The fortunes of the pharmaceutical industry’s stock depend on the assessments of its drug candidates. A positive response from regulators will almost always cause the stock price to skyrocket. On the other hand, a rejection will result in investors rushing to the exit gates.

Unfortunately, for ACADIA Pharmaceuticals (ACAD), the latter case is currently true. After closing on Monday, the company announced that the FDA said it had found deficiencies in ACADIA’s new drug supplement (sNDA) application for Pimavanserin – which bears the trade name Nuplazidin – for the treatment of hallucinations and delusions associated with dementia psychosis (DRP). Shares sank in the next session by 45%.

The FDA should discuss labeling and post-marketing requirements with the company, but said it cannot do so until the company resolves the issues. The problem is that ACADIA has not yet been informed of the reason for the setback.

“Although the real deficiencies have apparently not been communicated to the company,” commented Mizuho analyst Vamil Divan. “We assume that they are likely to receive a Complete Response Letter for the application by the Action Date of April 3. With limited information, we anticipate the launch of DRP by one year in our base case. “

The notification is even more surprising due to the fact that it is very late in the process. What’s more, says Divan, the app was granted FDA Breakthrough Therapy Designation (BTD) because it focuses on a significant unmet medical need.

In addition, to add to the perplexity, Pimavanserin has already received the FDA approval nod for the treatment of hallucinations and delusions related to the psychosis of Parkinson’s disease, which was another reason for the “reduced risk of surprises” before the FDA decision .

With uncertainty hanging in the air, Divan has now reduced the likelihood of successful treatment from 80% to 70% and reduced the target price from $ 70 to $ 55. However, after the stock price collapse, investors still expect an increase of 120% in relation to the current levels. (To watch Divan’s history, Click here)

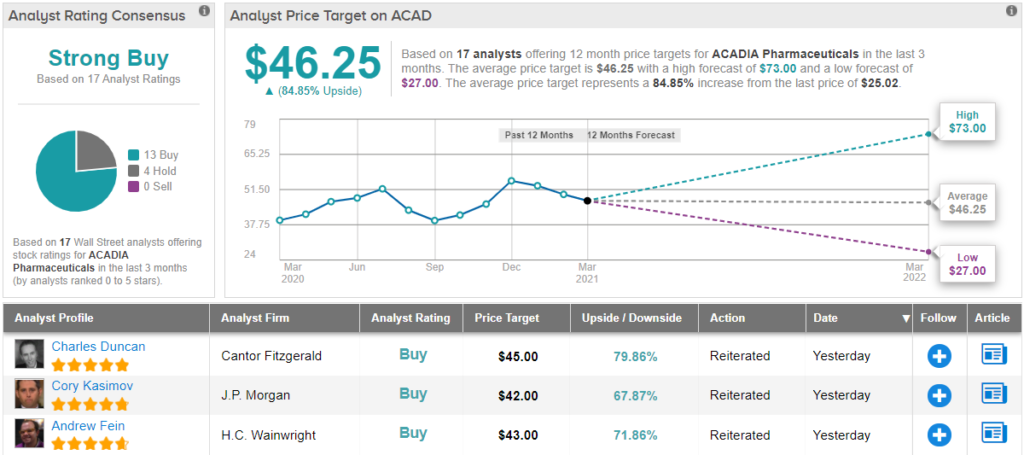

In all, the majority on the street remains on the corner of ACADIA. The analyst’s consensus classifies the stock as Strong Buy, based on 13 purchases and 4 retentions. At $ 46.25, the average price target suggests that the shares will be sold at an 85% premium a year from now. (See ACAD stock analysis at TipRanks)

To find good ideas for trading health stocks with attractive valuations, visit TipRanks ‘Best Stocks to Buy, a newly launched tool that brings together all of TipRanks’ stock perceptions.

Disclaimer of Liability: The opinions expressed in this article are exclusively those of the analysts presented. The content should be used for informational purposes only. It is very important to do your own analysis before making any investment.