(Bloomberg) – Stock market optimism among Wall Street strategists has soared near levels that signaled problems for stocks in the past.

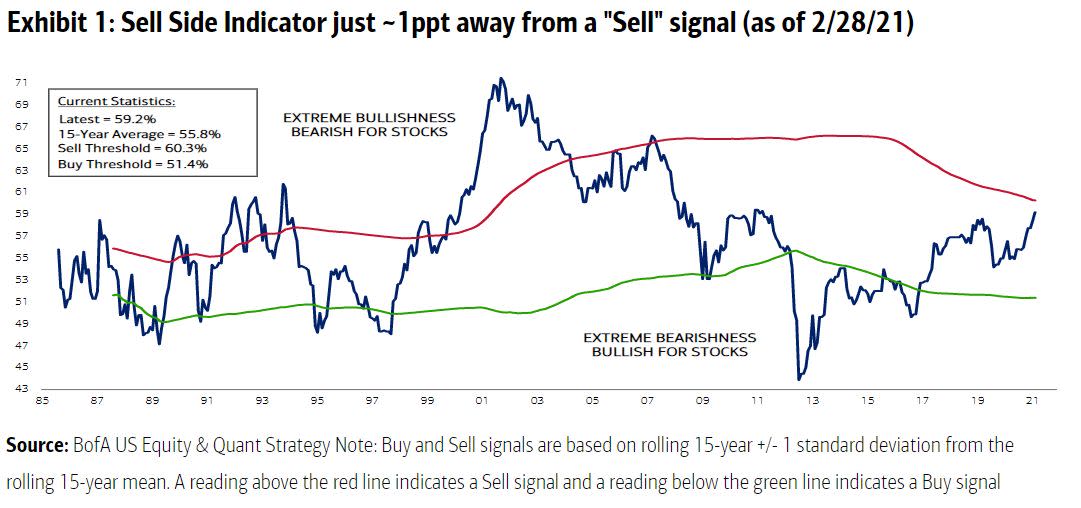

A Bank of America bullish move is close to a level that historically has been bearish for stocks. The indicator assesses the recommended average allocation for stocks by strategists on the side of the sale and is very close to triggering a sell signal, wrote a team including Savita Subramanian on Monday.

“The last time the indicator was so close to ‘Selling’ was in June 2007, after which we generally saw 12-month returns of minus 13%,” said the strategists, adding that even current levels signal stock returns below the average the following year. “We found Wall Street’s optimism to be a reliable contradictory indicator.”

Last week’s concerns about the impact of higher bond yields on equities evaporated on Monday, with U.S. stocks registering their biggest advance since June. The optimism is evident in the record amount of money poured into ETF stocks in February, as investors bet additional fiscal stimulus and the launch of the Covid-19 vaccine will boost growth.

The S&P 500 has risen about 4% so far this year and about 32% in the past 12 months. Bank of America’s indicator rose almost 1 point, to 59.2% in February.

“The current level is predicting 12-month returns of just 7%, a much weaker outlook compared to an average 12-month forecast of 16% since the end of the global financial crisis,” wrote the BofA team.

Although investors appear to have accepted the recent turmoil in the bond markets for now, an ongoing shake-up could create new distress, especially if real yields continue to rise.

The correlation between U.S. equities and inflation-adjusted Treasury yields fell to their most negative five-year value last week, according to data compiled by Bloomberg. This suggests that further increases in real earnings could hurt the S&P 500 index.

(Updates with more information on bond yields starting from the seventh paragraph.)

For more articles like this, visit us at bloomberg.com

Sign up now to stay up to date with the most trusted business news source.

© 2021 Bloomberg LP