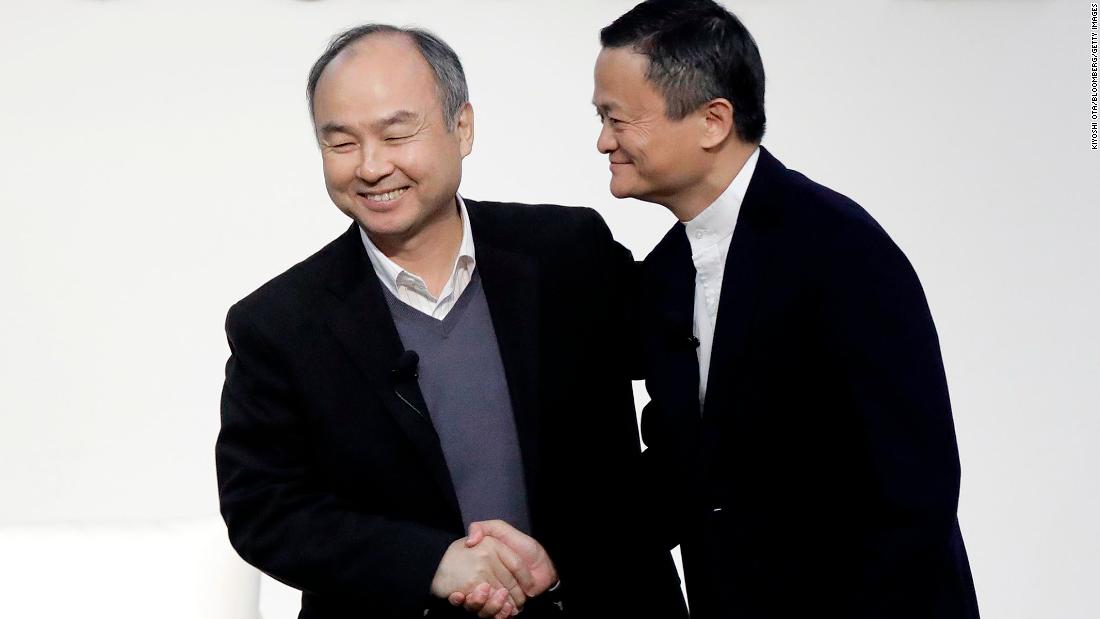

Filho, the CEO of SoftBank (SFTBF), talked about some of his recent exchanges with the Alibaba (NANNY) co-founder during a profit presentation on Monday, saying the two billionaires stayed in touch after Ma almost disappeared from public view for several months.

Alibaba has long been the crown jewel in SoftBank’s investment portfolio. And Son and Ma are famous for being close – the Japanese businessman invested $ 20 million in Alibaba more than 20 years ago, turning that bet into one that was worth $ 60 billion when Alibaba went public in 2014.

But “[we’re] not always [talking] about the deal, “Son said in response to questions about Chinese regulatory crackdown on Alibaba and its affiliate, Ant Group. Ma” likes to draw “and” sent me a lot of drawings, “said the Japanese tycoon.

Son added that he usually responds with his own creations, including sometimes before going to sleep. “About thirty minutes, before going to bed, I make some drawings … [and] show him. “

Alibaba has suffered a crisis of confidence in recent months, as it faces scrutiny from Chinese regulators. The stock fell 25% at the end of last year, although it recovered some ground in early 2021.

The saga began last fall, when the Ant Group was preparing for what would have the largest initial public offering in the world. Ma then accused the authorities of stifling innovation and criticized Chinese banks for having a “pawn shop” mentality. Within days, regulators called Ma and Ant executives to a meeting and then closed the IPO.

Since then, the scenario has worsened for Alibaba and other Chinese technology companies, with regulators announcing an antitrust investigation into Alibaba. Ma was quiet and canceled an appearance at a high-profile event before briefly resurfacing last month, appearing in an online video where he spoke to teachers in China.

Son referred to Ma as a longtime “friend and comrade” and said earlier that before the coronavirus pandemic, the two had dinner every month to catch up on work and life. The two were on each other’s company boards until last year.

“[SoftBank] remains Alibaba’s largest shareholder and Alibaba remains our most important investment asset, “wrote Son in an annual report for the company last July.

Asked about regulatory risk on Monday, Son dismissed the concerns, arguing that such moderation is healthy.

“These are necessary regulations, necessary laws,” he told reporters. “I think what they are discussing now is something that has already been done in the USA [and] European countries, and this does not exceed what we have seen in [those] countries. “

Son also used Alibaba as a case study for his own success on Monday, calling it a “golden egg” that was laid by SoftBank’s “goose”. “I understand that many people were concerned,” he said in reference to Alibaba. “The business itself is operating smoothly and growing.”

Asked why he thought his mother had chosen to speak out against the Chinese government, Son hesitated.

“I don’t know the details,” he said. “So, I hesitate to make any … comment on this.”

– Laura He and Jill Disis contributed to this report.

.Source

Related