Like no president before him, Donald Trump used the stock market as a result marker, arguing that sharp gains were a justification for his economic management.

Trump leaves office with the main U.S. benchmarks close to historical records. But how does your performance compare to your predecessors?

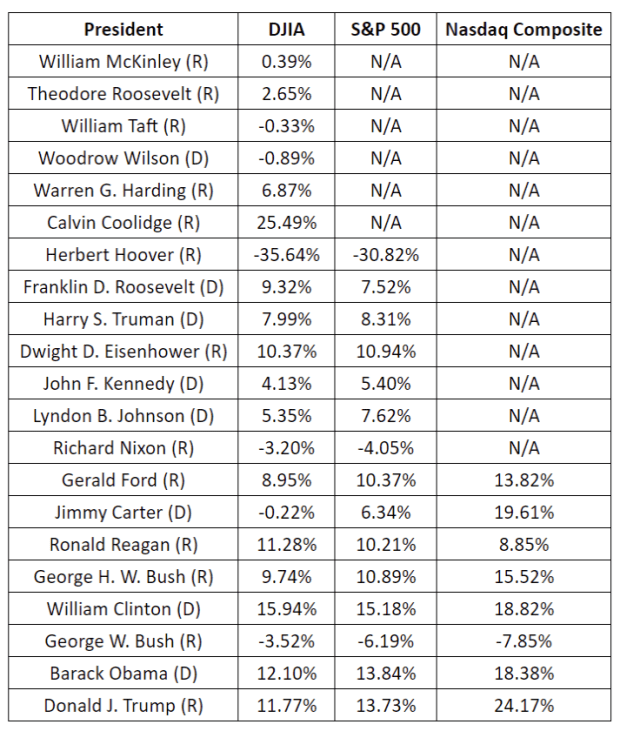

Not bad, according to the main indexes. Based on annualized returns for the S&P 500 SPX,

the U.S. benchmark, Trump (+ 13.7%) saw the third best performance of the 15 presidents who served since 1929, according to Dow Jones Market Data. Trump, however, fell slightly behind his immediate predecessor, Barack Obama (+ 13.8%). Bill Clinton (+ 15.2%) affirms the first place.

Dow Jones market data

The Dow Jones Industrial Average DJIA,

the most popularly known blue-chip indicator had an annualized return of almost 11.8% with Trump, against 12.1% for Obama and 15.9% for Clinton. Calvin Coolidge, with the benefit of the exuberant 1920s, surpassed all of them with an annual increase of 25.5%, based on data dating back to the late 1890s.

Trump can claim some bragging rights when it comes to the high-tech Nasdaq Composite, which made its debut in the early 1970s. An annualized 24.2% increase is at the top of the list, with Jimmy Carter coming in second place , with a gain of 19.6%.

Of course, there are reasons why previous presidents avoided linking their success to the stock market. On the one hand, the market is unstable. If you take credit for your rise, you’re probably only more to blame if it goes down.

The stock market is also far from being a perfect indicator of the economy or how families feel about their own circumstances.

So, what should investors read in the historical record? After all, many analysts have noted that no Democratic president has seen a decline in total returns over his term.

Opinion: The economy – and the stock market – tend to do better under Democrats

Jim Reid, a strategist at Deutsche Bank, argued that he may not offer a great guide anyway when it comes to Biden’s presidency.

The question comes down to whether performance during Democratic administrations was due to the ability to deal with the economy or simply bad luck for some Republicans.

“For example, the US had a Republican government when the pandemic hit last year, the period between the peak of the dot-com bubble and the GFC (Great Financial Crisis) casualties (George W. Bush.), When the oil shock 1973 occurred (Nixon) and during the Depression (Hoover), ”wrote Reid.

Biden, on the other hand, inherits an economy that is still struggling to recover from the pandemic COVID-19 and a stock market that many investors consider precious to perfection, if not in bubble territory. The stock has risen, however, since Biden’s electoral victory in November, partly due to expectations that he will adopt aggressive stimulus measures.

And the new presidential term began with a bang, as the Dow, S&P 500 and Nasdaq ended on record highs and recorded the best performance on Induction Day since Ronald Reagan took the oath of office to begin his second term in 1985.