The Treasury’s rising yields have contributed to the liquidation of major stock market pandemic flights, but they are unlikely to be enough to ruin the stock’s appeal on bonds in 2021, according to an analyst.

US equity investors “focused on the recent rise in 10-year Treasury yields last week, which go back to mid-February 2020 levels,” wrote Lori Calvasina, head of US equity strategy at RBC Capital Markets , on a Tuesday note. Bond yields and prices have an inverse relationship.

The yield of the 10-year Treasury TMUBMUSD10Y,

is rising from its six-week high, which was blamed for triggering a retraction led by technology-driven actions that benefited most from the stay-at-home dynamics created by the pandemic COVID-19.

Related: Can the bullish stock market survive rising inflation and bond yields? Here’s what the story says

The relationship was shown the other way around on Tuesday, with rising yields easing after the testimony of Federal Reserve Chairman Jerome Powell, allowing key benchmarks to erase or reduce significant losses. The high-tech Nasdaq Composite COMP,

who led the fall, cut a loss of almost 4% to close at 0.5% as yields declined; the S&P 500 SPX,

made a profit to break a five-day losing streak, while the cycle-oriented Dow Jones Industrial Average DJIA

erased a loss of more than 360 points to finish a little higher.

Meanwhile, Calvasina said that a look at what stocks are offering in terms of dividends and yields on bonds, as well as a reminder of what kind of bond movements have posed problems for stocks, offers some guarantee that 2021 is likely to it will not become a low year, she said.

Dividend yield

When it comes to dividend yield, the RBC measured the percentage of companies that continue to exceed the 10-year Treasury yield. Although it fell from 64% to 51.5% at the beginning of the year, it is still within a range normally followed by a 17% gain for the S&P 500 in the next 12 months, she said.

Earnings income

The yield on S&P 500 profits also deteriorated, moving to the lower end of the range in effect since the end of the financial crisis. It is now close to the level seen in 2017-18, but remains in a range that has been followed by average gains of 9.3% for the S&P 500 over the next 12 months, said Calvasina.

“In other words, this analysis is recognizing the need for a short-term retracement in the S&P 500, but it is not necessarily signaling that long-term investors should head out,” she wrote.

Calvasina also highlighted a “major difference” between 2018, when the trade war posed a threat to the U.S. and global economies, and now, when forecasts of gross domestic product are increasing rapidly.

Treasury yields and shares

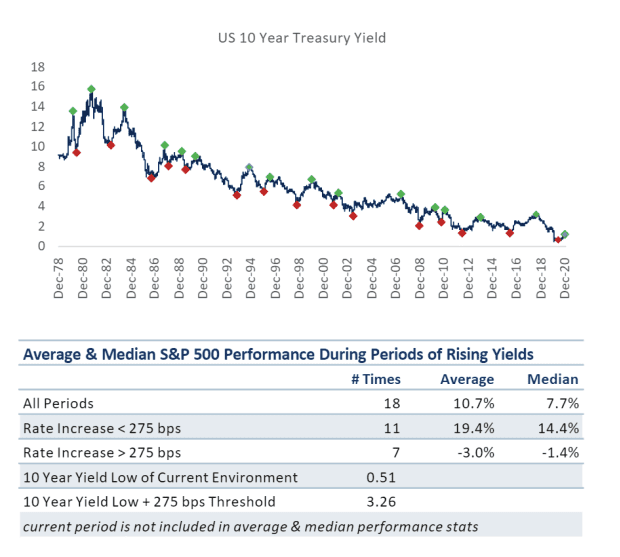

Finally, what about the increase in income from the Treasury itself? After all, many market watchers have argued that, while yields remain low by historical standards, it is the size of the rise that may be most worrying for stocks. Calvasina broke the relationship between income movements and stock market performance in the chart below:

RBC Capital Markets

Calvasina said US stocks tend to struggle when the 10-year yield rises more than 275 basis points, or 2.75 percentage points. Moving out of its 0.51% low, a move of 275 basis points would bring the yield to around 3.26%. The 10-year period ended Tuesday at 1.363%.