TSMC

When Li Ta-sen was small, he used to walk to school in sugar cane fields taller than himself. About 40 years later, he is making a living selling the same fields while the housing boom settles in his hometown, Shanhua.

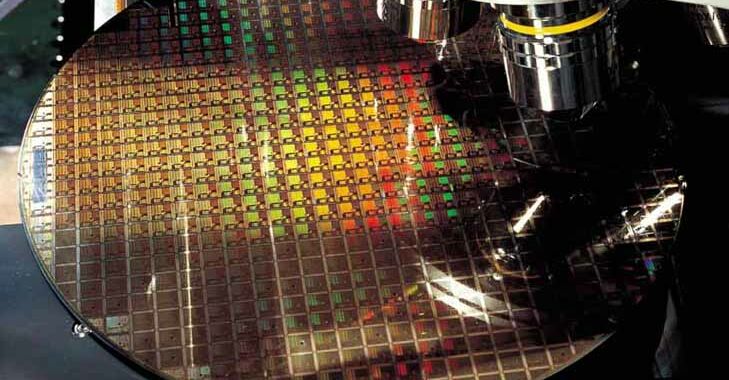

The reason for the construction frenzy in the once poor rural town in southern Taiwan is simple: the arrival of the world’s most advanced chip factory.

Taiwan Semiconductor Manufacturing Company, the world’s largest contracted chip maker, is building a factory to make 3-nanometer chips, semiconductors that are expected to be up to 70% faster and more energy efficient than the most advanced in production now and that will be used on devices from smartphones to supercomputers.

“Prices for adjacent farmland tripled in the past year and we had the highest volume of transactions in our 10-year history,” said Li, who runs the local branch of the Century 21 real estate broker and has watched TSMC engineers buy off newly-built apartments. built and housing.

But the impact of TSMC’s new manufacturing plant, or “fab,” radiates far beyond southern Taiwan. In the world of semiconductors, this is the center of the universe.

The plant, which is due to start mass production next year, will use process technology that so far only South Korea’s TSMC and Samsung Electronics have dominated – currently, the most advanced chips are 5 nm. The new chips bring huge advantages to customers: the smaller the transistors on a chip, the lower the power consumption and the higher the speed.

Financial Times

Measuring 160,000 square meters, the size of 22 football fields, the factory is compatible with TSMC itself: a hulk with absolute dominance in global semiconductor manufacturing.

Typically a discreet company, TSMC’s huge investment in cutting-edge technology and growing influence are quietly drawing it into the spotlight.

At a time when the global chip shortage has forced decelerations or even suspensions of car production from Japan to Europe and America, and with politicians in many countries making noise about bringing more manufacturing abroad, the Taiwanese company’s dominant position in the Global chip production is attracting attention.

Given that China maintains a permanent threat of invasion of Taiwan, the country has long been at the center of the military rivalry between Washington and Beijing in East Asia. But it is also increasingly being caught up in the technological competition between the two superpowers.

Chinese companies have been unsuccessful in their attempt to match TSMC’s manufacturing prowess, but the US has also begun to struggle: Intel is determined to outsource part of its processor production, its jewel, to the Taiwanese company. In Washington, the Pentagon has been quietly lobbying the United States to invest more in the manufacture of advanced chips so that its weapons do not depend on foreign manufacturers.

All of this makes TSMC possibly the most important company in the world that few people have heard of.

While many governments would love to emulate their success, they will likely find the costs of trying to match the TSMC prohibitive. And your customers are beginning to realize that they are not dealing with a traditional supplier.

“Automakers believe they are the giants of the world,” says Ambrose Conroy, founder and chief executive of Seraph, a supply chain consultancy. “But this is a situation where semiconductor manufacturers are the giants and the automotive buying teams are the ants.”

Foundry Victory

TSMC has gone a long way unnoticed because the semiconductors it manufactures are designed and sold in products by suppliers from brands like Apple, AMD or Qualcomm. Even so, the company controls more than half the world market for custom chips.

And it is becoming more dominant with each new process technology node: although it accounts for only 40 to 65 percent of revenues in the 28-65 nm category, the nodes used to produce most car chips, it has almost 90 percent of the market for the most advanced nodes currently in production.

“Yes, the industry is incredibly dependent on TSMC, especially when you reach the limit, and it is quite risky,” said Peter Hanbury, a partner at Bain & Company in San Francisco. “Twenty years ago, there were 20 foundries and now the most modern is on a single campus in Taiwan.”

Since each new process technology node requires more challenging development and greater investment in new production capacity, other chip makers over the years have begun to focus on design and have left production for dedicated foundries, such as TSMC.

The higher the cost for new manufacturing units became, the more other chip makers started to outsource and the more TSMC’s competitors in the pure foundry market got out of the race.

TSMC

This year, TSMC increased its capital investment forecast to an impressive $ 25 billion to 28 billion – potentially 63 percent more than in 2020 and putting it ahead of Intel and Samsung. Analysts believe that this includes at least some investment in the capacity that the Taiwanese manufacturer needs to supply Intel. The US chip maker is forced to outsource part of its processor production because it has struggled to master two successive process technology nodes – 10 nm and 7 nm – in time to make its own chips.

Intel’s stumbling block in the second successive generation of manufacturing technology sparked an appeal by an activist investor last year for the company to abandon chip manufacturing by switching to a “no factory” business model, as so many other chip makers have done.

Pat Gelsinger, the new chief executive of Intel, rejects this idea. “Confidence in 7 nanometers is increasing,” he told investors and journalists in a video message on Tuesday. He said the company was increasing its involvement with TSMC and other foundries and outsourcing the manufacture of some processors to TSMC.

Despite Gelsinger’s promise to resurrect Intel’s manufacturing prowess, the company needs TSMC at least for a transition period so as not to lose market share of central processing units – the heart of every computer and server – to its rival AMD .

According to two people familiar with TSMC and Intel, the American company has had a team working with TSMC for more than a year to prepare outsourced production of CPUs at Tainan’s new plant.

Mark Li, a Bernstein chip industry analyst, estimates that Intel will outsource 20% of its CPU production to TSMC in 2023, and the Taiwanese company needs to invest about $ 10 billion in capacity just for that.

The prohibitive cost has made it increasingly difficult for other companies to stay in the game of advanced chip making. But, as Intel’s example shows, money is not the only factor. Reducing the size of the transistors – the key feature needed to stack more and more components on a chip, which in turn allows for ongoing costs and energy efficiency – is becoming an engineering challenge.

The size of the transistor in a 3 nm node is only 1 / 20,000 of a human hair. The adjustments in machinery and chemicals needed to achieve this come more easily with the unique focus on this manufacturing technology, the large scale and the wide range of applications that TSMC has developed.

Matthias Hangst | Getty Images