Modern (MRNA) was one of the most successful stories of the past year. The shift from the high position of biotechnology a year ago to its current position was easy to say in the company’s last quarterly report.

In 4Q20, Moderna delivered revenues of US $ 571 million, a far cry from the US $ 14 million in sales it recorded in the same period last year. The number also came well ahead of Street’s $ 279.4 million bet.

Of course, the big change was due to sales of his Covid-19 mRNA-1273 vaccine, which received Emergency Use Authorization (USA) in December. The vaccine generated sales of nearly $ 200 million.

On the other hand, the company’s losses have deepened. Earnings per share of – $ 0.69 was worse than the net loss in 4Q19 of $ 0.37 per share and lost estimates by $ 0.28.

Investors, however, did not care about the latter part, due to the company’s outlook for the rest of the year. Specifically, due to the continued success of its Covid-19 vaccine, which is expected to generate more revenue than initially anticipated.

On February 24, the Advance Purchase Agreements (APAs) signed by Moderna for its vaccine are expected to generate ~ $ 18.4 billion, compared to the ~ $ 11.7 billion expected earlier this year. The new value is based on growing demand and Moderna producing more doses. The company raised the lower limit of its target for the AF21 from 600 million to 700 million. In 2022, Moderna expects to produce 1.4 billion doses.

With eight commercial subsidiaries now established in North America / EU and a global presence set to expand further, Oppenheimer analyst Hartaj Singh believes that the prospects are really very good.

“We are witnessing a company expanding / accelerating in an unprecedented manner, further increasing the MRNA scarcity value,” said the 5-star analyst. “We continue to see mRNA-1273 having the best profile in the class, with efforts additional (mutations / age / storage groups, etc.) further differentiating their profile. In our opinion, with platform technology, translating the success of mRNA-1273 into its pipeline candidates should not be overlooked, a key factor that underpins a new classification. “

Unsurprisingly, Singh classifies MRNA as Outperform (ie Buy), along with a target price of $ 106. Therefore, the analyst expects gains of ~ 30% in the next 12 months. (To see Singh’s history, Click here)

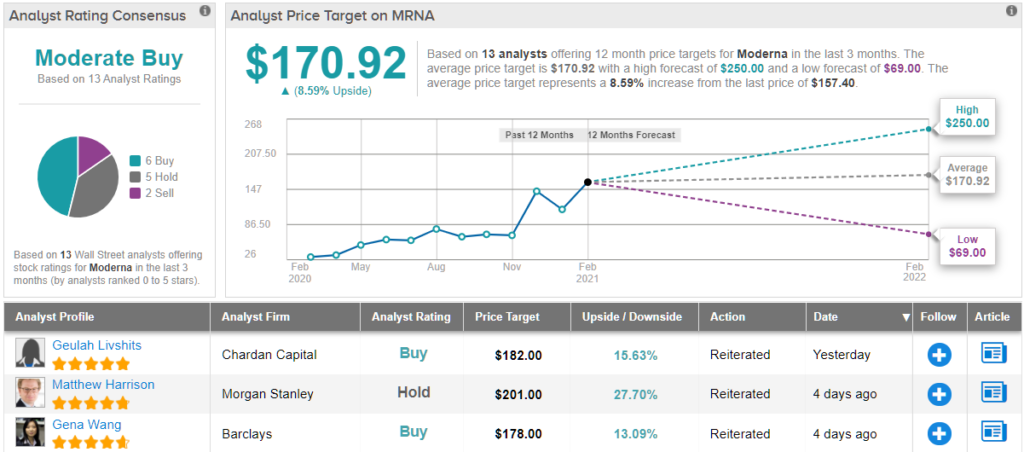

What does the rest of the street think? Looking at the breakdown of consensus, the opinions of other analysts are more dispersed. 6 purchases, 5 retentions and 2 sales add up to a moderate purchase consensus. In addition, the average price target of $ 170.92 indicates an upward potential of ~ 9%. (See MRNA stock analysis at TipRanks)

To find good ideas for trading coronavirus stocks in attractive valuations, visit TipRanks ‘Best Stocks to Buy, a newly launched tool that brings together all of TipRanks’ stock perceptions.

Disclaimer: The opinions expressed in this article are exclusively those of the analyst presented. The content should be used for informational purposes only. It is very important to do your own analysis before making any investment.