Several Democrats and Republicans have come together in opposition to the strict limits imposed by Robinhood and other online stock brokers over the purchase of GameStop and other stocks swept away in a trading frenzy fueled by Reddit this week.

Members of Congress, such as Alexandria Ocasio-Cortez, DN.Y., Ro Khanna, D-Calif., Ted Lieu, D-Calif., Ken Buck, R-Col. And Sens. Pat Toomey, R-Pa. and Texas Republican Ted Cruz are among those who have criticized the move, with many calling for hearings that Democratic leaders say will soon take place in the House and Senate, while what started as an Internet movement continues to cloud Wall Street.

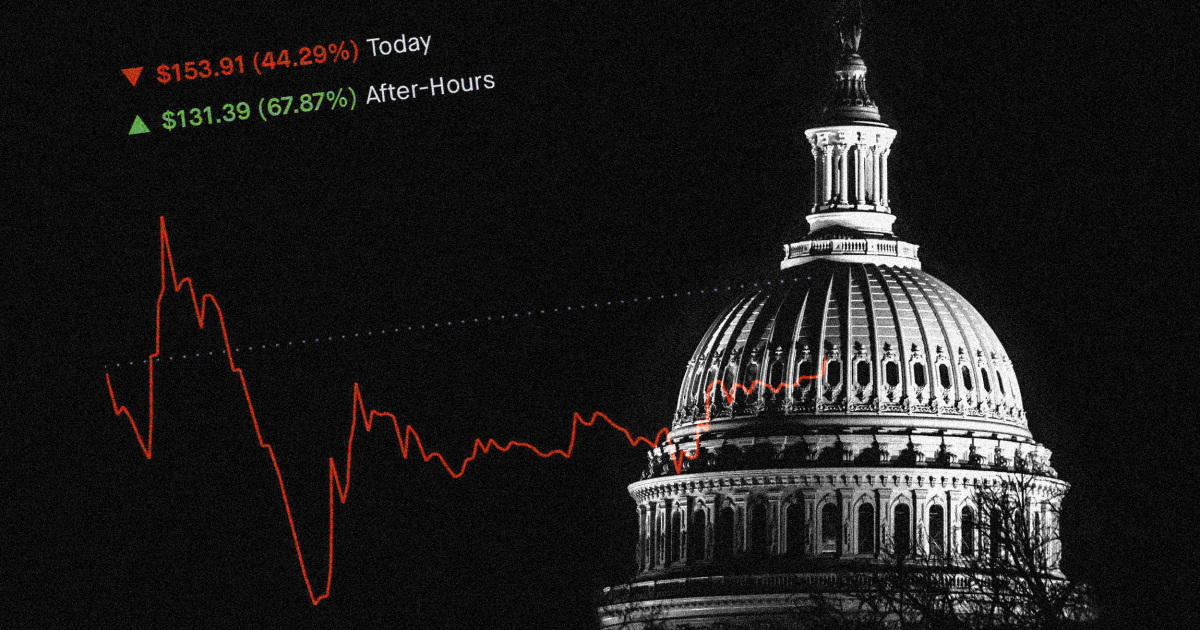

Lawmakers drew attention to the volatility surrounding GameStop’s shares, as well as many others this week. The stock rose from $ 4 just a few months ago to more than $ 400 this week, spurred by an online movement not unlike others that have largely changed the political landscape in recent years. At the same time, hedge funds that placed big bets on the fall of GameStop shares – known as “shorting” – began to accumulate huge losses. Then, the brokerage houses imposed limits, leading to accusations of collusion with the largest financial entities facing large losses.

Robinhood co-founder Vladimir Tenev said hours after the move that she had no choice but to limit stocks, as she and her peers were forced by obligations imposed by federal regulators. The decision “was not made based on the direction of any market maker we target or other market participants,” he said, adding that notions to the contrary are tantamount to “misinformation”.

For both progressive and more conservative members, there was a sense that the nation was watching a populist insurgency overcome, albeit temporarily, the so-called fraudulent system. However, there is no broad consensus on the political goals to be followed in response to brokers that limit users’ ability to trade a handful of shares.

“There is clearly a bipartisan concern,” Michael Steel, a former spokesman for then-Mayor John Boehner, R-Ohio, told NBC News. “I think the question is whether there are effective changes in public policies that make sense and make a difference”.

To the left, the restrictions were seen as further evidence of Wall Street’s misconduct, leading to demands for greater regulation. On the right, lawmakers condemned the limits as contempt for the free market, while comparing the restriction to other allegations of “censorship” of big technologies.

This dynamic agreement – at the superficial level that gives rise to existing party divisions – reflects party gaps in other areas in which the parties have found some complaints in common, especially with the main technology companies in the United States.

House Financial Services Committee chairman Maxine Waters, D-Calif., And new Senate Banking Committee chairpersons, Sherrod Brown, D-Ohio, said the two committees will soon hold hearings to deal with the ordeal. Democrats and progressives alike have said the episode makes confirmation of President Joe Biden’s choice for Securities and Exchange Commission chairman Gary Gensler even more pressing.

“Bipartisan support for an investigation is good, but at the end of the day, if you believe someone like Ted Cruz will actually face Wall Street, I have a short position on GameStop that I would like to sell to you,” said Tim Hogan, a Democratic consultant and former spokeswoman for Senator Amy Klobuchar’s presidential campaign.

Senator Elizabeth Warren, D-Mass., One of the leading Democrats on financial regulation issues, wrote to the SEC’s acting commissioner on Friday questioning the extent to which a combination of major investors and online forums impacted GameStop’s stock fluctuation, whether any of these practices conflict with existing laws and whether the “violent swings” in the value of GameStop and other companies “pose any systemic concerns for financial systems or the stock market?”

“There are rich people on both sides of it, people who are apparently trying to manipulate this market,” Warren told CNBC on Thursday. “And that’s what we don’t know the details about.”

Like many of the forces that have shaped American politics in recent years, the Reddit forum, r / WallStreetBets – which describes itself as “How 4chan found a Bloomberg terminal” and is credited with having originated much of the commercial frenzy – sells the idea of the boy taking over the great establishment. In the midst of a pandemic that sparked an increase in retail trade, its audience has grown substantially in recent months.

“You know something is about to fall when most members of Congress are united on Wall Street trying to f — us,” wrote one user on Thursday, with a link to a Lieu tweet. Another wrote about how he was not particularly moved to enter the GameStop trade until he “turned into a class movement”.

“I am a big populist and I think we need big changes in this country, especially a transfer of wealth and power from the elites to the people,” wrote the user. “When it became a class movement, I became obsessed.”

The wild rise of GameStop traders has been applauded by some of the richest individuals in the world, such as Tesla CEO Elon Musk and the Winklevoss twins. Former President Donald Trump’s eldest son, Donald Trump Jr., also sought to present himself as an ally of the Redditors.

Andy Surabian, a Republican strategist, said people are “probably underestimating how big the moment was”, adding that the episode probably “did more to harm Big Tech in the eyes of people who were not yet aiming at them than anything.” that I saw in recent history. “

Seeming to sense a shift in political winds, Robinhood listed a job on Friday for a “Federal Affairs Manager” to “focus on federal defense and government affairs” dealing with laws and regulations.

“The job list doesn’t mention that, but you’ll also meet the House Financial Services Committee,” Rep. Jamaal Bowman, DN.Y., tweeted, along with an emoji crying and laughing.