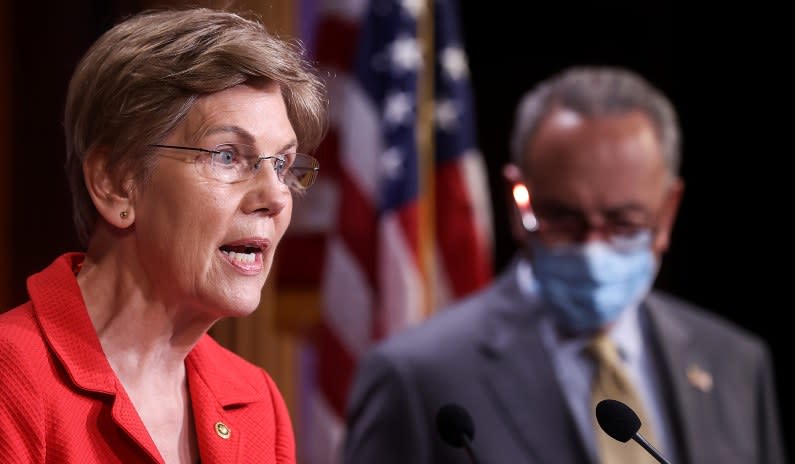

THEn On March 1, Senator Elizabeth Warren (D., Massachusetts), accompanied by representatives Pramila Jayapal (D., Wash.) And Brendan Boyle (D., Pa.), Introduced the so-called Ultra-millionaire Tax Law of 2021. The bill would impose an annual “fortune tax”, starting at 3% and reaching 6%, on the richest 0.5% of all Americans.

THE merits of the tax itself were discussed at length. What has not been discussed is the new IRS enforcement scheme that the project would create, which would include an impressive increase in the size of the IRS, a substantial expansion of the already oppressive IRS information reporting requirements, and many more audits and collection actions.

Let’s look at these elements more carefully.

IRS Financing

The bill proposes to increase IRS financing by $ 100 billion over the next ten years. To put this in perspective, the IRS budget for fiscal year 2021 is $ 11.92 billion, an increase of $ 409 million over fiscal year 2020. Warren’s bill would almost double the funding of the agency for fiscal year 2022 and would make it almost ten times higher in 2031.

What’s more, the bill stipulates that 70 percent of the new money must be used for tax law enforcement, compared with just 10 percent allocated to “taxpayer services”, such as pre-filing assistance and education, filing and accounting services, and taxpayers – advocacy services. Again, for one perspective, the IRS budget for fiscal year 2021 allocates $ 2.556 billion for taxpayer services and $ 5.213 billion, or nearly double, for enforcement activities, such as audits, collections, litigation and criminal investigations. . Warren’s account would give the IRS seven times more money for inspection than for taxpayer services.

This huge imbalance betrays the left-wing mantra that “the government is here to help you”. If that were true, more money would be spent on giving people the information they need to comply with the huge four million word tax code than on enforcement after the fact. Still, for decades, spending on enforcement has exceeded spending on education – and Warren would make the imbalance much worse.

While it is admittedly naive to believe that enforcement is unnecessary, the fact is that 98% of every dollar owed to the IRS is paid without the need for any agency intervention. People work hard to comply with our huge tax code. In 2019, it ended 67 million Americans sought some form of IRS compliance assistance in some capacity; only 1,800 were charged with a tax crime.

Clearly, the IRS has much more to gain by teaching people to obey than grinding them to dust if they don’t.

Expanded information reporting requirementsSpeaking of being turned to dust, one of the IRS ‘main compliance tools is the “information report”, which comes from the “information returns” that the IRS uses to collect data. Form W-2, which reports wages paid by an employer to an employee, and forms 1099, which reports interest, dividends, payments from independent contractors, etc., are two prominent examples of such “information returns”. But there are literally dozens of other forms that the IRS uses to collect data so that it can verify income reported on tax returns.

The scale of this data is impressive. In 2019 alone, a total of 3,503,499,195 returns of information were filed with the IRS. The U.S. population in 2019 was 328,239,523, which means that more than ten information statements were submitted to the government for every man, woman and child in America in 2019 – not counting income tax returns.

However, according to Warren, it is not enough.

According to its bill, within twelve months of enactment, the IRS must create a palette of new regulations designed to force the reporting of “any information regarding the net asset value” that the agency deems relevant. The reporting load may be based on “ownership, control, management, income claim of, or other relationship to assets” subject to taxation under the law, including “financial institutions, commercial entities or other people” with any connection with people responsible for the tax. In addition, business entities belonging to persons subject to tax must “provide estimates of the value of the tax. [business] entity itself. “And if you are planning to avoid the new requirements, the bill further provides that the IRS has the power to draft new regulations specifically deemed” necessary to prevent taxpayers from avoiding the purpose of reporting information. “

Now, a reasonable person can ask if all of this data cannot simply overwhelm the IRS, making the application of reporting requirements unsustainable. Well, the “We’re here to help” crowd also thought about it: the law would direct the IRS to “develop a comprehensive plan to manage efforts to leverage the data collected” to improve compliance efforts, with the stated goal of addressing “ non-compliance with such requirements. “

Greater general oversight In 2019, there were 154.1 million individual tax returns filed. Warren’s fortune tax is directed only at the wealthiest 0.5% of architects. Do you think the IRS needs to double its budget to handle just 0.5% of America’s taxpayers? No, friends, the application component of the 2021 Ultra-millionaire Tax Law is not just for ultra-millionaires. And to you.

If Warren’s bill is approved, you should expect the IRS to hire legions of new auditors and tax collectors who will be released from American taxpayers over the next ten years. As the tax code becomes more voluminous and complex, more people make honest mistakes when calculating their taxes. This reality leads to tens of millions of penalty assessments. In 2019, the IRS assessed more than 40 million civil penalties. Nearly 33 million were fined against individuals, the vast majority of whom are honest taxpayers caught in tax code traps and holes they didn’t even know existed. These same people then became targets of a flurry of IRS notifications and payment requirements and, if that fails, eventually encumbrances and tax rates. Ultra-millionaires tend not to have this problem; they can only pay their taxes, because they are ultra-millionaires. But when middle-income Americans fall into tax debt, they fall victim to law enforcement precisely because they don’t have the money to make the deal.

And that is the most sinister thing about Warren’s bill: it is meant to be a crackdown on wealthier Americans, but in reality it is likely to hit ordinary taxpayers the hardest.