If a deal is struck, experts say it will take at least two weeks for the Treasury to put the money in individuals’ bank accounts after signing any new legislation.

“The timing may be more challenging this time around, but the IRS can probably start withdrawing the money in January,” said Howard Gleckman, senior researcher at Urban-Brookings Tax Policy Center.

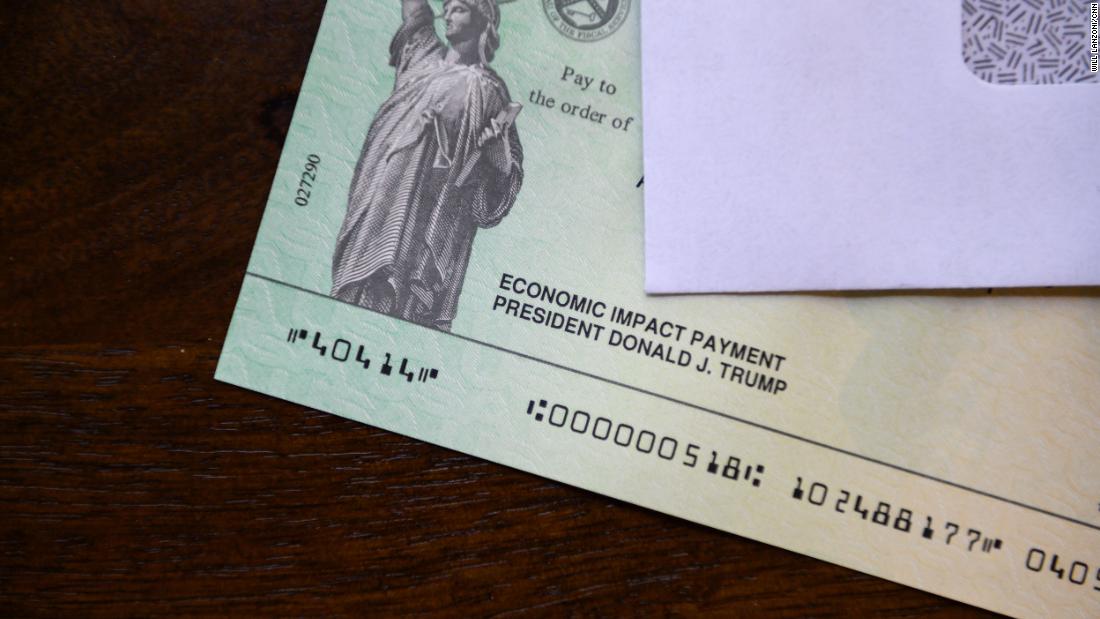

In March, Congress awarded individuals with direct payments of $ 1,200 and couples $ 2,400 plus $ 500 per child under the $ 2 trillion CARES Act.

As in the first round, the $ 600 payments included in current legislation would begin to be eliminated for individuals with an adjusted gross income of more than $ 75,000, and those who earn more than $ 99,000 will receive nothing. Income limits would be doubled for couples.

Who wins the fastest money

Payments don’t come out all at once. Those whose bank information is filed with the IRS you will probably receive the money first because it will be deposited directly into the account. Others will receive prepaid paper checks or debit cards in the mail.

IRS under pressure

If Congress keeps the eligibility requirements the same as in the first round of checks, the process can be almost as easy as pressing a button. But it can complicate things if the parameters are changed – especially if Congress adds restrictions in addition to revenue.

Additional checks may delay the beginning of the 2020 tax reporting season. A second stimulus check means that the agency will have to make changes to the tax return forms, some of which have already been sent to printers.

“I believe the IRS will deliver stimulus checks in a timely manner. It may be at the expense of the start date of the filing season,” said Chad Hooper, executive director of the Professional Managers Association, which defends more than 30,000 non-union workers at the IRS .