President Joe Biden won’t get everything he wants, but the size of the coronavirus aid spending package that is likely to come out of Congress shouldn’t be too far from his $ 1.9 trillion proposal, according to a Deutsche poll Bank.

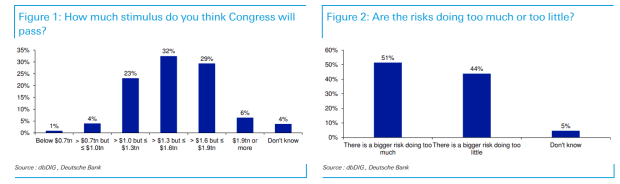

The chart on the left below, highlighted in a Friday note from macro strategist Jim Reid, showed that 68% of the 450 global market professionals who participated in the survey in the past two days expect the package to total more than $ 1.3 trillion, while 35% expect it to be above $ 1.6 trillion.

German bank

Meanwhile, the graph on the right shows that a simple majority sees the risks around the package tilted to do “a lot” as opposed to “very little”.

“Therefore, the debate is relatively balanced, but generally respondents think it will be an aggressive package and fear a little that it is too big,” said Reid.

Although the survey did not ask specifically, Reid said he suspected “overheating” was the biggest concern.

Expectations of another major shock to government spending to boost the economic recovery from the coronavirus pandemic are widely cited by analysts and investors as one of the main drivers of the stock market race at historic levels.

Although the momentum in the stock recovery has stagnated somewhat this week, the shares recovered from the oscillation at the end of January. The S&P 500 SPX,

Dow Jones Industrial Average DJIA,

and Nasdaq Composite COMP,

all on track for weekly earnings after hitting the highest highs this week. The small-cap Russell 2000 RUT,

underlining the optimism regarding an economic growth spurt, it surpassed its large capitalization counterparts, growing more than 10% in the year to date.

“More than economic data or earnings reports, the stock market is being driven by the current and expected liquidity injected into the economy,” said David Donabedian, chief investment officer at CIBC Private Wealth, in comments via email.

Investors are looking beyond expectations for the aid package to come close to the upper limit of estimates, also anticipating a round of heavy infrastructure spending that would affect the economy in late 2021 and 2022, he said.

Fears of overheating the economy, which would increase inflation, were blamed in part by a sale on the long end of the Treasury bond market, which saw the yield of the 10-year note TMUBMUSD10Y,

flirting with 1.2% on Friday, despite a lackluster January inflation report on Thursday.

“Investors should be on the lookout for what might hinder progress in the stock market – bond yields,” said Donabedian. “The question is: are all these government expenditures going to trigger a strong economic recovery, but also cause inflationary pressures? This is the biggest item on the risk side of the ledger and we need to keep an eye on the next inflation data. “

A debate broke out last week among economists over whether the proposed fiscal stimulus was too big. Economist Larry Summers, who served as Treasury secretary in the Clinton administration, argued in a column of guests of the Washington Post that the Biden plan was in danger of creating “inflationary pressures of a kind that we have not seen in a generation” and criticized government officials. government for dismissing “the possibility of inflation.”

Government officials have denied that they neglect inflation prospects. Proponents of the stimulus program argued that the greatest danger to the economy, in trying to recover from the COVID-19 pandemic, is to do very little as a fiscal incentive, and not much. It is easier to control overheating, they argued, than to recover all the jobs lost in the pandemic and restore economic growth.