Consumer discretionary stocks are the most sensitive to the market cycle and, at the moment, give no indication that the cycle is about to change, according to one of Wall Street’s most followed technical analysts.

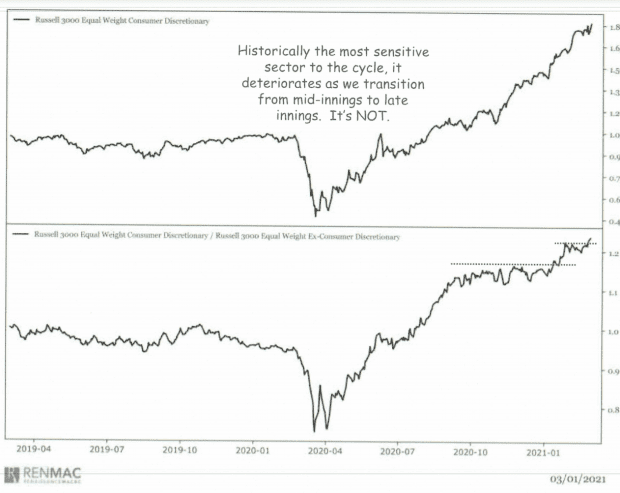

“Discretionary names have historically deteriorated before the cycle is over,” said Jeff deGraaf, founder and president of Renaissance Macro Research, in a note on Wednesday. “This makes them excellent substitutes against the market cycle. With discretionary names in new relative maximums, this suggests that the market cycle is still in the middle, even at the beginning, but not the late shifts that inflation and growth suggest, “

He pointed to the graphs below, following the absolute and relative performance of the discretionary consumer sector Russell 3000 of equal weight, to clarify the point.

Renaissance Macro Research

The shares performed mixed on Wednesday, with the Dow Jones Industrial Average DJIA,

up to 90 points, or 0.3%, while the S&P 500 SPX,

fell 0.3% and the high-tech Nasdaq Composite COMP,

fell 1.1%. The stock faltered last week, with fears of an inflationary spike that caused a jump in bond yields. But if discretionary stocks serve as a guide, there is little evidence of price pressures so far.

“We may be wrong, but discretionary names tend to weaken as we see sustained inflationary pressure and the costs of consumer and energy lending erode their purchasing power (this is not yet happening),” wrote DeGraaf.