Gabe Plotkin spent the first half of January defending his hedge fund portfolio from a Reddit mob, the second half trying to convince investors that he can survive a 53% loss and the beginning of February explaining to Congress what happened .

Now, with the public spectacle waning, the more concrete sign is still emerging that his Melvin Capital Management may indeed be able to grow again. After adjusting the strategy, Plotkin achieved a gain of almost 22% in February, about eight times the return on the S&P 500.

Thus begins the most arduous part of the 42-year-old hedge fund manager’s attempt to get out of the hole left by the January confrontation, in which retail investors organized themselves on social networks to boost stocks like GameStop Corp. Melvin and others bet would fall. The episode cost its investors – including billionaire Steve Cohen, Brown University and the Robin Hood Foundation – more than $ 6 billion.

Photographer: Alex Flynn / Bloomberg

But even with the recovery, the Plotkin fund, which had $ 8 billion in early February, will need to produce an additional 75% gain for previous clients before it reaches equilibrium. Customers who stayed or joined the company are betting that he will be able to do so due to his track record, which has ranked him as one of the best stock pickers so far this year.

Last month’s performance was especially welcome for investors who decided to disburse a collective $ 250 million in early February – probably seeing this as an opportunity to increase their exposure to a hedge fund that had been closed for new capital.

This vote of confidence followed an investment in late January by Ken Griffin, his partners and hedge funds Citadel, and Cohen’s Point72 Asset Management, which together gave the company $ 2.75 billion in exchange for a three-year minority share of Melvin’s revenue. The deal was closed in a matter of hours.

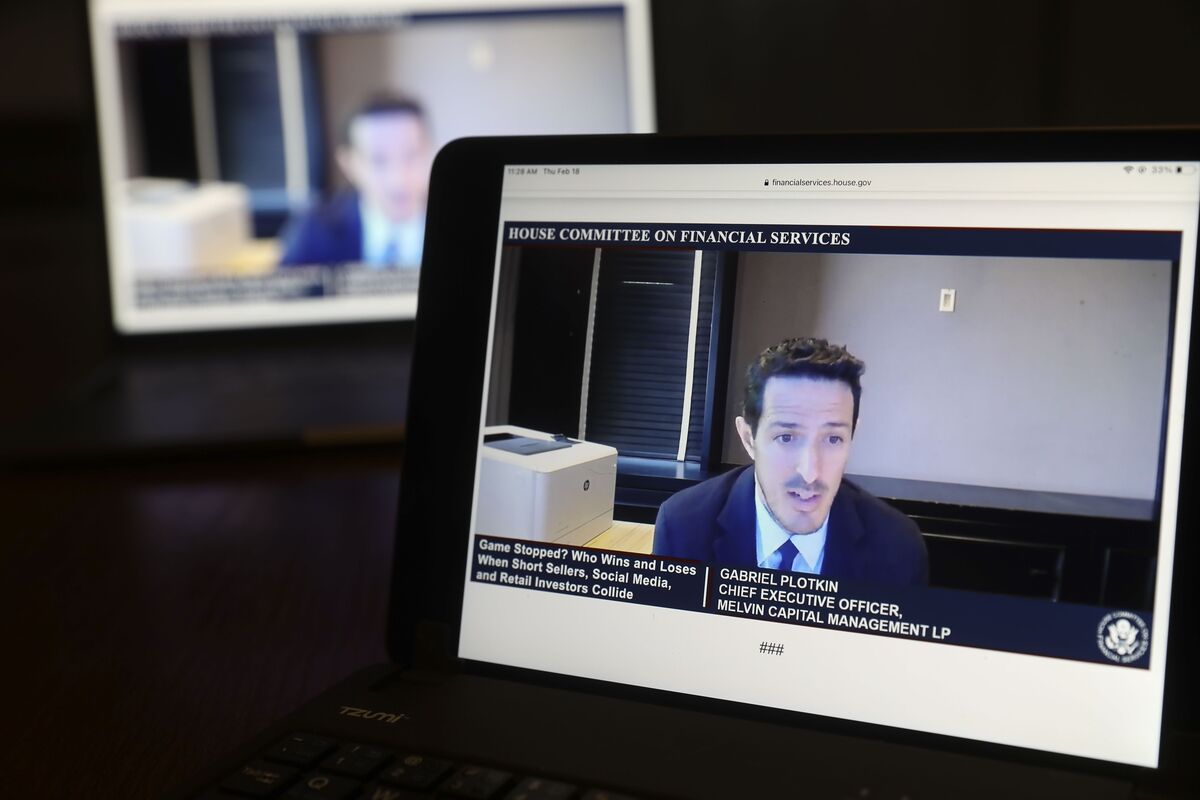

Plotkin said in his statement to the House Financial Services Committee last month that Griffin had contacted him and that the cash injection was not an emergency ransom.

People close to their sponsors say they have doubled because they have faith in their business acumen and personally like Plotkin, who is known to be family-oriented and relatively good in an industry that is famous for being cruel.

Betting Modification

He is also a confident risk-taker. Since his days at Cohen’s store, Plotkin has been known to take great positions on the long and short side. His recent performance suggests that the January defeat did not impair his ability to make money.

He modified his stock bets that he hopes to plummet, saying in his testimony that he would avoid crowded shorts. A person familiar with his strategy said he would also take on smaller positions to limit exposure to isolated companies. And Plotkin told his team of data scientists to scour social media and message boards for actions that retail investors are taking.

He stopped using exchange-traded options that appear in his quarterly files with the Securities and Exchange Commission – clues that allowed his company to be chosen by the Reddit crowd.

Read More: Reddit crowd beats Melvin Capital in warning to industry

Some hedge fund watchers question whether Plotkin will still be able to produce successful returns without large short positions. In Melvin’s first year of trading, 70% of the fund’s profits came from its bearish bets.

Plotkin, who grew up in a middle-class family in Portland, Maine, did not have a bright start in his money management career. At first, he landed at Griffin Citadel, hired to evaluate new businesses, instead of taking on a more coveted investment position. After a year, he jumped to Greenwich, based in Connecticut North Sound Capital, where he was a consumer equity analyst for two years, with limited commercial authority.

Then, in 2006, he got a job at Cohen’s predecessor company, SAC Capital Advisers, and in five years he was managing more than $ 1 billion in consumer-related stocks. He was among just a handful of managers at the Stamford, Connecticut-based company with such a large portfolio.

Cohen help

Within SAC, he was one of the biggest moneymakers, known for rigorous research by the companies he invested in, former colleagues said. He used detailed models to analyze everything from cash flows to product demand, rather than relying on market information from brokers. He was also one of the first users of credit card data.

Plotkin announced that he was leaving Cohen’s company in early 2014 to open his own store, just a few months after SAC pleaded guilty to securities fraud and paid a record fine to settle the six-year state government crackdown. United to insider trading. Plotkin, who was not charged with any wrongdoing, was one of several senior portfolio managers to step down. As part of the deal, Cohen would be – for a time – managing only his own money, thereby reducing the amount of money to be distributed among portfolio managers.

That December, Plotkin was up and running at Melvin. He named the company after his grandfather, who owned a convenience store and had the work ethic and integrity he wanted to imitate in his own business. Plotkin raised about $ 1 billion, including about $ 200 million from Cohen’s company, now called Point72. Its only low year was in 2018, when it lost 6%. In the following two years, his return was around 50%.

Overall, it posted annualized returns of around 30% from its start in 2014 until last year.

Plotkin declined to comment for this article, but during his testimony in the House, he showed confidence that it will change things.

“We will adapt,” he said. “The entire industry will have to adapt.”

– With the help of Saijel Kishan and Peter Eichenbaum