SACRAMENTO – Governor Gavin Newsom said he would seek to create a billion-dollar economic aid and recovery package for California companies struggling with the coronavirus pandemic.

The plan, part of a state budget proposal that Newsom will formally disclose later this week, would include more than $ 4 billion in small business subsidies, corporate tax credits, financing to expand housing and green infrastructure, and exemption from fees for industries that were hit especially by blocking measures.

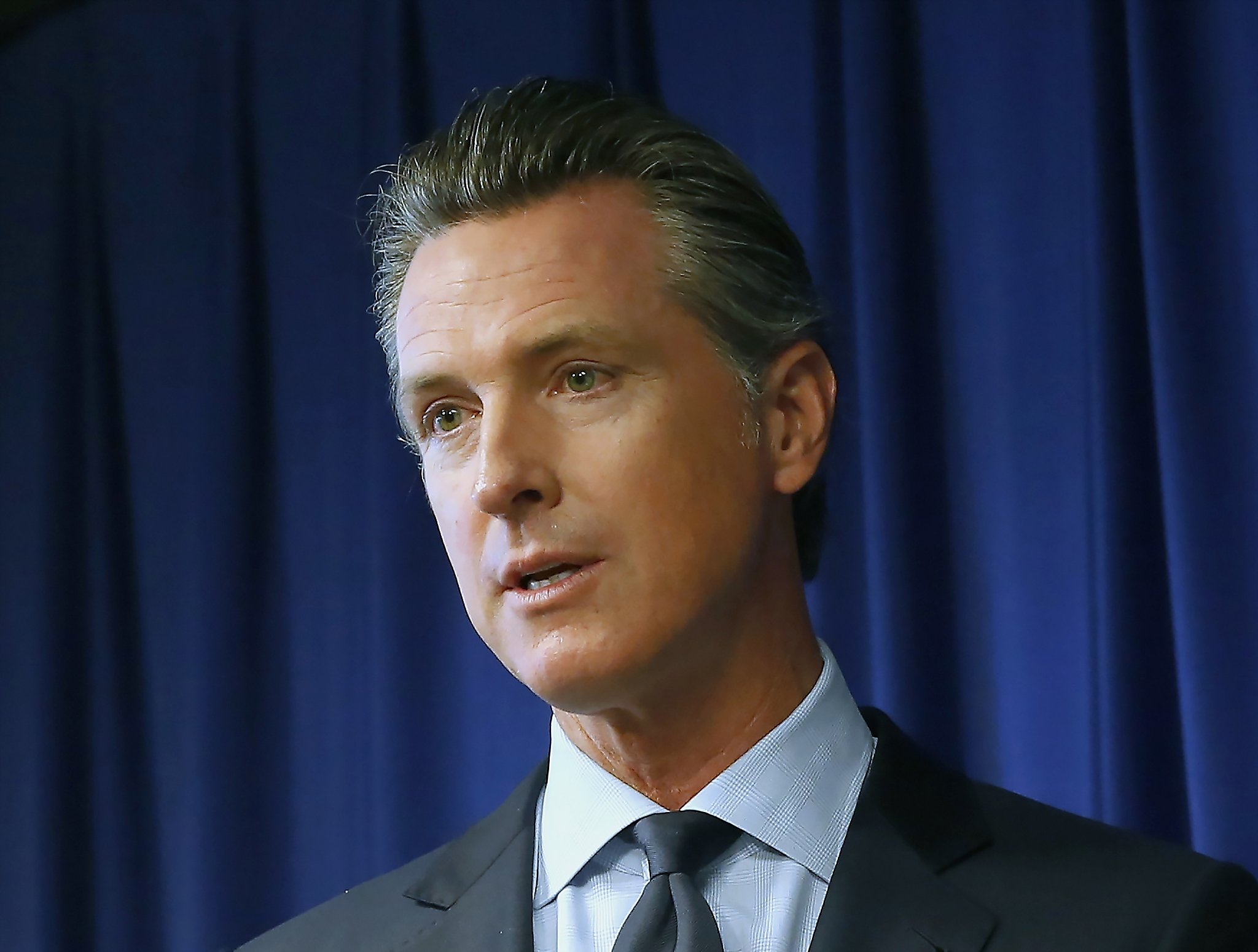

“California’s economy is known around the world for our innovation, inclusion and resilience. That spirit will take us through this pandemic and beyond, ”said Newsom in a statement Tuesday. “These budget proposals reflect our commitment to a fair and wide-ranging recovery that ensures that California remains the best place to start and expand a business – and where all Californians have the opportunity to make their dreams come true.”

A faster-than-expected economic recovery eased California’s budget problems, bringing the state to an unexpected fortune that legislative analysts estimate could rise to about $ 26 billion in the next fiscal year. This will provide Newsom and policymakers with more resources to chart an economic recovery for the state, which has been hit by the pandemic, although analysts also project that California will face an operating deficit in the coming years.

At the heart of Newsom’s proposed financial assistance is an additional $ 575 million to help small businesses adapt their operations to the coronavirus. The state set aside $ 500 million in November to provide companies with donations between $ 5,000 and $ 25,000. The second round of financing would include $ 25 million dedicated to small cultural institutions, such as museums and art galleries, that have been unable to operate or are financially challenged by the pandemic.

The plan would also provide $ 765 million for job creation and economic development efforts, including $ 430 million to increase a tax credit for companies that move to or grow in California, $ 100 million to extend a tax credit of hiring for small businesses and $ 100 million to defray sales tax on manufacturing equipment.

Bars, restaurants, barber shops, manicurists and other companies that were forced to close or limit their capacity during the pandemic would receive about $ 71 million in fee exemptions under the Newsom proposal.

The governor also proposes to support employment growth through a $ 353 million increase in funding for worker training and learning programs; $ 300 million in cash to handle deferred maintenance and greening projects, such as installing electric vehicle charging stations in state buildings; and $ 500 million in grants to reduce the cost of housing developments.

In the largest single item in the package, Newsom is proposing an additional $ 1.5 billion to boost the state’s transition to clean cars, financing the construction of more charging stations and discounts on vehicle purchases. The governor signed an executive order in September requiring all new passenger vehicles sold in California to have zero emissions by 2035.

Newsom’s plan would need legislative approval, which is expected to approve a state budget by June. The governor’s office said it would ask lawmakers to act immediately to appropriate $ 575 million in small business subsidies and $ 71 million in tax exemptions.

“Californians are suffering and need immediate help to face the current crisis,” said Senate President Pro Tem Toni Atkins, D-San Diego, and Assembly President Anthony Rendon, D-Lakewood (Los Angeles County) ) in a statement. “A unified effort is critical to success and we look forward to working with the governor on the details of his legislative proposals and to taking early action to provide significant additional relief.”

On Monday, Newsom said he would also seek an immediate $ 300 million infusion to reinforce the distribution of the coronavirus vaccine in the state. The governor’s announcement of his full budget plan is expected by Friday.

Alexei Koseff is a writer for the San Francisco Chronicle. Email: alexei.koseff@sfchronicle.com Twitter: @akoseff