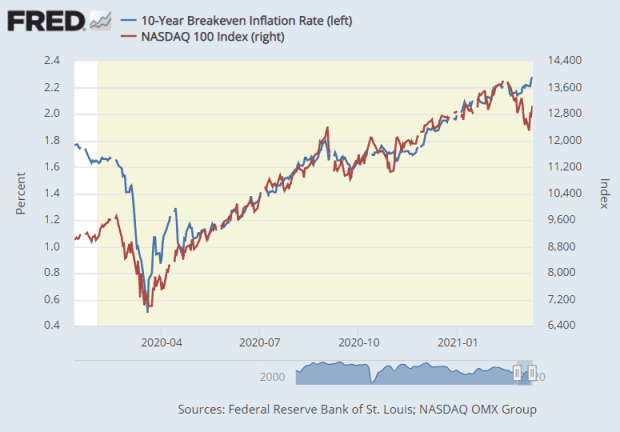

At Friday’s stock, the 10-year Treasury’s yield was rising and the Nasdaq 100’s futures were falling.

That has been the pattern for the past month. After a very close connection since the start of the pandemic, inflation-adjusted yields have continued to rise, but the Nasdaq 100 has suffered. This makes sense, given the rich assessment that technology stocks enjoy – when safe bonds offer more than crumbs of return, they present an investment alternative to stocks.

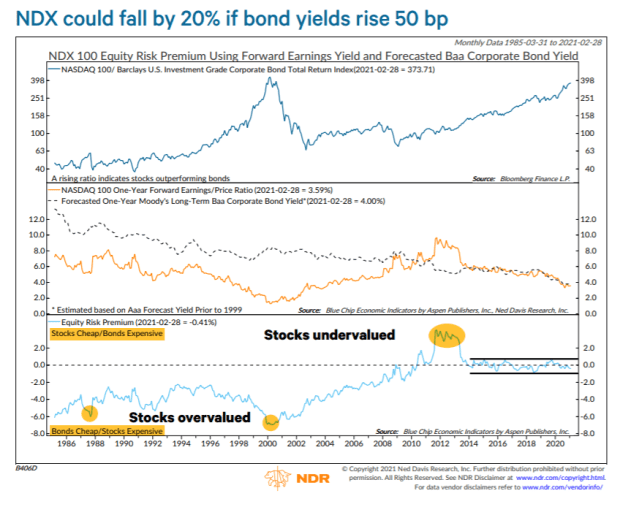

Therefore, analysts are now modeling how far technologies can fall if bond yields continue to rise. Joe Kalish, chief macro strategist at Ned Davis Research, says the Nasdaq 100 could drop 20% from its peak if the 10-year Treasury reaches 2%. (The index is already 6% below its peak.)

Kalish’s calculation depends on whether other relationships remain stable. He says that earnings on earnings and expected yields on corporate bonds have changed together since 2014. A 10-year Treasury at 2% would likely cause Baa-related bond yields – the lowest investment grade rating – to reach 4 , 5%, requiring a 20% drop in the Nasdaq 100 to keep this relationship consistent.

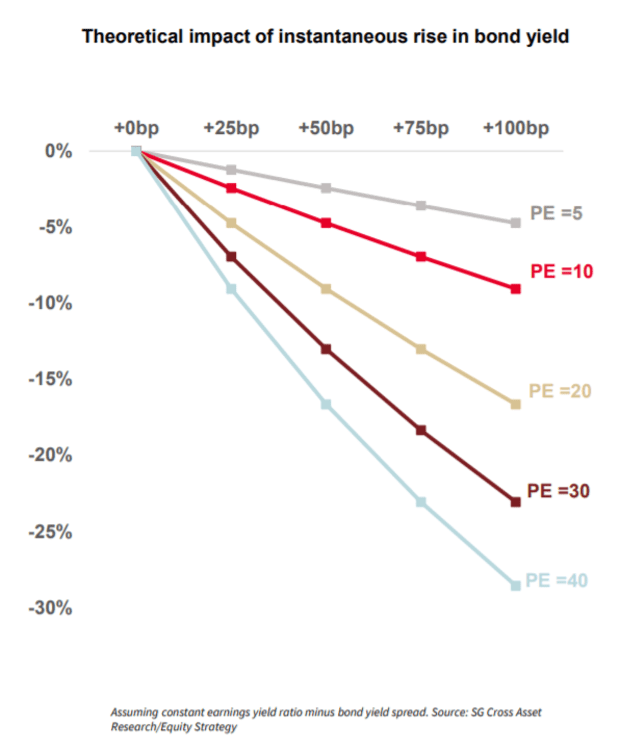

Strategists at the French bank Societe Generale tend to agree. They examined the theoretical impact of an increase in bond yields, at different price to capital ratios. Given that Nasdaq Composite is trading at 31.5 times earnings, according to FactSet data, the chart shows that the impact can be accentuated.

That said, the most notable is that Kalish remains optimistic about stocks, even with these risks. He looked at another valuation measure, using data from the Census Bureau on cash flow margins. “As cash flow has improved since the early 1990s and the cost of capital has dropped with interest rates, the economic margin has increased,” he writes. At the moment, this margin is above the 5-year average. In the United States, the company is recommending small caps instead of large caps and value for growth.

The buzz

The $ 1,400 stimulus checks from President Joe Biden’s $ 1.9 trillion aid package could arrive this weekend. Biden has set a May 1 target for all adults to be eligible to receive vaccines.

Novavax NVAX,

will be in the spotlight after biotechnology said a completed final-stage clinical study showed that its candidate vaccine was 96.4% effective against “mild, moderate and severe illnesses caused by the original COVID-19 strain”. Thailand delayed the launch of AstraZeneca AZN,

vaccine, joining Scandinavian countries, including Denmark, due to concerns about the blood clot Italy is supposed to impose a blockade over the Easter weekend, according to reports by the news agency that cite a draft decree.

China is planning ways to tame e-commerce giant Alibaba BABA,

according to The Wall Street Journal. China also fined 12 technology companies, including Baidu BIDU,

and Tencent 700,

for alleged antitrust violations.

Electronic signature company DocuSign DOCU,

it exceeded revenue and profit expectations for the last quarter and presented a better than expected outlook on these metrics.

Data on producer prices and consumer sentiment highlight the economic calendar.

The markets

The yield of the 10-year Treasury TMUBMUSD10Y,

rose by 1.61% – surprising analysts, given the successful auction of bonds due earlier in the week.

ES00 stock futures,

particularly on the Nasdaq 100 NQ00,

dropped down. GC00 future gold,

fell about $ 20 an ounce.

Random readings

There is a bull market for twins – with the birth rate rising by a third since the 1980s.

Scientists want to send 6.7 million sperm samples to the Moon as a global insurance policy.

Need to Know starts early and is updated until the opening bell, but sign up here to have it delivered once to your inbox. The emailed version will be sent around 7:30 am Eastern Time.

Want more for the next day? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive comments from Barron’s and MarketWatch writers.