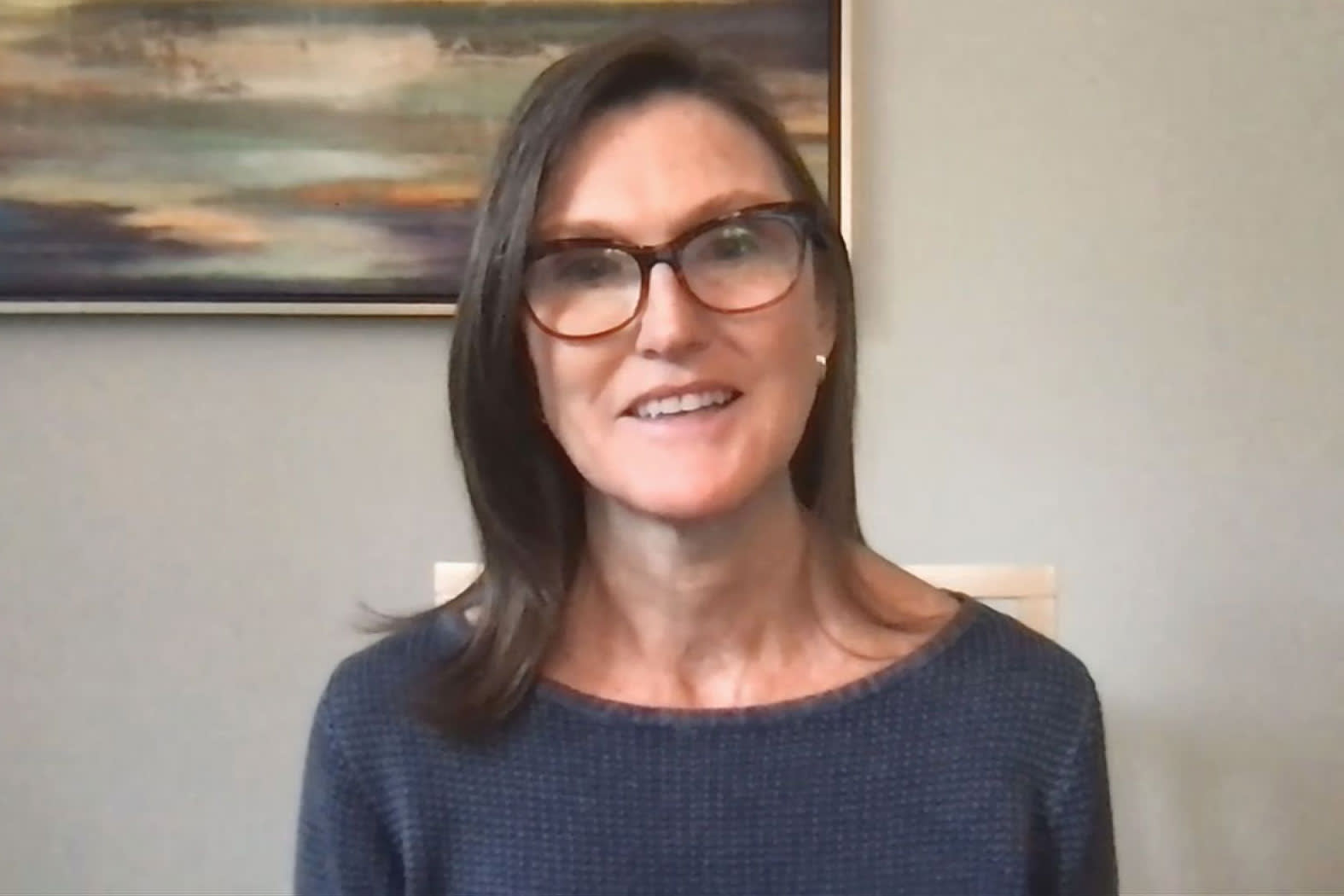

Now that Ark Invest has become a whale in the stock market, managing the largest actively managed ETF and accumulating legions of fans, Cathie Wood faces the difficult task of navigating the turbulent waters of the market as the “innovative” stocks she advocated face unstable terrain.

Ark Invest’s assets under management skyrocketed to nearly $ 54 billion, from about $ 3.9 billion last year. Wood has his own fan page on Reddit after his main fund – Ark Innovation – returned almost 150% in 2020.

But the fund lost about 15% this week amid weakness in technology stocks under pressure from rising interest rates. For the second time this year, Wood’s Ark Innovation saw outflows of the order of $ 465 million on Wednesday.

This difficult week revealed Wood’s strategy: buy the drop in the innovative stocks that brought him here. And despite a difficult day of outflows, this week has shown that its investors are not as fickle as they realize and can believe in its long-term philosophy as well.