The bond market stabilized after a big sale, and that gave comfort to the shares. The Nasdaq Composite COMP, dominated by technology,

advanced to six of the last nine sessions, and the Russell 2000 RUT,

jumped 2.2% to bring earnings from the small cap index to 35% since the election in the United States.

Will the tranquility continue? Manoj Pradhan, former managing director of Morgan Stanley responsible for the global economy and founder of Talking Heads Macroeconomics, said in a presentation by fund manager Tabula Investment Management that inflation will heat up just when the Federal Reserve expects it to cool down, next year. .

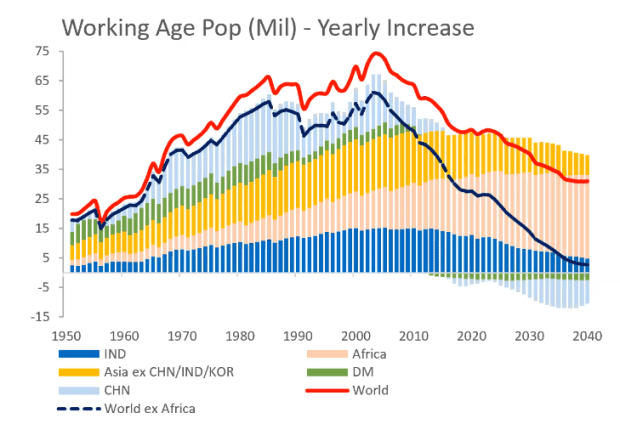

Pradhan argued that the collapse of the Phillips curve – the traditional relationship that shows inflation rising as unemployment falls – occurred because of China’s entry into the global workforce. But he said the demographics and pandemic of COVID-19 are going to fix that.

First, demography. The aging population in the US and the developed world will mean a loss of workers, and the aging population is also creating an increase in government spending. Pradhan also noted that taking care of the elderly will take a lot of work. “We need technology to destroy jobs in other parts of the economy so that the labor it frees up can be relocated to care for the elderly, at a similar level of skill,” he said.

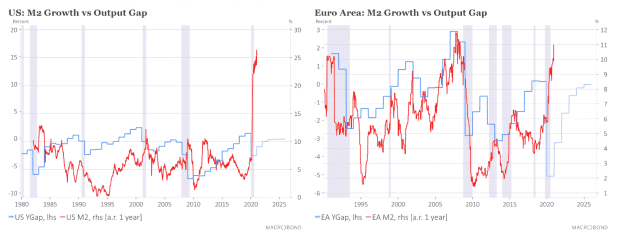

About the pandemic. At the moment, he said, the money supply signals are giving “the most extreme signals you have ever seen”. It has not translated into inflation now, because the speed of money has collapsed and the savings rate has skyrocketed, both consumer functions closed at home. Citing European Central Bank research, Pradhan said the increase in savings is “forced”, not “preventive”.

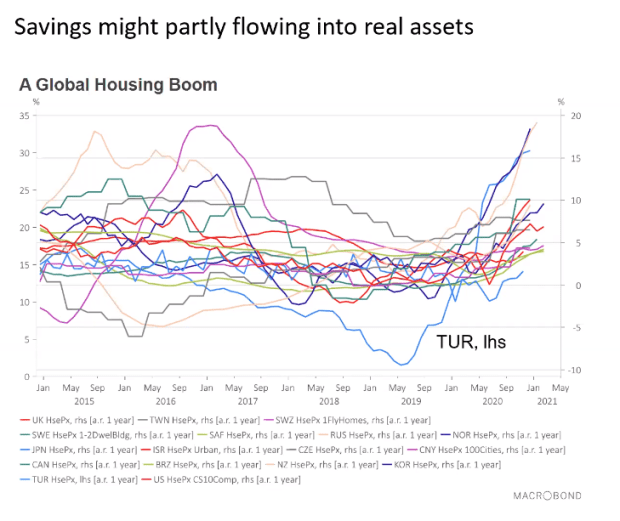

As the economy normalizes, forced savings will act as a delayed stimulus. Even now, the housing market is on fire, with prices soaring around the world. “This is a way of spending that can also drag some of that surplus labor,” he said. But the rise in house prices does not appear in official inflation measures.

The Fed is already trying to meet the challenge of the next inflation readings which, in May and June, may show gains of 3.5% to 4% in the annual comparison. “I will tell you that anything above 3.5% -4% will create a significant drop in the correlations [between stocks and bonds], because people have not seen inflation really on a large scale in advanced economies in the past 30 years, ”he said.

“The real challenge will come in 2022, when a lot of spending will have been directed towards goods or housing, monetary aggregates will still be high with the speed increasing,” he said. He expects the interest curve to tilt further and that if the Fed implements another Operation Twist or controls the interest curve, it will further increase inflation.

Asset returns will be more difficult to extract, inequality will fall, but in a scenario of weak growth and central bank independence will be increasingly threatened, he predicts.

WeWork Agreement

Shared office provider WeWork has agreed to merge with a special purpose acquisition company BowX Acquisition Corp. BOWX,

to a $ 9 billion valuation. The Wall Street Journal reported that media startups Axios and The Athletic could merge and then go public with a merger with SPAC.

Container ship Ever Given is still trapped in the Suez Canal, disrupting about $ 10 billion worth of trade a day.

L Brands LB,

it raised its outlook for profits, citing sales trends that it expects to be driven by changes in consumer spending patterns stemming from government stimulus checks, a relaxation of COVID-19 restrictions on movement and other factors.

Personal income fell 7.1% in February – close to economists’ expectations – reversing much of the 10.1% increase in January. Consumer spending fell 1%, while the PCE price index rose from 1.4% to 1.6%.

The deficit in the trade balance grew 2.5% in February, while inventories remained stable.

The Fed said that temporary limits on dividend payments and share buybacks will end for most banks after June 30.

Another day awake?

US stock futures ES00,

NQ00,

were aiming for a smooth start, with the 10-year Treasury yield TMUBMUSD10Y,

rose to 1.67%.

CL.1 crude oil futures,

were approaching $ 60 a barrel, while the dollar DXY,

it was stable.

Random readings

NASA is preparing to fly a helicopter over Mars.

Nothing like the pandemic to inspire competition for the most important shed of the year.

Need to Know starts early and is updated until the opening bell, but sign up here to have it delivered to your inbox once. The emailed version will be sent around 7:30 am Eastern Time.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from Barron’s and MarketWatch writers.