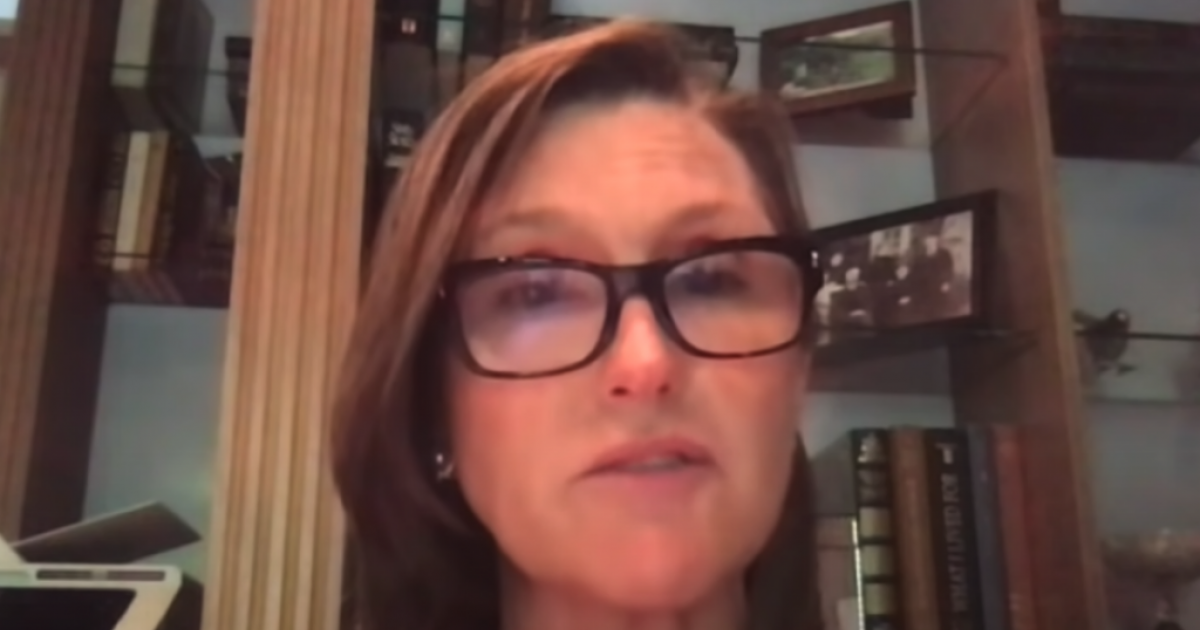

Ark Funds CEO and co-founder Cathie Wood joined Benzinga for the “Raz Report” interview earlier this month. At that time, Wood promised that a new target price would come from the Tesla of Ark.

On Friday, he arrived.

Ark funds on Tesla: Ark Funds updated its price target for shares of Tesla Inc (NASDAQ: TSLA) to $ 3,000 in the year 2025.

Last year, Ark Funds listed a $ 1,400 split-adjusted price target for Tesla shares by the year 2024.

Ark Funds uses a Monte Carlo model, based on a series of simulations to determine the probability of different results with random variables. A total of 34 entries and more than 40,000 possible simulations were used to create the new target price.

Ark Funds ‘negative argument is that Tesla’s shares reach $ 1,500 in 2025. Ark Funds’ new positive argument is that Tesla’s shares reach $ 4,000 in 2025.

Ark Funds’ price target does not include Tesla’s energy storage or solar business in the models. The impact of Bitcoin’s price is also not included in the Ark Funds model.

See also: How to Invest in Tesla Shares

Growth ahead: Ark Funds said Tesla could sell between 5 million and 10 million vehicles in 2025 after new technologies and production improvements. Tesla sold more than 500,000 vehicles in 2020.

The average selling price of Tesla’s electric vehicles was $ 50,000 in 2020. Ark predicts that value will be between $ 36,000 and $ 45,000 in the new target price model.

For the first time, Ark Funds is including insurance opportunities in its forecasting model.

“Ark estimates that Tesla could achieve better-than-average insurance margins, thanks to the highly detailed driving data it collects from customers’ vehicles,” says Ark in the report.

Tesla launched its insurance product in 2019. Currently, it is only available in California. Ark believes that in the coming years Tesla will be able to distribute insurance to other states by underwriting its own policies.

Ark Funds updated its pricing model for Tesla to include assumptions about a fully autonomous direction. Ark estimates the probability of delivering fully autonomous driving by 2025 at 50%. Ark previously listed a 30% chance by the year 2024.

Related link: Automotive companies that served shareholders rather than future growth, will regret: Cathie Wood

Ark Funds and Tesla: Wood has been a remarkable Tesla bull for years. It gave a $ 800 split-adjusted target price, which was criticized by many on Wall Street. His prediction came right earlier this year.

Tesla is the largest holding in the Ark Innovation ETF (NYSE: ARKK) with more than 3.7 million shares worth US $ 2.4 billion.

Tesla is also the largest holding in the Ark Next Generation Internet ETF (NYSE: ARKW) with 1.1 million shares in the amount of $ 752.5 million.

Tesla represents 10.5% of assets in ARKK and ARKW.

Price action: Tesla shares closed at $ 654.87 on Friday. Tesla’s shares have traded between $ 82.10 and $ 900.40 in the past fifty-two weeks.

See the full interview with Cathie Wood and Benzinga here.

Most recent reviews of TSLA

| Meeting | Company | Action | From | For |

|---|---|---|---|---|

| March 2021 | Mizuho | Starts coverage in | Purchase | |

| March 2021 | New street | Upgrades | Neutral | Purchase |

| February 2021 | Morgan Stanley | Keeps | Overweight |

See more analyst reviews for TSLA

See the latest analyst reviews

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.