Bloomberg

A-Rod joins the Blank-Check Derby to build the SPAC Yankees

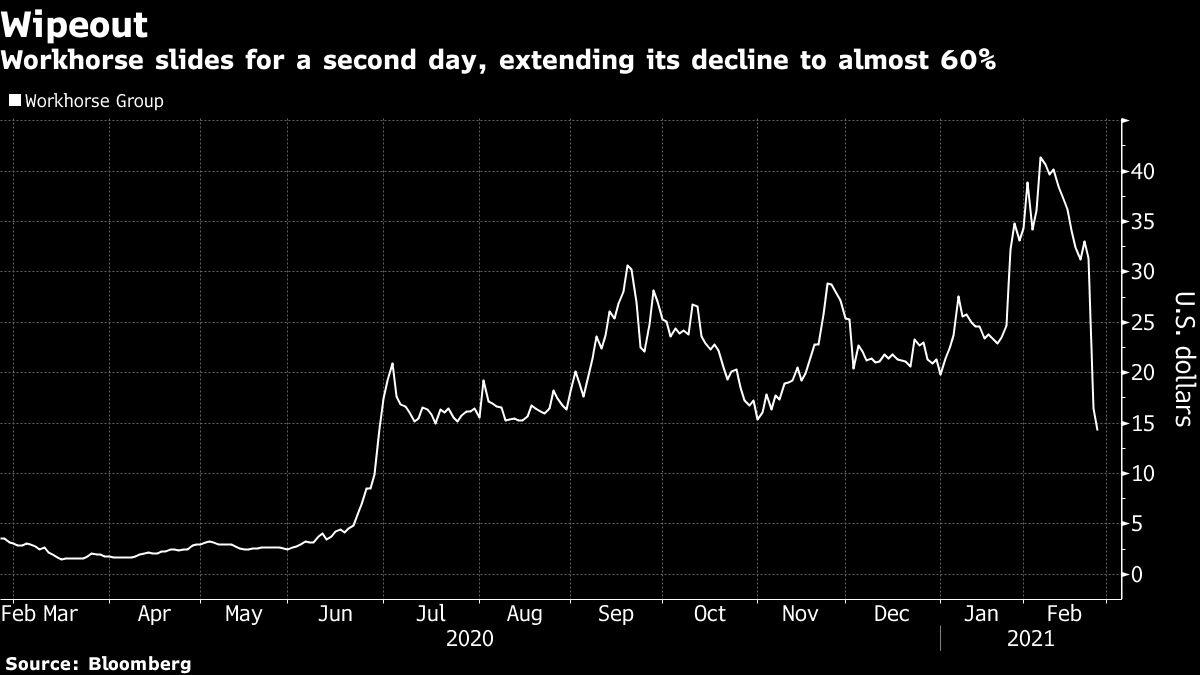

(Bloomberg) – After losing a contract to the New York Mets baseball team to billionaire Steve Cohen, Alex Rodriguez has another game he wants to win. executives, politicians, celebrities and athletes who signed up for special purpose procurement companies, or SPACs. Rodriguez, whose Slam Corp. started trading on Tuesday, will now start looking for a merger agreement to enrich him and his investors. “I said to myself over and over, ‘Boy, if I had the capital, I would love to buy this company,'” said Rodriguez, perhaps better known simply as A-Rod, in an interview. “Now, with SPAC, the game is our game to win.” A-Rod’s move comes at a time when increased business with blank checks encourages some investors to point to the asset class as the latest example of foam on the market, amid concerns that many SPACs will also seek out fewer companies quality to go public. Two months later, 164 blank check companies raised more than $ 50 billion in initial public offerings on US stock exchanges, according to data compiled by Bloomberg. This already represents more than half of the record SPAC volume of all time last year. SPAC SlumpMeanwhile, the IPOX SPAC Index on Tuesday suffered its worst intraday drop since its July 31 launch, while one of the most prominent blank check companies, Churchill Capital Corp IV, fell 40% a day after announcing an agreement with Lucid Motors Inc. Still, Churchill SPAC units closed at $ 38.31 in New York, well above its $ 10 confidence price. Rodriguez and his partners expect Slam to stand out from the accelerated cascade of SPACs in part due to their celebrity status combined with their long and tested business history. “George Steinbrenner would have said that there is only one Yankees and I feel that we have an opportunity to build the Yankees of SPACs,” said Rodriguez, referring to the longtime owner of Major League Baseball club who died in 2010.Slam, a partnership between the Rodriguez A-Rod Corp. investment firm. and the hedge fund Antara Capital LP, will focus on acquisition targets in the areas of sports, media and entertainment in the ent, health and wellness and consumer technology sectors, according to its listing documents. Marc Lore, a former executive at Walmart Inc. and founder of Jet.com, is a special advisor to Slam. Roodriguez is the CEO of Slam, while Antara’s Investment Director and managing partner Himanshu Gulati is the president. They emphasized that they do not intend to make a professional sports franchise public. “We received a lot of emails about sports teams and it’s not something we’re focused on,” said Gulati. Instead, Slam is looking for a high-growth technology business with a large addressable market. Red Sox MissRedBall Acquisition Corp., a blank check firm that counts Oakland Athletics executive Billy Beane of “Moneyball” famous as co-chair speaks to the company that owns the Boston Red Sox. These negotiations failed, however, Bloomberg News reported. Rodriguez, as part of an investment team that included host Jennifer Lopez, also shot the New York Mets, but missed. Hedge fund manager Cohen won the deal with an offer of more than $ 2.4 billion, which exceeded his group by $ 50 million, said Rodriguez. “We had an incredible race at the Mets, we learned a lot,” said Rodriguez. “I can’t do many things and that is why Slam is at the forefront of my time, my energy and my focus. I’m not saying that 10 years from now we wouldn’t revisit sports. ”Slam is traded on Nasdaq under the symbol SLAM. The units, made up of one share and a quarter of a warrant, closed their first day of trading at $ 10.51, after being offered at $ 10 each. Kaepernick, Shaq. At least two other SPACs are linked to well-known athletes. Colin Kaepernick, the former National Football League defender who became an activist, is co-chairman of one, while former National Basketball Association star Shaquille “Shaq” O’Neal was a strategic advisor to another. Rodriguez has already seen one of his investments, Hims & A Hers Health Inc. went public through an agreement with SPAC last year. He said his A-Rod Corp. it has 30 to 35 risky investments and at least six of them are going public this year. “We didn’t partner with Alex because he is an athlete,” said Gulati of Antara. “I think it’s great because he has great social networks, but I partnered with him because he is a phenomenal entrepreneur.” Rodriguez said he was watching the market closely, including the fall of SPAC on Tuesday. “One of my mentors, Mr. Warren Buffett, always told me not to confuse wisdom with a booming market.” For more articles like this, visit us at bloomberg.comSubscribe now to stay on top of the most trusted business news source. © 2021 Bloomberg LP