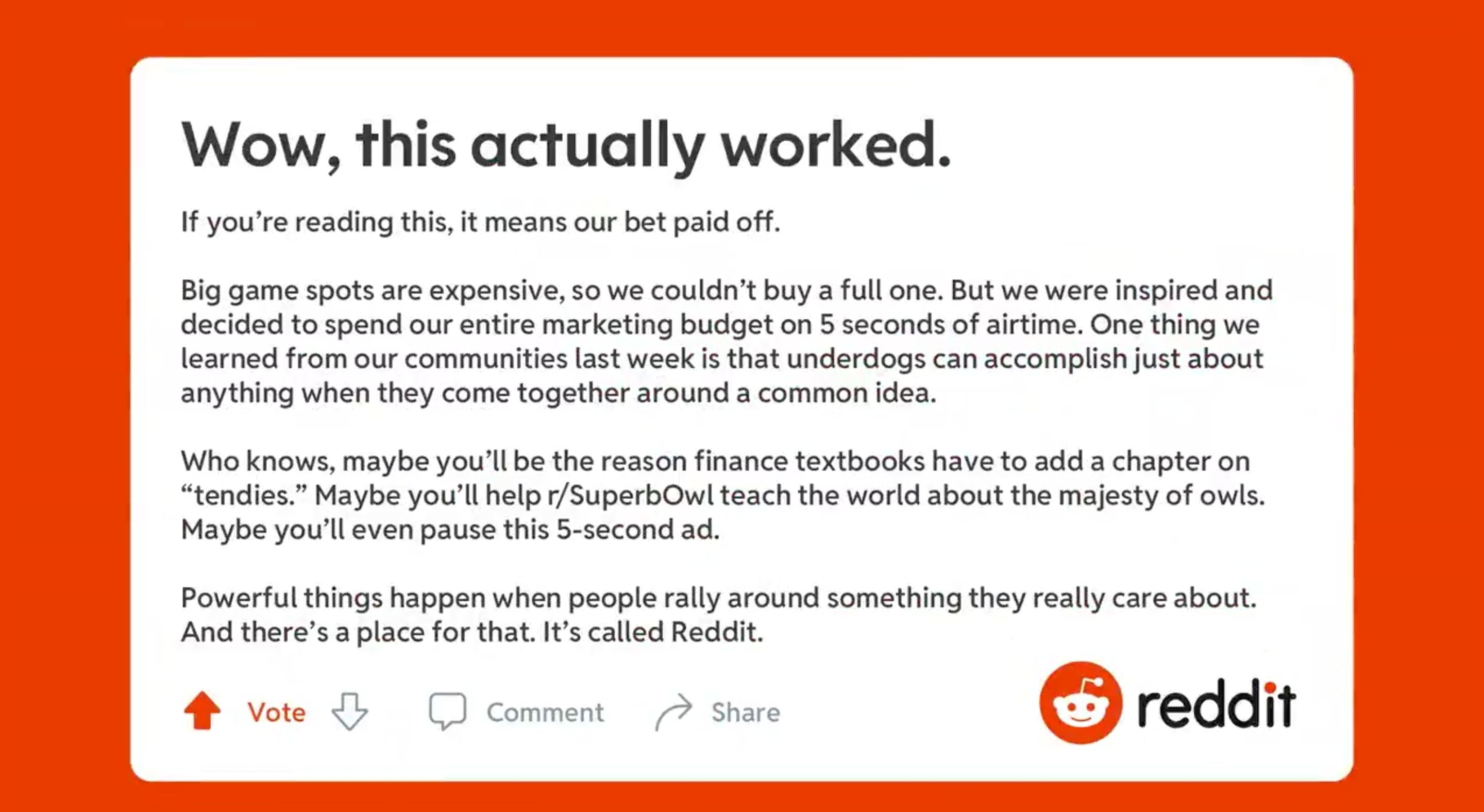

The announcement lasted a total of five seconds, consisting of a simple message honoring the “underdogs” involved in the GameStop commercial frenzy last month, which seemed to be squeezed between a car commercial and a video of horses.

AFTER GAMESTOP STOCK FRENZY, ‘VERY LITTLE GOVERNMENT CAN DO TO REGULATE TRADING’: EX SEC PRESIDENT

“Wow, this really worked,” read the message from Reddit. “If you’re reading this, it means that our bet was worth it.”

The company acknowledged that while it could not buy a full Super Bowl ad, it was “inspired” and decided to spend its entire marketing budget within the five seconds of broadcast. According to Variety, a full 30-second Super Bowl ad costs about $ 5.5 million. Therefore, a five-second ad would cost about $ 915,000.

But the ad did not air nationally, since the big chains – especially for the Super Bowl – do not split the ad stock. This aired on several CBS-owned stations, including WCBS in New York, KCBS in Los Angles, WBBM in Chicago and KPIX in San Francisco.

“One thing we learned from our communities last week is that underdogs can do anything when they come together around a common idea,” continued Reddit, referring to the platform’s speculative investment discussion forum WallStreetBets. “Who knows, maybe you are the reason why finance textbooks have to add a chapter on“ trends ”. Perhaps you will help the / SuperbOwl to teach the world about the majesty of owls. You may even pause this 5-second ad. Powerful things happen when people come together around something that really matters. And there is a place for that. It’s called Reddit. “

Reddit’s marketing director, Roxy Young, told FOX Business in a statement that the Super Bowl ad came in “just a few days” with the help of its agency partners on R / GA.

“I am very proud of what we achieved in just five seconds and I think it captures the heart of Reddit in our unique and brilliantly absurd tone,” added Young.

DISCOVER FOX BUSINESS ON THE MOVE BY CLICKING HERE

The announcement comes after Reddit users teamed up last month to buy the video game retailer’s call options, causing GameStop’s stock to rise to unprecedented levels and hurt short sellers in the market. According to data provided to FOX Business by financial data company Ortex, short sellers lost at least $ 19 billion in GameStop shares on January 29.

WallStreetBets then began targeting other heavily sold shares, including AMC Entertainment Holdings, Blackberry Limited, Bed Bath & Beyond, Express Inc and Nokia Corp, among others.

The move caught the attention of Wall Street and Main Street equally and prompted investment platforms like Robinhood to restrict securities trading. Robinhood’s decision sparked anger online, resulting in two lawsuits filed against the company before the change was reversed.

However, some lawmakers, like Rep. Alexandria Ocasio Cortez, DN.Y., Senator Ted Cruz, R-Texas, and Senator Elizabeth Warren, D-Mass., Agreed that there should also be a congressional investigation into Robinhood’s action. Robinhood co-founder Vlad Tenev was reportedly asked to testify on Capitol Hill before the House Financial Services Committee on February 18 at 12:00 pm Eastern Time to deal with the recent market volatility.

Tenev previously said in a Twitter thread that the investment app restricted shares because it has many financial requirements, including “SEC net equity obligations and clearinghouse deposits”, which fluctuate based on market volatility.

“These requirements exist to protect investors and the markets and we take the responsibility to take them seriously, including through the measures we take today,” he added. “To be clear, this decision was not made based on the direction of any market maker we target or other market participants.”

His comments were made amid reports that large hedge funds with ties to Robinhood, including Sequoia Capital and Citadel Securities, were involved in the decision to stop trading. Both companies denied involvement in the decision.

CLICK HERE TO READ MORE ABOUT FOX BUSINESS

In addition, Treasury Secretary Janet Yellen met with the heads of the Federal Reserve, the Federal Reserve Bank of New York, the Commodities Future Trading Commission and the Securities and Exchange Commission to determine whether “additional actions” would be justified in relation to the GameStop surround volatility market. Both the SEC and New York Attorney General Leticia James also said they would conduct their own analysis on the matter.

| Ticker | Safety | Last | change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP | 59.95 | -3.13 | -4.96% |

GameStop’s shares fell more than 7% during Monday’s trading session until the time of publication.