(Bloomberg) – The potential listing of Porsche by Volkswagen AG would be a strategic turning point and indicates that the unprecedented turmoil in the auto industry may just be beginning.

The German industrial giant and other established companies navigated a global pandemic much better than initially feared, with robust profits and large amounts of cash flow. Even so, its ratings are stubbornly low compared to Tesla Inc.

No automotive CEO has regretted this as openly and often as Herbert Diess, who routinely makes headlines emphasizing the urgency with which VW must move to transform. Exploring a Porsche list is a nod to that need and will be a kind of test for your future.

“There is a loss of power due to the low valuation, which Diess complained about in the past, and that is a significant disadvantage,” said Juergen Pieper, an analyst at Bankhaus Metzler. “A Porsche IPO would be the silver bullet.”

VW’s preferred shares rose up to 1% shortly after the start of regular trading in Frankfurt.

Porsche’s appeal is obvious to investors. Bloomberg Intelligence analyst Michael Dean estimates that the 911 maker could withstand an assessment of 110 billion euros ($ 133 billion) in an initial public offering, about 20 billion euros more than investors currently value VW .

But doing this business will not be simple because of the institutional obstacles that have prevented Diess, 62, from trying to shake up VW since he became CEO in 2018. Major decisions must be approved by dominant and often disagreed shareholders, led by the Porsche and Piech family and by the German state of Lower Saxony, which tends to side with powerful unions.

‘Old-Auto’

What Tesla’s meteoric rise did, however, was to send a clear signal to Diess that extreme measures must be taken to turn the capital markets to “old” companies. The review of VW’s options for Porsche comes in the wake of Daimler AG’s decision to break up its truck unit after years of management opposition to such a move. Its shares have advanced 13% since then and are hovering around a three-year high.

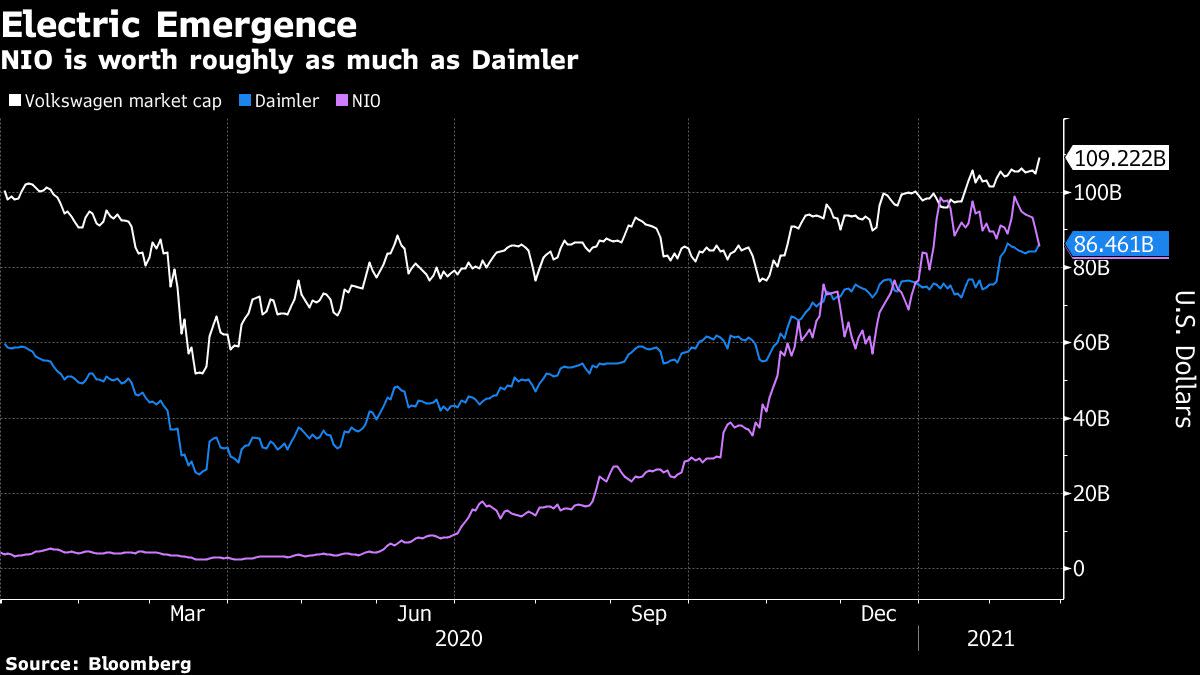

Even after the spinoff momentum, Daimler is worth about $ 86 billion, almost equaling the valuation of NIO Inc., which generated about a tenth of last year’s revenue.

Investors have had a bleak view of the automakers’ ability to keep up with new competitors, without the burden of expanding production networks centered on combustion engines. Ford Motor Co. put that reality in sharp relief this week when it announced plans to stop selling any electric vehicles last year in Europe to offer only fully electric passenger cars by the end of the decade.

Of course, VW will spare no expense in its efforts to reach Tesla, having budgeted a larger share of its € 150 billion budget for investments in electric cars and software over the next five years. No matter how strong the gains are now, they will be hurt by all the costs associated with the retirement of some operations.

“VW’s balance sheet may not be adequate to guarantee accelerated investments in electric and autonomous vehicles and to finance an accelerated reduction of legacy issues,” said Jefferies analyst Philippe Houchois in a note.

Ferrari-like

Porsche listing profits can go a long way, as the power of its brand and its prestige of luxury are on par with Ferrari NV, one of the rare recent success stories among traditional automakers. Fiat Chrysler spun off the supercar maker in 2015, and shares have soared 282% since the IPO.

The Porsche 911 alone probably exceeds Ferrari’s earnings before interest, taxes, depreciation and amortization, according to Dean, an analyst at Bloomberg Intelligence. It also has a strong electrical history to tell, with the Taycan model that debuted in 2019 presaging a shift to about half of sales being battery powered by 2025.

Porsche will add a more spacious version of the Taycan to the line later this year, then launch a battery-powered version of the Macan crossover in 2022 that will be based on a new dedicated EV platform being co-developed with Audi.

Nothing new

The idea of a separate list for Porsche is not new as such. Three years ago, Lutz Meschke, chief financial officer of the sports car manufacturer, pointed out the potential for value during an informal meeting at a research and development center outside Stuttgart, only to be rebuked by VW headquarters.

Opposition within VW’s board appears to have subsided in the wake of an industry transformation that many predicted for years, but is now gaining momentum at an unprecedented pace. Approximately 10% of passenger vehicles purchased in Europe in the fourth quarter were battery powered. In December, the participation was around 14%.

Still, a Porsche list is far from certain. VW started an asset review half a decade ago, aiming at more decentralized and agile reporting lines and simplifying its difficult to control conglomerate structure. The results of reform efforts have so far been modest, with attempts to separate niche brands, such as Ducati and Lamborghini, undermined by key stakeholders. The 2019 reduced IPO of the Traton SE truck unit was almost derailed by internal disputes.

“You would think that the Italian business would have been easier to sell domestically, and the fact that it did not raise the question of why Porsche would happen,” said RBC Capital analyst Tom Narayan, by telephone. “It is frustrating for traditional automakers. Tesla can use capital currency to finance growth and grow in its backyard. “

(Updates with VW shares being traded in the fifth paragraph.)

For more articles like this, visit us at bloomberg.com

Subscribe now to stay up to date with the most trusted business news source.

© 2021 Bloomberg LP