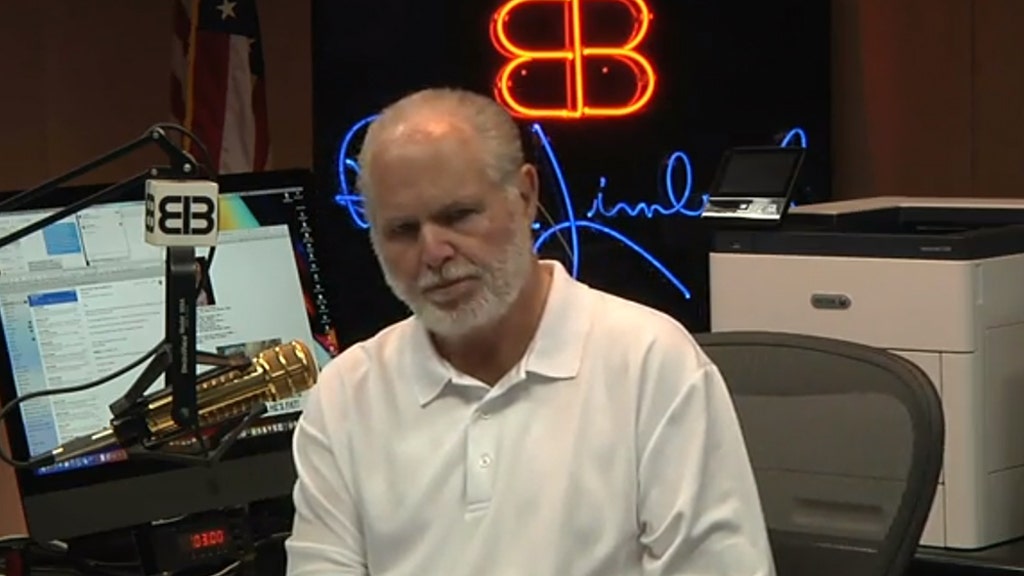

Radio presenter Rush Limbaugh called the GameStop story “the most fascinating thing” that has happened in a long time because it reflects politics with elites trying to prevent ordinary people from benefiting – just as the political establishment tried to contain ordinary Americans.

Robinhood, TD Ameritrade and others restricted trading on Thursday and Wednesday, respectively, after an unexpected increase in trading volume for shares in GameStop, AMC Entertainment, Bed Bath & Beyond, BlackBerry and others. Limbaugh believes the move was made to protect hedge fund billionaires.

GAMESTOP STOCK PRICE FRENZY: WHAT TO KNOW

“Guys, it’s not just political now. The elites are out of shape because a bunch of ordinary users figured out how to become billionaires,” said Limbaugh on Thursday. “I’ve been studying all morning and the best thing I can say is … whatever you think is going on in politics, in the Washington establishment, in the Deep State, whatever it is, it’s the same thing in finance . “

Limbaugh said there are “those who can make a lot of money” and those who cannot.

Rush Limbaugh called the GameStop story “the most fascinating thing” that has happened in a long time, because it reflects politics with elites trying to prevent ordinary people from benefiting.

“If you find out how to make a lot of money, and if you are like Donald Trump and find out how to be elected, you will find out how to defeat the Deep State, they will come and end you,” he said. “They will destroy you, and that is what is happening with GameStop.”

Limbaugh then explained that a lot of people on Reddit figured out how to “manipulate the system” and turn the stock market into a “profit device for themselves”, but that has consequences.

“In the process, they are hurting the intended winners in this financial circumstance and that would be the hedge funds out there. The hedge funds should be the ones that make a lot of money. They are not and are begging for another hedge funds to save them.” , he said.

Instead, GameStock’s stock prices soared this week with retail investors, spurred on by Reddit’s online forum WallStreetBets, accumulating shares. Volatility continued on Wednesday as platforms like Robinhood and Interactive Brokers limited trading in certain stocks.

CHARLES PAYNE DOWNLOADS ON WALL STREET ‘RECURRING’ ABOUT GAMESTOP, AMC FRENZY: ‘NOW YOU’RE LOSING’

GameStop Corp. shares have risen more than 1,900% since the beginning of this year, hurting short sellers. The stock shot up from $ 17.08 a few weeks ago to $ 347.51 at Tuesday’s close. GameStop’s shares had been struggling for six consecutive years before a slight hike in 2020 and its most recent explosion.

Limbaugh said the elite no longer call ordinary people racist, sexist and intolerant when it seeks to shame Americans.

“Now they are making it clear to anyone who has the ability to realize that you are not allowed to use the stock market the way they do, you are not allowed to profit, you are not allowed to make the kind of money,” he said, noting that “elites” expect many advantages.

“And the advantages are, the ability to guarantee your child’s financial future. The ability to guarantee a financial future, the ability to guarantee yourself a position of some power, depending on who you are at the establishment, at the elite club, whatever it is you want to call it, and it extends to a lot more than just political, “said Limbaugh.” This GameStop business now makes it understandable beyond the political world and that is its value. It is no longer just political. It is not just that you cannot think for yourself, on issues and issues of politics … everything is manipulated in favor of the elites and that came and defined that manipulation.

Limbaugh said the system censors or cancels anything that does not benefit the ruling class, be it freedom of speech or even attitude.

“Well, now, with this GameStop story and the revelations contained in it, the elites, the same people who were determined to get rid of Donald Trump, the same people are now trying to say what you can or cannot do with yours money, “he said.

GameStop had lost much of its charm among investors in recent years as a physical store trying to survive in the Amazon world, but an increase in video game purchases amid the coronavirus pandemic suggested that things could change for the video game retailer.

Meanwhile, a single investor on Reddit, a social site where users can discuss news and opinions, was promoting GameStop and suggesting that users join together to buy them short, despite initially getting little interest from other investors, on a forum called WallStreetBets.

After the Reddit user suggested a small squeeze, smaller investors urged each other online to keep GameStop’s stock up, as short sellers were betting against him.

As a result, sellers’ big bets that GameStop’s stock would fall went awry, leaving them facing billions of dollars in collective losses. In these bets, called “short sales”, investors borrow a stock and sell it in the hope of buying it back later at a lower price and pocketing the difference. GameStop is one of the best selling stocks on Wall Street.

As GameStop’s earnings grew and short sellers struggled to get out of their bets, they had to buy stocks to do so. This further accelerated momentum, creating a feedback loop. As of Tuesday, GameStop short sellers had already dropped more than $ 5 billion in 2021, according to S3 Partners.

CLICK HERE FOR THE FOX NEWS APP

Most Wall Street professionals remain pessimistic that GameStop’s stock can keep its huge gains. The company is unlikely to start making profits big enough to justify its $ 22.2 billion market valuation soon, analysts say.

Mobile brokerage apps faced disruptions on Wednesday and Thursday amid market volatility.

The Robinhood app, popular with new and young investors, has restricted transactions on certain securities, including GameStop, according to a press release. TD Ameritrade also restricted certain transactions.

Aubrey Conklin of Fox News contributed to this report.