Wall Street had Georgia on its mind on Tuesday night, with stock and bond futures mostly in the sights, as investors looked at two contests for key Senate seats reaching minimal margins on early returns.

Victor Reklaitis of MarketWatch reported that analysts are describing the races in Georgia as “as close as you can get”, and there are expectations that the winners will not be declared until Wednesday morning.

At the latest check, counts from populous Democratic-tipped counties, particularly in Dekalb, which could rock the vote count, were approaching.

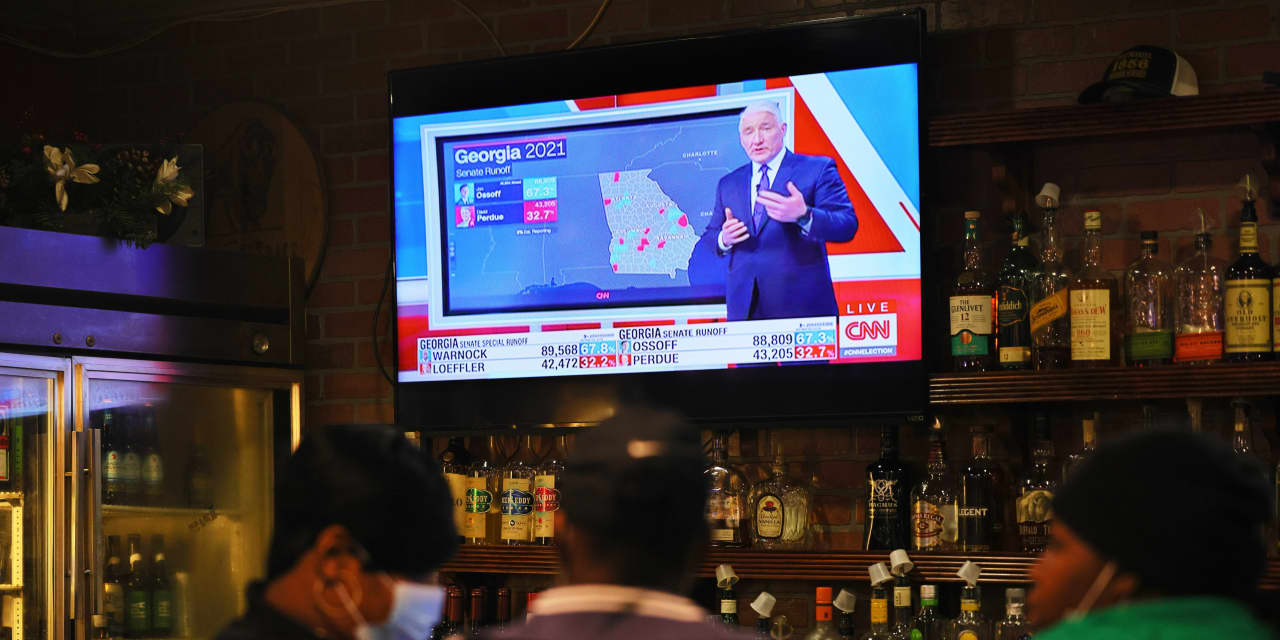

Democratic challenger Jon Ossoff was after current Republican senator David Perdue, with more than 90% of the votes counted, after enjoying a useful advantage earlier, according to data aggregated by the Associated Press.

In the second round, Democrat Raphael Warnock was also slightly behind current Republican Senator Kelly Loeffler.

Senate contests are the second round of the November general election, when none of the candidates has reached the 50% threshold required to be declared the winner.

What is at stake for the markets is the prospect of a small Democratic majority in the Senate if candidates overthrow Republican Party officials.

Senate Republicans, if Loeffler or Perdue win on Tuesday night, could block new coronavirus relief laws and undermine any democratic expansive spending plan after President-elect Joe Biden takes office, experts said.

A Democratic sweep in Georgia, however, would give that party virtual control of the chamber because Vice President-elect Kamala Harris would have tied votes as mayor.

Futures for the S&P 500 ESH21 index,

ES00,

fell 0.7%, while those of the Dow Jones Industrial Average YMH21,

YM00,

were 0.3% lower, and Nasdaq-100 NQH21 futures,

NQ00,

fell 1.3% on Tuesday.

In the regular session, Dow DJIA,

S&P 500 SPX Index,

and the Nasdaq Composite Index COMP,

ended the session solidly higher before political clashes.

However, some of the biggest moves emanated from the bond market, with the 10-year Treasury yield TMUBMUSD10Y,

knocking on the door of 1%, around 0.985%, with the fall in prices, after rates ended at 0.955%, marking its biggest closing at 3 pm since December 4, according to Dow Jones Market Data. The title of the 30-year Treasury TMUBMUSD30Y,

it also rose almost 4 basis points, yielding 1.744% against an afternoon closing at 1.705%, also its highest rate in a month.

For the bond market, Democrats’ victories may increase downward pressure on the Treasury, as analysts say inflation expectations have increased, as Congress may be more inclined to approve additional fiscal spending measures with a majority, the that would weigh on bond prices, pulling yields up.

“It appears that some of the largest democratic counties have not yet been fully accounted for, so my belief is that this may very well depend on Democrats,” Tom di Galoma, managing director of Treasury trades at Seaport Global Securities, told MarketWatch.

“If that happens, rates will continue to increase in the coming days. We could very well see 10-year earnings close to 1.2% soon, ”he wrote.

It is almost impossible to assume what outcome Wall Street considers more appropriate to push stocks further up in 2021. Last year, market participants had bet that a Biden presidential victory, along with Democrats reaching a majority in the Senate, would be the best scenario for additional financial relief measures to help sustain the recovery of the Covid-19 pandemic economy.

However, a blue wave did not manifest itself and the markets emerged in the final weeks of 2020 anyway.