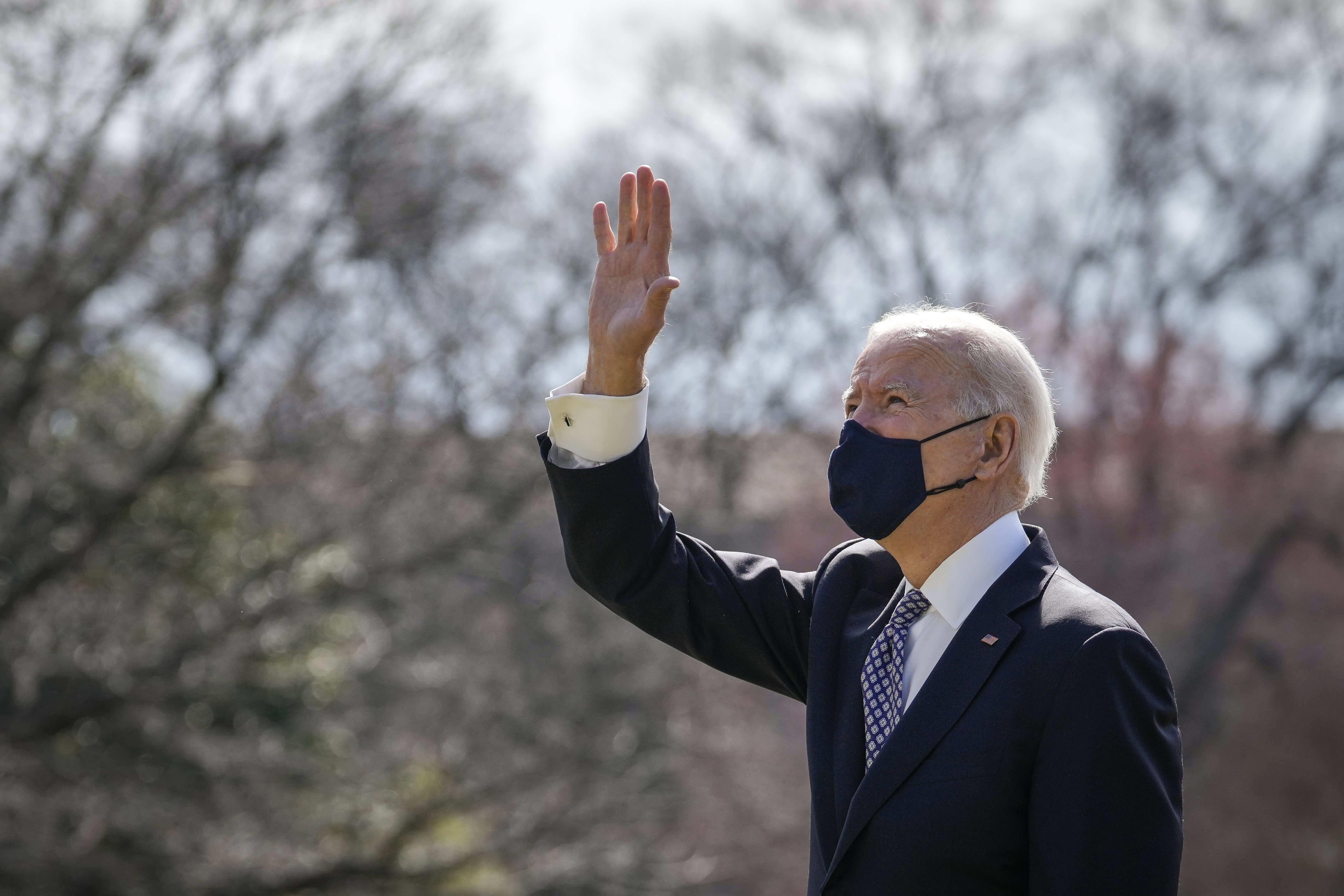

Drew Angerer | Getty Images News | Getty Images

Soon, Democrats may raise taxes on the rich, while lawmakers seek priorities beyond the relief of the pandemic.

A change in the way Uncle Sam taxes the wealth, capital gains and property of the super-rich may be on the table, according to tax experts.

The White House and Congressional Democrats are eyeing higher taxes to raise trillions of dollars in additional revenue to, for example, improve the country’s infrastructure and combat climate change.

President Joe Biden and his aides are considering up to $ 3 trillion in new spending for such ventures, the New York Times reported on Monday.

More from Personal Finance:

Some $ 1,400 stimulus checks will arrive in the mail

TurboTax, H&R Block tweak software to reduce unemployment taxes

Department of Labor creates website for victims of unemployment fraud

There is a chance that radical changes to the tax code will not be approved, especially if they require Republican support. But wealthier Americans can expect at least some kind of tax increase, experts say.

“The question we are really dealing with now is not whether tax rates are going to increase, but when and what taxes?” said Alison Hutchinson, managing director and senior wealth planner at Brown Brother Harriman in New York.

Capital gains taxes

In essence, Biden’s tax plan focuses on raising taxes for Americans earning more than $ 400,000 (it remains unclear whether this is for families or per individual). The plan would increase the maximum income tax rate and tax more of your income for Social Security, for example.

And Biden would raise more taxes for millionaires and billionaires.

For example, he wants to tax long-term capital gains at the same rate as salaries for families earning more than $ 1 million a year.

Wealthy Americans currently pay a 37% tax on wages and a lower 20% tax on investment income (plus a 3.8% surcharge).

The Biden tax plan would raise the capital gains tax for millionaires to 39.6% – the same rate at which the president would tax labor income for those who earned more.

Treasury Secretary Janet Yellen told the Senate in January that this change in capital gains taxes was a long-term goal for the Biden government.

“We recognize that our tax system cannot be biased towards corporate interests and the wealthy, while those that are supported predominantly by wages carry an uneven burden,” she said in a written statement during her confirmation hearing.

The capital gains policy can go beyond the consistently wealthy, however.

This could happen if a businessman who earns $ 75,000 a year sells his company for more than $ 1 million, for example, said Robert Keebler, a tax consultant and certified public accountant in Green Bay, Wisconsin.

“You could argue that this is fair for a Wall Street tycoon who makes a lot of money each year, but it may not seem so fair for a guy who sells his business in a year,” said Keebler.

Real estate tax rules

Biden also proposed changes to the rules on wealth transfers, such as the property tax and donations.

Current law allows heirs to receive an asset, such as a stock or a house at the current market rate (instead of the cost of the original owner), courtesy of an “increase in the base” at the time of death.

This allows the heir to sell the asset without paying tax on the owner’s life appreciation.

On the campaign trail, Biden said he would eliminate the step-up at the base.

If Congress doesn’t agree on anything, it would happen anyway.

Bruce Steiner

lawyer in Kleinberg, Kaplan, Wolff & Cohen

It would also reduce the amount individuals can transfer without paying property and donation taxes, to $ 3.5 million in death bequests and $ 1 million in lifetime gifts. There is also a chance that Biden will increase the tax rate from the current 40%, said Bruce Steiner, a lawyer for Kleinberg, Kaplan, Wolff & Cohen.

The Tax and Employment Reduction Act increased the tax exemption limit to $ 11.7 million for individuals in 2017. This limit will revert to pre-TCJA limits in 2026, due to the expiry clauses enshrined in the law.

This means that more properties (over $ 5.5 million for individuals) will automatically be subject to tax on wealth transfers in a few years.

“If Congress does not agree on anything, it would happen anyway,” said Steiner.

Tax on fortune

Senator Elizabeth Warren, D-Mass., Gives a press conference to announce legislation that would tax the net worth of America’s wealthiest individuals on March 1, 2021 in Washington.

Chip Somodevilla | Getty Images News | Getty Images

Biden did not propose an annual tax on total wealth. However, the policy is on the wish list of some more liberal members of the House and Senate.

Sen. Elizabeth Warren, D-Mass.; Sen. Bernie Sanders, I-Vt .; and eight other Democrats proposed the Ultra-Millionaire Tax Act in early March.

The bill would charge a 2% wealth tax on the net worth of families and trusts ranging from $ 50 million to $ 1 billion. The tax would be 3% for something above $ 1 billion.

About 100,000 Americans would be subject to a fortune tax in 2023, according to Emmanuel Saez and Gabriel Zucman, economists at the University of California, Berkeley. The policy would raise at least $ 3 trillion over a decade, they found.

“When people universally criticize Warren’s wealth tax and say there is a low probability, I agree that the first cut will not be approved by Congress,” said Hutchinson. “But I think tax planners need to focus on these types of proposals, because something like this could very well come up.”