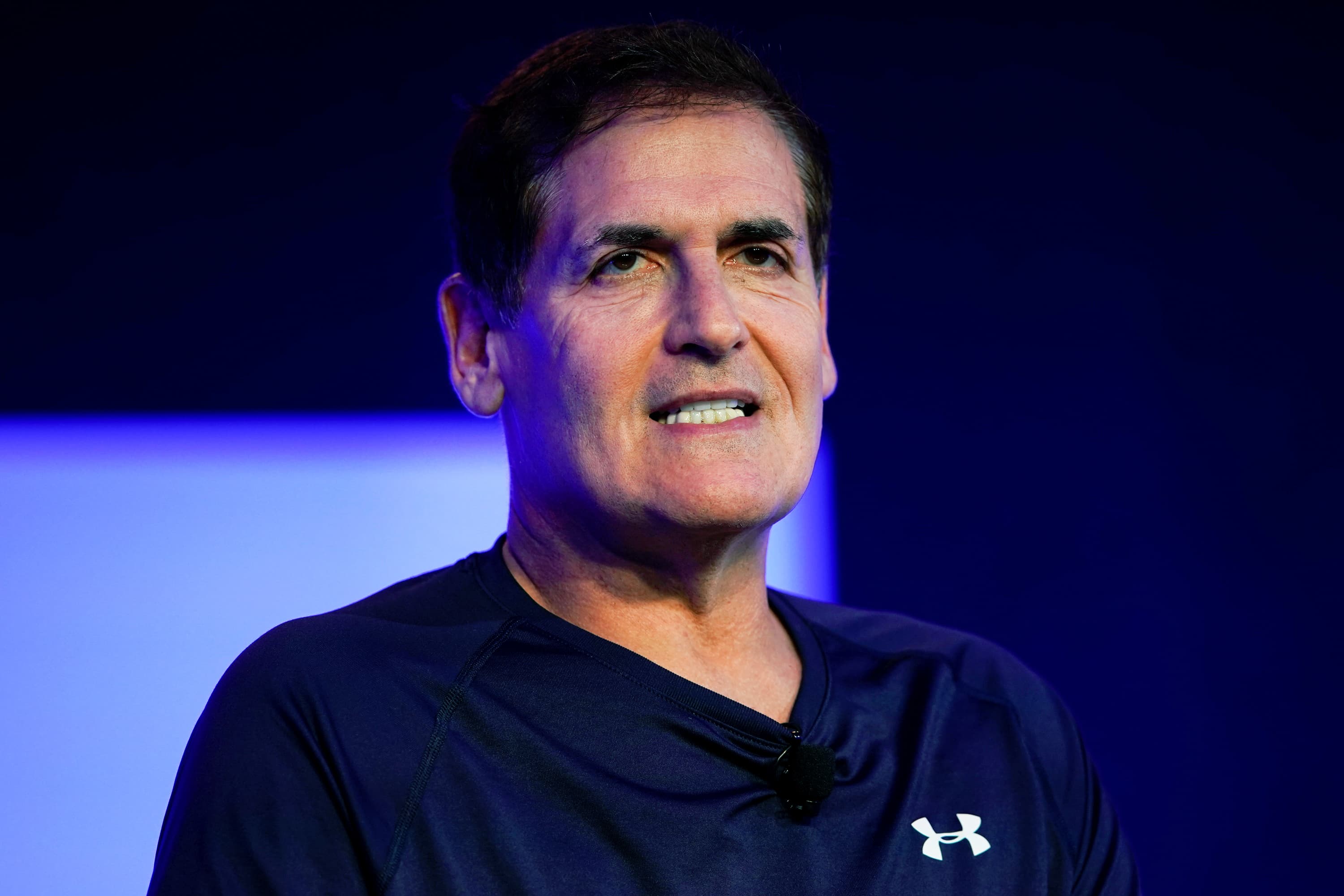

Billionaire businessman Mark Cuban told CNBC on Thursday that he was concerned about valuations in a number of asset classes and adjusted his investment portfolio accordingly.

“I cleaned my portfolio,” said Cuban in the “Squawk Box”. He said the Federal Reserve’s near-zero interest rates helped lead to “speculation” in several areas, “be it cryptocurrency, be it commercial cards, or non-fungible tokens”.

“When you have such low interest rates, you will have appreciable assets inflating,” said Cuban, who owns the NBA’s Dallas Mavericks and investor Shark Tank. “This creates a lot of concern because when interest rates go up, if and when, and who knows if it’s years or decades, we’ll see 4%, 5% interest rate again, people will have different decision criteria.”

Cuban, who made billions of dollars during the dot-com boom, said he hesitates to describe the current situation in the financial markets as “a bubble because it is a reality given interest rates”.

“But there will be deflation of some kind in these appreciable assets and it will be scary when that happens,” said Cuban, who sold Broadcast.com to Yahoo in April 1999 for $ 5.7 billion.

Cuban also commented on the frantic and short negotiation – led by the Reddit WallStreetBets crowd – that has taken shares like GameStop to dizzying heights in recent weeks. Despite his fundamental stock market concerns, Cuban said he likes what retail investors are doing en masse online and sees this as a great equalizer on Wall Street, which has historically been dominated by major institutional investors and hedge funds. .

Disclosure: CNBC holds exclusive cable rights off the network for “Shark Tank”, of which Mark Cuban is co-host.