(Bloomberg) – Long-term bassist RBC Capital Markets updated his recommendation on Tesla Inc., admitting that he had misjudged the electric vehicle manufacturer.

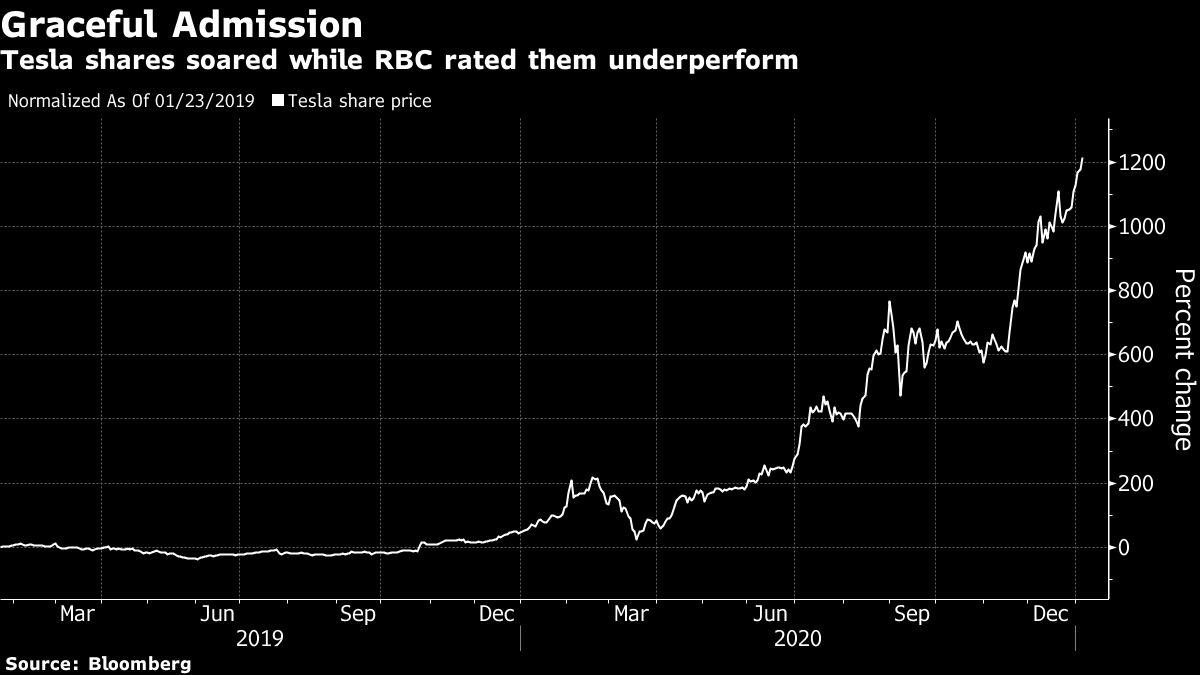

“There is no elegant way to put it other than to say that we understand TSLA’s actions completely wrong,” wrote analyst Joseph Spak in a report that elevated Tesla to the industry’s performance. The brokerage has maintained an equivalent inferior selling performance rating since January 2019, according to data compiled by Bloomberg. During that period, the shares rose about 1,200%.

Reassessing his vision “in the spirit of New Year’s resolutions,” Spak said his biggest mistake was underestimating Tesla’s ability to Palo Alto, Calif., To take advantage of its stock price to raise capital and finance growth or acquisitions. It also increased its 2025 delivery estimate to 1.7 million cars from 1.3 million, based on capacity and market share assumptions, and its target stock price from $ 339 to $ 700.

RBC comments follow a 50% increase in Tesla’s price target earlier this week by Morgan Stanley analyst Adam Jonas to $ 810, after the automaker posted better-than-expected deliveries in the fourth quarter and an increase of capital of $ 5 billion. In November, the broker gave the stock an overweight rating for the first time since 2017.

Tesla rose up 4.9% to a new intraday record of $ 792.93 per share and traded up 4% at 9:52 am in New York. Electric vehicle pairs have also won formal recognition of Joe Biden by Congress as the next president of the United States, seen as a positive thing for the industry. Nio Inc. and Nikola Corp. increased to 7.2% and 8%, respectively.

Among analysts monitored by Bloomberg, Tesla now has 13 buying recommendations, 13 retentions and 14 sales.

(Updates the share price in the penultimate paragraph)

For more articles like this, visit us at bloomberg.com

Subscribe now to stay up to date with the most trusted business news source.

© 2021 Bloomberg LP