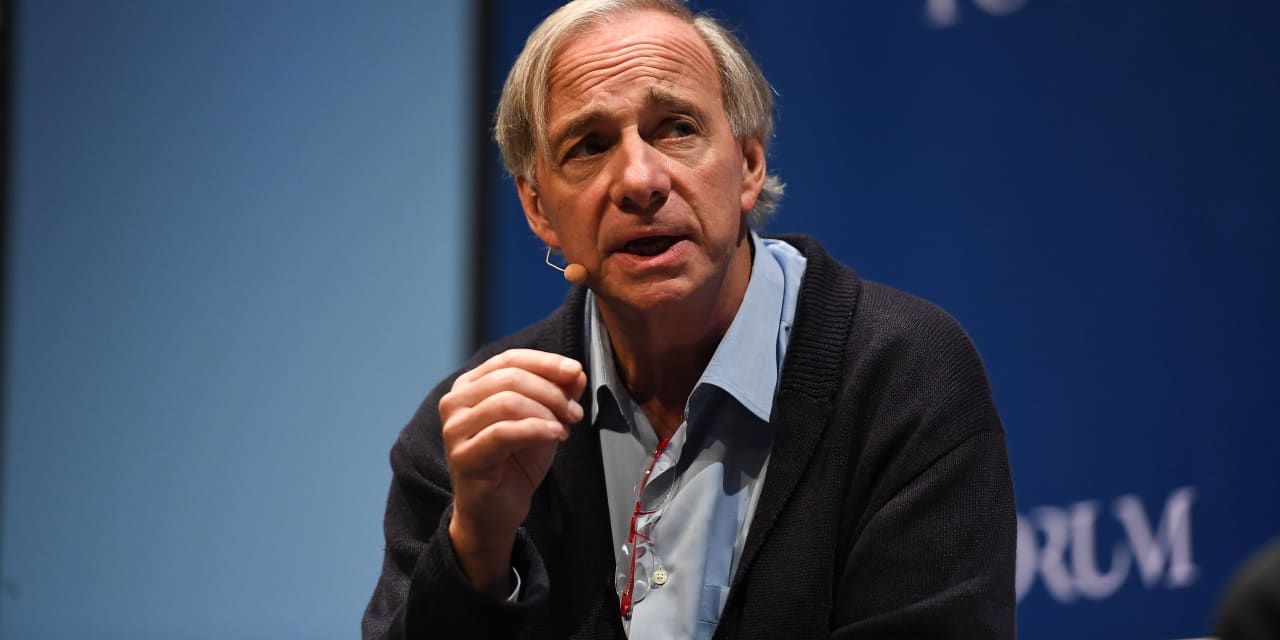

Ray Dalio is not a fan of titles.

The founder of Bridgewater Associates, the world’s largest hedge fund firm, criticized the bonds’ “ridiculously low yields” in a LinkedIn blog post on Monday, while defending a diversified portfolio.

“

“The economy of investing in bonds (and most financial assets) has become stupid. . . Instead of receiving less than inflation, why not buy things – anything – that will be equal to or better than inflation? ”

“

(The yield of the 10-year US Treasury bill TMUBMUSD10Y,

withdrew from the one-year highs on Monday, before a meeting of the Federal Reserve.)

Dalio has also never been a fan of holding money – and he still isn’t.

“I believe that money is and will continue to be rubbish (that is, it has returns that are significantly negative in relation to inflation), so it is worth a) borrowing money instead of keeping it as an asset and b) buying more return, not debt investment assets, ”he wrote.

“History and logic show that central banks, when faced with a situation of supply / demand imbalance that would cause interest rates to rise more than is desirable in the light of economic circumstances, will print money to buy bonds and create ‘interest curve controls’ to limit bond yields and devalue cash, ”said Dalio. “It makes money terrible to have and great to borrow.”

Reading: Opinion: Why inflation makes holding long-term securities more risky than owning shares

Dalio also warned that a tax on wealth in the United States, such as that proposed by Senator Elizabeth Warren, would only lead to an outflow of capital and efforts to evade taxes. “The United States can be seen as an inhospitable place for capitalism and capitalists,” he wrote.

So, what does Dalio recommend in today’s market?

“I believe that a well-diversified portfolio of non-debt and non-dollar-denominated assets, together with an uncovered cash position, is preferable to a traditional stock / bond mix that is strongly inclined to US dollars. I also believe that assets in developed countries with reserve currency will underperform Asian emerging markets (including Chinese). I also believe that we must be aware of tax changes and the possibility of capital controls ”.