As much as rising bond yields have been the subject of financial markets in the past two weeks, there is something different about how government debt is reacting to signs of an improving economy.

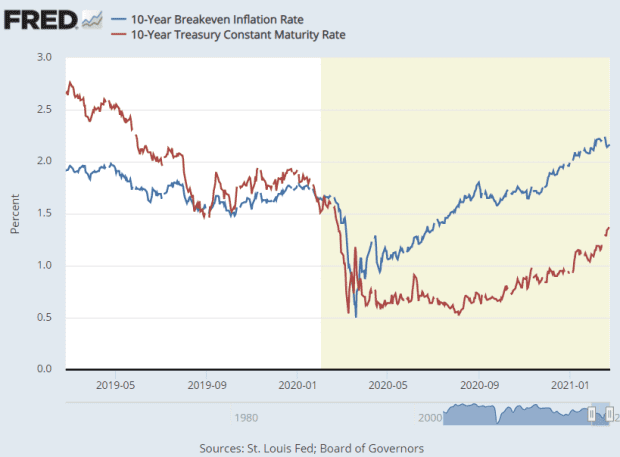

According to the BlackRock Investment Institute, a 1% increase in US equilibrium inflation rates over 10 years – a measure of market inflation expectations – usually led to a 0.9% increase in Treasury yields from 10 years since 1998. But since March 2020, breakeven inflation has risen by 1.2% and nominal yields have risen by just 0.5%.

“We expect the strengthening of the economy, a huge fiscal boost and rising inflation to further increase nominal earnings this year, although less than in similar periods in the past. We expect central banks to lean against any market concerns about rising debt levels and to keep interest rates low for now, ”said the strategists of the world’s largest fund manager.

On Monday, European Central Bank President Christine Lagarde said the central bank was closely monitoring bond yields, while Federal Reserve President Jerome Powell said on Tuesday in front of the Bank’s Banking Committee. Senate that the increase in bond yields “was in a way a statement of confidence” That there will be a robust and complete economic recovery.

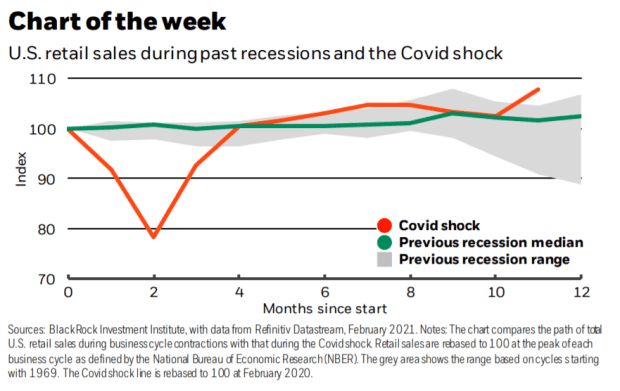

BlackRock strategists compared retail sales in the United States to previous recessions. “The different nature of the COVID shock means that activity has restarted much faster than seen in previous business cycle recessions – and implies exceptionally high growth rates as a vaccine-led reopening unfolds,” they said.

BlackRock offers a long-term strategic vision and a 6 to 12 month tactical vision. But for both stocks and government bonds, they changed their strategic and tactical views to the same extent, citing the launch of the COVID-19 vaccine and the US fiscal stimulus. BlackRock said it is underweight government bonds “as its ability to act as a portfolio backing is reduced with yields close to the lower limits and rising debt levels may eventually pose risks to the low rate regime”.

BlackRock was overweight in stocks. “We see a better prospect for profits amid moderate valuations. Incorporating climate change into our expected returns illuminates the appeal of the developed market’s actions, given the great weight of sectors such as technology and health in benchmarks ”, he said.

By region, BlackRock is above the US due to its exposure to technology and health, with small US capitalizations geared towards a cyclical rise. BlackRock has become neutral with regard to underweight European stocks, as there is room for the valuation gap to be closed as the economic restart becomes more entrenched.

The buzz

Powell takes his narrative about low interest rates to the House’s Financial Services Committee, while two senior officials, Governor Lael Brainard and Vice President Richard Clarida, will deliver speeches. The US economic calendar also includes sales of new homes, while Germany reported a stronger than expected increase in the fourth quarter’s gross domestic product.

President Joe Biden is expected to sign an executive order to join Taiwan, Japan, South Korea and Australia to build supply chains for semiconductors, electric vehicle batteries and rare earth metals, according to Japanese newspaper Nikkei. The Washington Post said Biden would sign the order on Wednesday.

Cathie Wood’s ARK Invest funds added $ 168 million to Tesla TSLA,

shares on Tuesday, after the electric vehicle maker closed below $ 700, according to its website.

Square SQ payment service,

fell 4% after announcing a new $ 170 million investment in bitcoin BTCUSD,

as it overcame the fourth quarter earnings estimate in slightly better than expected revenue.

PRA Health Sciences PRAH,

rose 25% in pre-market trade after agreeing to be purchased by Icon ICLR,

in a $ 12 billion cash and stock deal.

Bausch Health Companies BHC shares,

rose to a five-year high in the premarket on Wednesday after the pharmaceutical and medical device company said it had reached an agreement with billionaire activist Carl Icahn, and will add two of its nominees to the board of directors. .

GameStop GME,

the video game retailer announced that its chief financial officer was resigning. Forbes reported that the board lost faith in Jim Bell’s ability to shift to the focus of e-commerce. Likewise, Robinhood’s co-chief executive, Vlad Tenev, defended the way his company handled the GameStop saga in an interview with Barstool Sports founder Dave Portnoy.

The markets

US stock futures ES00,

NQ00,

were rising on Wednesday. On Tuesday, the S&P 500 SPX,

ended on a high after five consecutive defeats.

The yield of the 10-year Treasury TMUBMUSD10Y,

rose to 1.37%. Hong Kong stocks HSI,

it fell after the government announced it was raising the stamp duty on stock trading.

Random readings

A Chinese court assessed a woman’s domestic work in a historic divorce case on roughly what the country’s poorest earn.

Night owls perform less well than early risers at work, a study concluded.

A new study found that it is possible to create an almost 100% accurate brain-computer interface for wheelchairs.

Need to Know starts early and is updated to the opening bell, but sign up here to have it delivered to your inbox once. The emailed version will be sent around 7:30 am Eastern.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from Barron’s and MarketWatch writers.