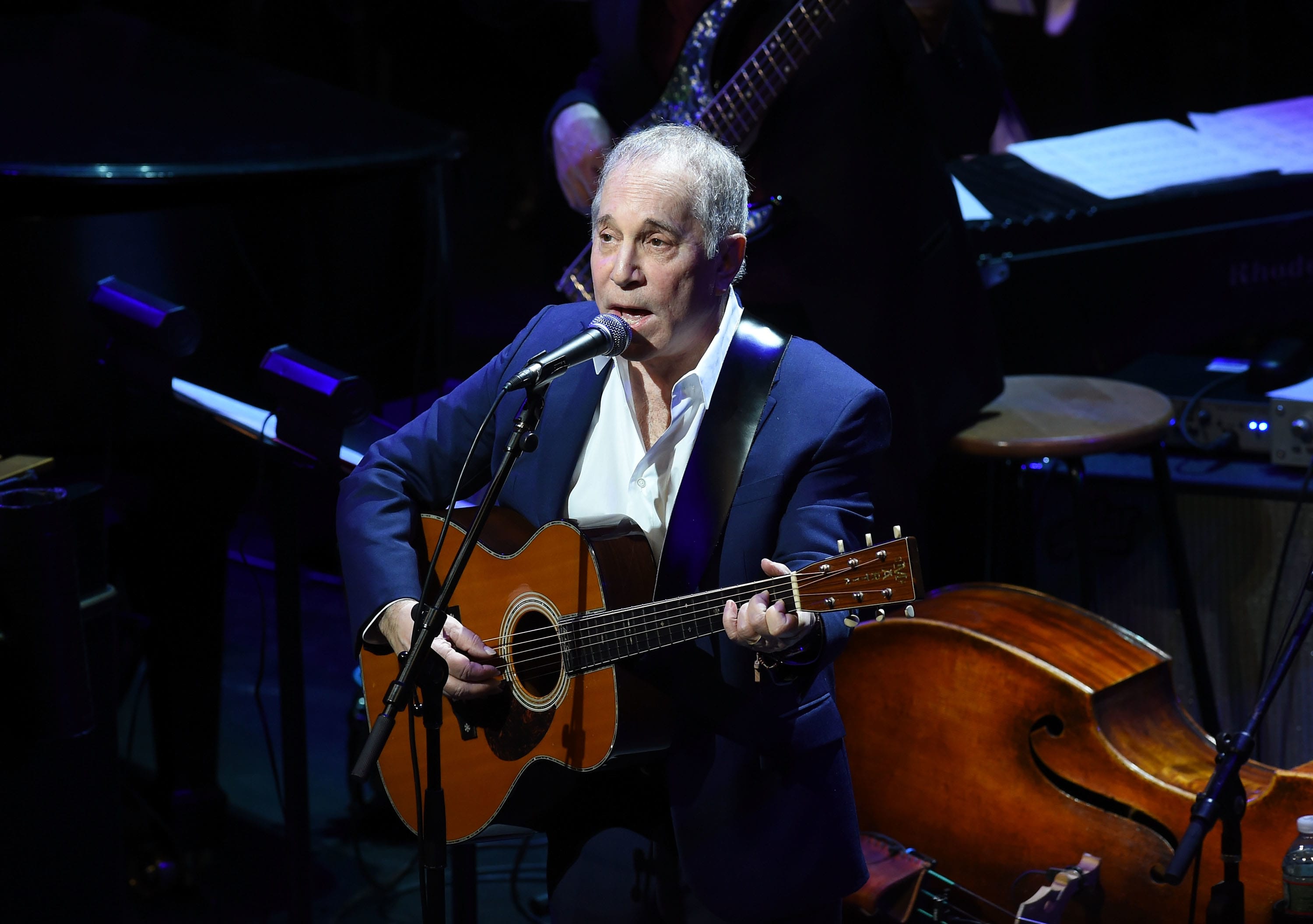

Paul Simon performs on stage during The Nearness Of You Benefit concert at Frederick P. Rose Hall, Jazz at Lincoln Center on January 20, 2015 in New York City.

Ilya S. Savenok | Getty Images Entertainment | Getty Images

From Bob Dylan connecting his electric guitar for the first time to Super Bowl commercials, there have always been times in music history when diehard fans accuse their idols of doing the unthinkable: selling everything. But at the moment, “selling” has a new connotation and is an expanding market for both investors and famous artists.

A wave of rock boomer icons is running out of their music catalogs. The moves, the last of which was made by Paul Simon last week, point to a direct truth about the intersection of art and money: music has always been a business, and one in which the creative genius deserved to be rewarded with riches. And it is a business that is now seeing major changes caused by streaming and more disruptions caused by the pandemic. The businesses of Paul Simon, Bob Dylan, Neil Young (in the case of Young, a 50% stake) and Stevie Nicks (80% of the rights to his songs), highlight the main trends in the entertainment industry, capital markets and management of fortunes.

Music publishers, such as Hipgnosis Songs Fund and Primary Wave Music, and conglomerate companies such as BMG, Sony, Warner Music Group and Vivendi’s Universal Music Group, are buying top-notch music catalogs in major businesses fueled by record low interest rates, with the belief that there will be more profitable returns in the future by selling the rights to these songs on entertainment platforms.

Record music offers at low prices

Larry Mestel, CEO of Primary Wave Music, the company that has just acquired a majority stake in the Stevie Nicks catalog, twice nominated for the Rock and Roll Hall of Fame, told CNBC that the economic environment created by the Coronavirus pandemic has worked in favor of companies looking to acquire large assets. These low interest rates make it easy to borrow money and the high rates of return have created a perfect opportunity for buyers.

“You are talking about a low interest rate environment and can reach 7% to 9% … and then increase it through marketing and generate returns in your teens. It is a very attractive place for people to put money, ”he said.

Music catalogs have also proven to be recession-proof, and the pandemic has only increased the amount of business being done as the music industry goes through a major disruption caused by the closure of concert halls and tours.

Increased streaming music

The deals also come at a time when streaming music – despite all the controversy and skepticism on the part of the musicians themselves about getting an unfair deal – has proved to be an economic juggernaut, at least for record companies. In 2020, Goldman Sachs predicted that global music revenue would reach $ 142 billion by the end of the decade, reflecting an 84% increase compared to the 2019 level of $ 77 billion and streaming would capture 1.2 billion people. users in 2030, four times the level of 2019, and mainly benefiting companies like Sony, which purchased the Simon catalog, and Universal, which acquired Dylan’s songs.

Global music streaming revenue reached the highest percentage in the industry last year (83% according to a recent report) and favors the stars as well. Spotify said its mission is “to give a million creative artists the opportunity to live off their art”, but, as a recent New York Times analysis noted, Spotify data shows that only about 13,000 generated $ 50,000 or more in payments in the past year.

It is not just streaming, however. The rights to catalogs of major acts, once acquired, can be used in synchronization channels that license music in various forms of media, including films, television programs, advertisements and video games.

“From a publisher’s point of view, it is extremely valuable to obtain the rights to a particular catalog that we can launch to synchronize,” said Rebecca Valice, copyright and licensing manager at PEN Music Group. “A catalog can make its own launch just because of its legendary success.”

Valuing rock icons

The more recognizable a catalog is, the more valuable it becomes for companies to buy and use it in films or television. The best catalogs “pay for themselves” over time, she says, since synchronization helps to recover the money that buyers have spent “and more over time”.

“I believe that icons and legends are worth more than other artists,” said Mestel. Primary Wave has catalogs of stars like Whitney Houston, Ray Charles and Frankie Valli and the Four Seasons.

Some famous boomer musicians attacked the situation the industry put them in, like David Crosby, who said in a tweet in December: “I’m selling mine too … I can’t work … and streaming has stolen my money remember … I have a family and a mortgage and I have to take care of them, so it’s my only option … I’m sure others feel the same way. “

He sold his entire catalog to Irving Azoff’s Iconic Artists Group in March, which also recently acquired control of the Beach Boys’ intellectual property, including a portion of the song catalog.

“Given our current inability to work live, this agreement is a blessing for me and my family and I believe these are the best people to do so,” said Crosby in a statement announcing the agreement.

Boomer generation estate planning

For the musicians themselves, there is a megatrend in action: the real estate planning needs of America’s wealthiest generation. Boomer musicians (and those born at the beginning of this generation, like Simon and Dylan in 1941), as well as their fans, are aging. “Artists are getting older now, so they can use the money, they can plan the estate,” says Mestel.

Of course, the downside may be the loss of control over an artist’s most precious asset: the creative genius who made their careers.

“These rock stars may want to profit to support their properties … but you lose control of your brand and legacy, to some extent, depending on the protections you put in place as part of the business,” said John Ozszajca, musician and founder of Music Marketing Manifesto, a company that teaches musicians how to sell and promote their music.

Crosby and Azoff have been friends for a long time, a statement by Azoff in the statement announcing the deal.

It seems that anyone who has a relationship in the music world and knows someone is trying to raise money.

Larry Mestel

CEO of Primary Wave Records

Some fans are not very happy to hear hits like Nicks’ “Edge of Seventeen” or Dylan’s “Like a Rolling Stone”, selling cars and clothes – although Dylan has done several Super Bowl commercials dating back many years to GM and IBM, and its songs have been presented alone in others – but decisions to sell catalogs can also help musicians avoid posthumous legal battles like the properties of Tom Petty, Prince and Aretha Franklin had to endure.

BMG acquired the interests of Nicks bandmate Mick Fleetwood’s catalog from Fleetwood Mac earlier this year and noted some statistics in its announcement that show that, however old the boomer acts are, they can have a life renewed with viral streaming hits. Fleetwood Mac’s song ‘Dreams’ generated over 3.2 billion streams globally (over an eight-week period from September 24 to November 19, 2020) due to a video with a fan who loved cranberry juice, and introduced a new generation, more accustomed to TikTok, for Fleetwood Mac. The band’s album “Rumors” reached sixth place on the Billboard streaming music chart 43 years after its release.

The Dylan deal is the largest reported to date, estimated at $ 300 million, although no sales price has been officially released and Universal only said in a statement that it was “the most significant music publishing deal of this century”.

Mestel believes that the boom is not coming to an end.

“It seems that anyone who has a relationship in the music world who knows someone is trying to raise money. But that does not mean that they can go out and identify assets to sell or even know what they are doing.”

BMG and private equity giant KKR recently signed an agreement to go out and make a major acquisition of music rights, and as one executive told Rolling Stone: “We are not chasing January 2021 hits. We are looking for a proven repertoire on be part of our lives. “

KKR has participated in major music businesses in the past and the trend towards buying rights is not new, but the current boom is notable and fits in with the asset class appreciation that occurs in so many parts of the market as investors look for more ways to put your money to work. While the boomer’s business is the main headline, recent acts are also paying big bucks. Earlier this year, KKR bought a stake in OneRepublic’s Ryan Tedder catalog for a supposedly high sum.

Companies like Primary Wave are working with artists like Nicks to try to keep them as part of the business and make that business even better for them in the future, according to Mestel, who says that many did not understand that they could enter into a partnership, sell one piece from your catalog and that piece will potentially become more valuable in the future than the 100% they owned before.

“If everything goes well, [artists] get the most out of what they’re trying to sell, and it’s usually a win-win scenario for both the buyer and the seller, ”said Valice.