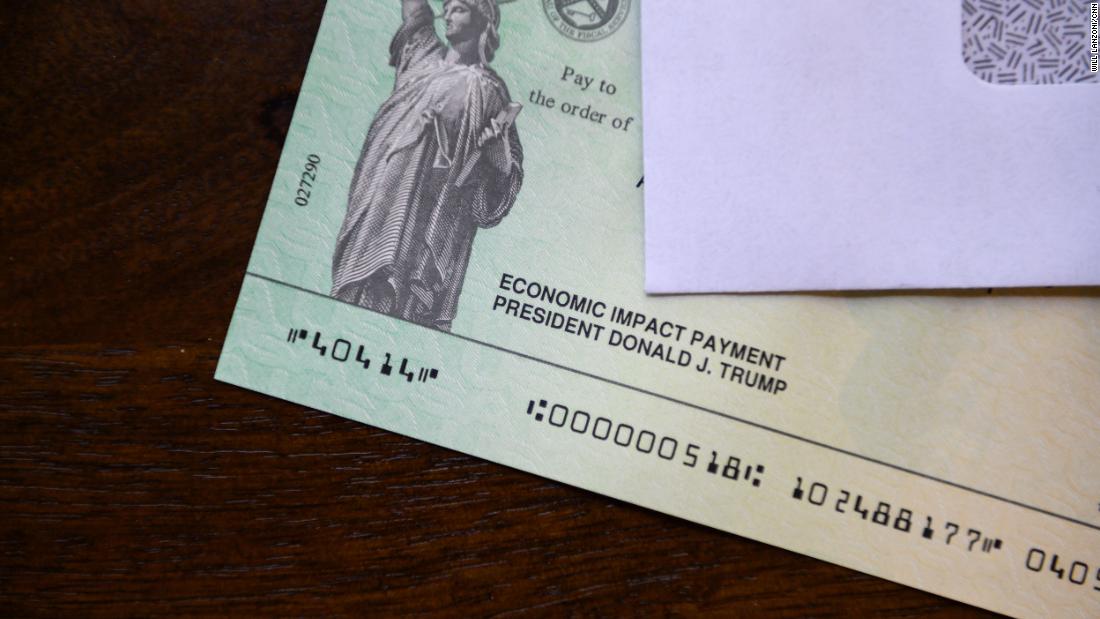

The money comes almost eight months after the first round of stimulus payments, worth up to $ 1,200 per person, was sent as part of a larger coronavirus aid package approved last March. Many of the same people will receive the money again, but there are some minor differences in eligibility.

Recipients may have seen a direct deposit pending in their bank accounts as early as December 29, but the funds officially became available on January 4.

Paper checks or debit cards will be sent to those who do not yet have a bank account registered with the IRS. Checks also started coming out last week.

Some people may not receive the money in the same way as in the first round. If you received a pre-loaded debit card last year, payment will not be added to that card. You will receive a new card in the mail or a paper check.

The law requires the IRS to stop issuing payments after January 15. Those who have not yet issued the payment will have to wait to claim it on their 2020 tax return. The money will either increase their refund or reduce the taxes due. If the payment was sent to an old bank account, you will also have to wait to file your taxes to receive the money

Who is eligible?

Eligibility is largely based on income. Individuals earning less than $ 75,000 per year will receive a total of $ 600. Heads of households earning less than $ 112,500 and couples who file a joint claim for less than $ 150,000 must also pay the full amount. They will receive $ 600 per child under 17, which is $ 100 more than in the first round.

Payments begin to be eliminated for people who earn more money, at a rate of $ 5 for every $ 100 of additional income. Some people who received the first payment can be eliminated from the second round because the payments are lower.

Undocumented immigrants who do not have a Social Security number remain ineligible for payments. But, in a change since the first round, your spouses and children are now eligible, as long as they have the Social Security number.

Those who are declared dependent on someone else’s income tax return, like some college students, remain ineligible.

Lost your job? You can claim more money

First and second round payments are based on the 2019 income adjustment. This means that someone who saw their revenue drop dramatically in 2020 may be eligible for more money than they initially received.

If that is the case, they can claim a “Recovery Credit Rebate” on their 2020 tax return. Credit eligibility and credit amount will be based on revenue for fiscal 2020, according to the IRS .

Those who may have earned more in 2020 than in 2019 are not required to return the money they have already received.