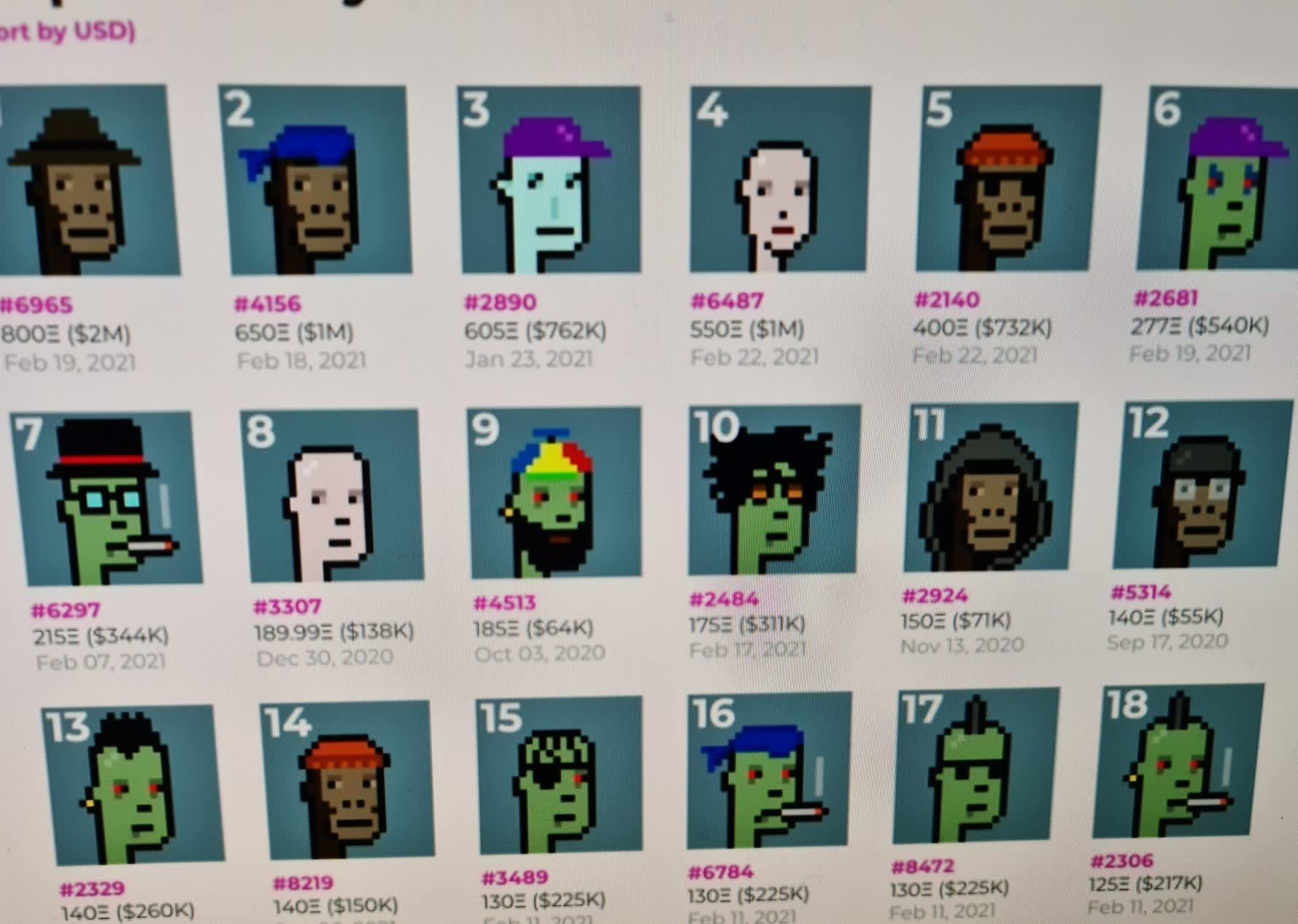

Digital avatars listed on the CryptoPunks non-fungible token platform.

Ryan Browne | CNBC

The cryptocurrency world is full of conversations about digital collectibles, unique virtual tokens that can represent anything from art to sports memorabilia.

People pay hundreds of thousands of dollars for these NFTs, or non-fungible tokens. One investor, Sheldon Corey from Montreal, Canada, told CNBC that he paid $ 20,000 for one of the thousands of computer-generated avatars called CryptoPunks.

CryptoPunks is not a new phenomenon – it was launched by the developers Larva Labs in 2017. But it has grown in popularity recently, generating $ 45.2 million in sales volume in just the past seven days, according to the NonFungible website, and inspiring a ” wider crypto art “movement.

CryptoKitties, one of the original NFTs, generated $ 433,454 in sales last week, according to NonFungible. Digital cats, developed by a start-up company called Dapper Labs, were once so popular that they clogged the digital currency’s ether network.

NBA Top Shot, a platform created by Dapper Labs in partnership with the basketball league, has attracted $ 147.8 million in sales in the past seven days, according to NFT data tracker CryptoSlam. The service allows users to buy and sell short clips showing the highlights of the best basketball players’ matches.

The biggest impetus for these tokens comes as bitcoin and other cryptocurrencies have increased significantly in recent months, and at a time when people are spending more time indoors due to coronavirus restrictions.

What are NFTs?

NFTs are non-fungible tokens – meaning that you cannot exchange one NFT for another – that run on a blockchain network, a digital ledger that records all cryptocurrency transactions like bitcoin.

The difference with bitcoin and other tokens, however, is that each NFT is unique and cannot be replicated. Each adds value independently. Crypto investors say NFTs derive their value from how scarce they are. They are stored in digital wallets as collector’s items. In addition to art and sports, people have also found uses for NFTs in virtual real estate and games.

Nadya Ivanova, head of operations at research firm L’Atelier, affiliated with BNP Paribas, says that collectible digital assets can be considered a better version of an MP3 file. Musicians have struggled to profit from their work in the digital age, and Ivanova says some are turning to NFTs to prove they own their work and find an additional source of revenue.

“This allows content creators to really own the ownership rights of what they create, allowing them to profit in different ways that they cannot do with physical art,” she told CNBC, adding that crypto is the growth subsection. strongest in the digital collectibles market.

The total value of NFT transactions tripled to $ 250 million last year, according to a study by NonFungible and L’Atelier. The number of digital wallets trading almost doubled to more than 222,179, while some traders managed to make profits of more than $ 100,000.

“We are seeing a new generation of traders in the NFT market; people who are digitally native looking for native digital asset classes outside the established asset markets,” said Ivanova. “They are people who have accumulated reputation and wealth and want to invest in purely virtual assets, such as NFTs.”

Ivanova says the NFT market is maturing. The famous auction house Christie’s auctioned off an NFT-based artwork created by Beeple, a well-known digital artist who created videos and graphics for celebrities like Ariana Grande and Justin Bieber.

Cryptomania

A highlight of the NBA Top Shot video featuring LeBron James was recently sold for a record $ 208,000. But sales can be volatile – NBA Top Shot and CryptoPunk trades have dropped in the past 24 hours, according to NFT data tracker CryptoSlam.

The rise in prices for these virtual items has raised fears of a repeat of speculative cryptomania. This reminded some investors of the initial coin offering, or ICO, bubble in 2017, when several start-ups issued new digital tokens to raise money. Almost none of the ICO’s projects exist today, and some have even deceived investors by millions of dollars.

There are some parallels to the ICO frenzy – for example, celebrities like Lindsay Lohan and Mark Cuban have recently sold NFTs.

“We had a very similar time in 2017,” Billy Rennekamp, scholarship manager at blockchain research firm Interchain Foundation, told CNBC. “Each gallery was considering an NFT. Every top artist was considering it. But there was a lot of risk when the market was down and it was embarrassing to be involved in NFTs when prices were falling.”

“I would not be surprised if we go through another bull market and a bear market,” added Rennekamp.

Still, the companies behind these tokens don’t think it’s a fad.

“The NFTs are here to stay,” said Caty Tedman, head of partnerships at Dapper Labs, who led the NBA Top Shot project. “The flow will be the blockchain to enable mass consumer adoption. The future is now.”

NBA Top Shot now has more than 100,000 active collectors and has grossed $ 215 million in sales so far, Tedman said. He is working on a digital collectible game based on the UFC mixed martial arts league and has also attracted support from Warner Music to develop NFTs for music fans.

“The billions spent on Fortnite skins point to the importance of our lives and personas online, and how valuable they are to people,” Matt Hall, co-founder of Larva Labs, told CNBC.

“What NFTs offer is a formalization of digital property and a way for that property to be permanent beyond the life of any company, game or platform.”

Hall said Larva Labs does not charge any fees to users in its market – although it does pay blockchain processing fees. “We are owners of CryptoPunk like everyone else,” he added. “So, as the general market grows, those we own are more valuable as well.”

The cheapest punk available on CryptoPunks is currently worth $ 36,000, Hall said. Larva is working on a successor to CryptoPunk, Hall added, without elaborating on the company’s plans.