The question that still reverberates in the financial markets is how far the $ 1.9 trillion coronavirus relief will be spent, either immediately or whether the virus will go back far enough that customers can and want to leave.

This column previously pointed to research on how the initial $ 600 stimulus was used and plans for the $ 1,400 that came in for many families, to suggest that much of it will not be implanted in the economy.

Another way to see this is whether families perceive the stimulus as additional income or additional wealth. Studies show that the propensity to spend on wealth is only 5%, while the propensity to spend on income ranges from 10% to 50%, according to a recent speech by Gertjan Vlieghe, a voting member of the Bank of England. Policy Committee.

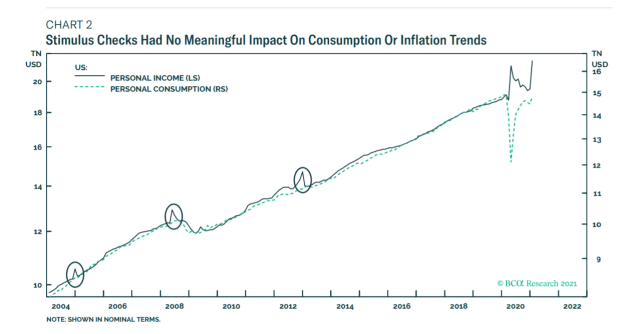

Dhaval Joshi, chief strategist at BCA Research, says that whether the new stimulus is considered wealth or income depends on whether the family that receives it has a high or low income to start with. But, looking at the previous stimulus checks, there have been no significant changes in consumption or inflation.

Thus, he believes that market expectations regarding inflation are moving away. He also says – in a note written before oil prices fell on Thursday – that inflation expectations are positively correlated with high commodity prices, although real inflation tends to fall when commodity prices are high.

“Since the bond market is useless to predict inflation, it is also useless to assess real interest rates,” he says. If the bond market is exaggerating the future level of inflation, the correct yield on inflation-adjusted bonds should be even higher. “The important conclusion now is that, in any comparison with the real yield on the bonds, stocks and other risky assets are even more expensive than they appear.”

Cold trading in China

Negotiations between the United States and China started icily in Alaska, with public criticism from both sides in the opening comments.

FedEx FDX,

could rise after the delivery service said that third-quarter tax gains have increased more than analysts anticipated and have moved into a stronger-than-expected current quarter.

Nike NKE,

could slip after the clothing manufacturer reported slower-than-expected sales growth in its third fiscal quarter.

Chubb CB,

made an offer of $ 65 per share to buy rival insurer Hartford Financial Services Group HIG,

The Bank of Japan has removed the targets for buying publicly traded funds and real estate investment funds and widened the range that will allow for 10-year bond trading.

Recovering oil, a little

After the 7% drop in oil prices on Thursday, CL.1 light-sweet oil futures,

were a little bit bigger. Analysts at UBS say to focus on the pace of vaccination COVID-19, which should help ease restrictions and support oil demand.

The yield of the 10-year Treasury TMUBMUSD10Y,

fell slightly to 1.69%. US stock futures ES00,

NQ00,

were bigger.

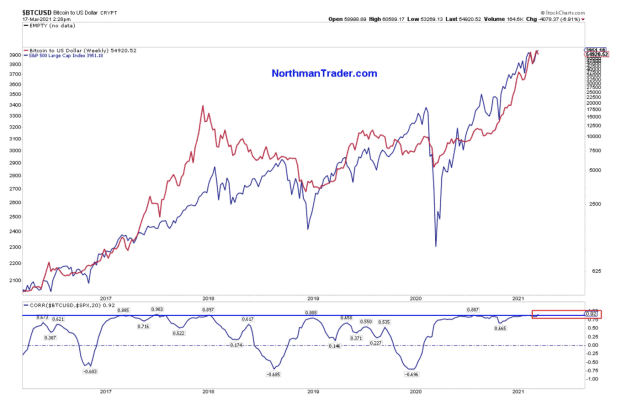

Bitcoin flows mirror stock flows

It’s bitcoin BTCUSD,

a diversifier? It is a big debate in the markets, which several major banks have taken over in the past two weeks. Sven Henrich, the technical analyst who runs the Northman Trader website, produced this chart, showing that the correlation between weekly bitcoin flows and stocks is at the highest level ever.

Random readings

The tulip craze in the 1600s is often cited by financial market analysts when discussing speculative crazes. For lovers of irony, there are non-fungible tulips – that is, illustrations of tulips sold on the blockchain – for sale.

A winged shark? Scientists were intrigued by the fossil found in Mexico.

Need to Know starts early and is updated until the opening bell, but sign up here to have it delivered once to your inbox. The emailed version will be sent around 7:30 am Eastern Time.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from Barron’s and MarketWatch writers.