JEFFERSON CITY, Missouri (AP) – Responding to the concerns of state officials, the U.S. Treasury Department said on Wednesday that states can cut taxes without penalty under a new federal pandemic relief law – as long as they use their own funds. to compensate for these cuts.

Republican governors, legislators and attorney generals have expressed concern over a provision in the broad relief law signed by President Joe Biden that prohibits states from using $ 195 billion in federal aid “to offset directly or indirectly a reduction” in net tax revenue. The restriction can be applied until 2024.

Republican attorney generals from 21 states wrote to Treasury Secretary Janet Yellen, seeking clarification about the ban, which they said could be interpreted as “denying states the ability to cut taxes in any way”.

A treasury spokesman told the Associated Press that the provision is not intended to be a general ban on tax cuts. States can still offset tax cuts by other means.

“In other words, states are free to make political decisions to cut taxes – they simply cannot use pandemic relief funds to pay for these tax cuts,” said the Treasury Department.

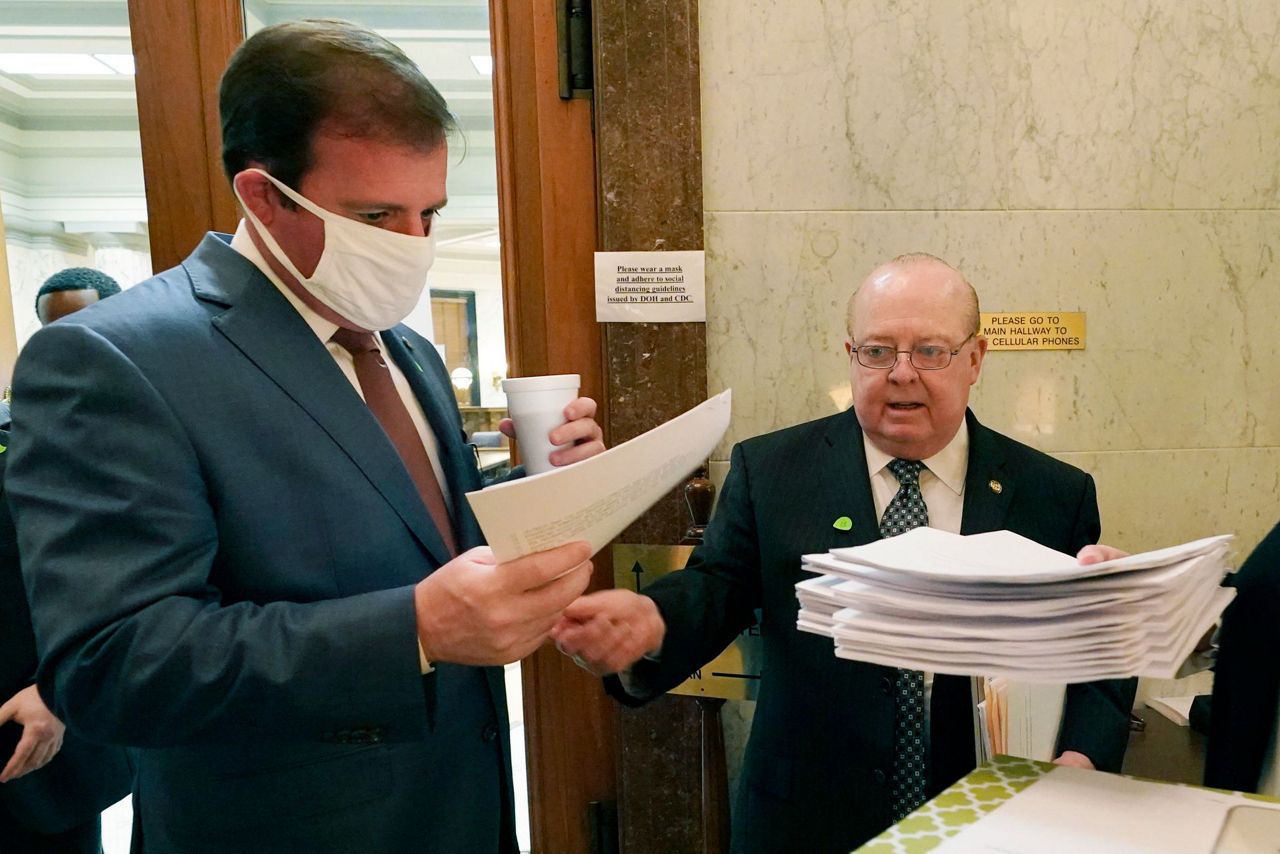

Treasury law enforcement may provide clearance for some tax cuts, such as Missouri legislation that would expand online sales taxes to offset proposed 2023 income tax cuts. Republican Senator Andrew Koenig said he thinks his legislation it is OK, but asked the state attorney general for guidance on whether this could conflict with federal law.

“To say that we are cutting taxes because of (federal) money would be a ridiculous argument,” said Koenig on Wednesday, “because this is a complete package that is completely separate.”

Arkansas Governor Asa Hutchinson said the Treasury Department’s formal guidance will be critical in determining how much flexibility exists for states. The Republican governor, however, wants lawmakers to move forward with his proposal to set aside $ 50 million for tax breaks, including a cut in taxes on used vehicle sales.

“We must not allow federal restrictions to weigh in the direction we are taking as a state,” said Hutchinson.

The nonprofit Tax Foundation said in an analysis last week that state tax cuts financed by natural state revenue growth or new tax increases are likely to be acceptable under federal law. But he said doubts could arise if states used federal aid to pay public health workers, freeing up existing state revenue and contributing to a surplus that helps finance a tax cut.

Legislatures in several states are considering tax cuts this year.

Oklahoma House, led by Republicans, passed bills last week to reduce corporate and corporate income tax rates and restore the ability to repay earned income tax credit. The Oklahoma Tax Commission estimates that these accounts could cost the state $ 103 million next year and $ 284 million the following year. But the House spokesman’s office said a $ 1 billion surplus gives the state plenty of room to offset potential tax cuts.

The Republican-controlled Mississippi House passed legislation that would eliminate the state income tax, cut the food tax in half, and increase the sales tax on most items. The plan faces opposition in the Senate led by the Republican Party, but it also faces federal limitation on state tax cuts.

“Our tax policy needs to be formulated on what is best for Mississippi, no … as the winds blow from DC,” said Senator Josh Harkins, a Republican who is chairman of the state Senate Finance Committee.

Georgia Republicans are working on a $ 140 million annual cut that would raise the income threshold from which taxes begin. Some Republicans are also maneuvering to lower the maximum income tax rate. That plan, which was shelved last year for fears of a sharp drop in state revenue, would forgo more than $ 500 million a year. The tax incentives proposed to companies are also passing through the Legislative.

The Louisiana legislature, led by Republicans, plans to debate tax reform during its session beginning in mid-April. Republican Party leaders have said they want to keep it as close to “revenue neutral” as possible, and Democratic Governor John Bel Edwards has said he will not support any package that cuts revenue.

“But we fear that federal law provisions could put this work at risk,” said Dawn Starns McVea, director of the National Federation of Independent Businesses in Louisiana.

The federal law’s tax-cut provision also created uncertainty in Utah, where the Republican-led legislature passed $ 100 million in tax cuts this year, benefiting families, veterans and older residents who receive Social Security. The chairman of the state Tax Commission said the reductions would have occurred regardless of whether Utah received federal relief from the coronavirus, but Republican Attorney General Sean Reyes said these tax cuts are “now at risk” because of federal law.

According to the law, states that use part of their aid to offset tax cuts might have to pay an amount equal to the federal government. Because of uncertainty about what could trigger this, the Republican chairman of the South Carolina House budget drafting committee said he plans to use federal money slowly.

“If you put this in the direction of restoring unemployment, is this considered a tax cut for companies?” Rep. Murrell Smith said. “If you wanted to create a small business concession program, would that be … a tax cut for small business owners?”

The top Republicans in the Kansas Legislature made income tax cuts a priority for several years. The mayor, Tem Blaine Finch, recently condemned the federal government’s attempts to guide state tax policy.

“It must be up to the states to decide what their tax rates are and how much their citizens have to pay in taxes,” said Finch.

But Democratic governor Laura Kelly, who vetoed two Republican tax cuts in 2019, welcomed the restrictions on the use of federal aid against a pandemic to offset state tax cuts. She said Kansas is still “recovering” from several years of budget deficits that followed a 2012-13 tax cut experiment under former Republican Party governor Sam Brownback.

“I’m glad we can’t use that money for tax cuts,” said Kelly on Wednesday. “I don’t think we should make tax cuts right now, as we are recovering from this pandemic.”

___

Associated Press writers Josh Boak in Washington, DC; Jeff Amy in Atlanta; Jeffrey Collins in Columbia, South Carolina; Andrew DeMillo in Little Rock, Arkansas; Sophia Eppolito in Salt Lake City; Melinda Deslatte in Baton Rouge, Louisiana; John Hanna in Topeka, Kansas; Sean Murphy in Oklahoma City; and Emily Wagster Pettus in Jackson, Mississippi, contributed to this report.

Copyright 2021 from the Associated Press. All rights reserved. This material may not be published, transmitted, rewritten or redistributed without permission.