When America’s amusement parks and baseball stadiums no longer need to serve as COVID-19’s mass vaccination sites, some investors believe that families receiving pandemic financial aid from the government may begin to boast.

While consumer ostentation may initially boost parts of the economy devastated by the pandemic, a major concern for investors is that a sustained wave of spending can also cause prices for goods and services to rise dramatically, damage the values of financial assets and finally, increasing the cost of living for everyone.

“I don’t think inflation is dead,” said Matt Stucky, equity portfolio manager at Northwestern Mutual Wealth Management Company. “The desire of the main policy makers is to have it, and it is the strongest that has ever existed. You will see an increase in inflation. “

Wall Street investors and analysts have focused in recent weeks on the potential of the $ 1.9 trillion fiscal stimulus package planned by the Biden government, which aims to relieve hard-hit families to get inflation out of control.

Economists at Oxford Economics said on Friday they expect to see “the longest inflation above 2% since before the financial crisis, but it is unlikely to exceed 3% in a sustainable way”.

Severe inflation can hurt companies, increasing costs, reducing profits and causing stock prices to fall. The value of savings and bonds can also be undermined by high inflation over time.

Another concern among investors is that rampant inflation, which consolidated in the late 1970s and pushed 30-year mortgage rates close to 18%, could force the Federal Reserve to reduce its $ 120 bond purchase program. billion a month or raise its benchmark interest rate above the current target of 0% to 0.25% earlier than expected and scary markets.

At the same time, it is no exaggeration to argue that some financial assets have already been inflated by the Fed’s pedal-to-the-metal policy of low rates and an easy credit flow, and may be due to some cooling off.

US stocks, including the Dow Jones Industrial Average DJIA,

S&P 500 index SPX,

and Nasdaq Composite COMP,

closed on Friday at historic highs, while debt-laden companies can now borrow on the corporate junk, or speculative grade, market at record low rates of around 4%.

Reading: Stock market fueled by stimulus hopes – what investors are counting on

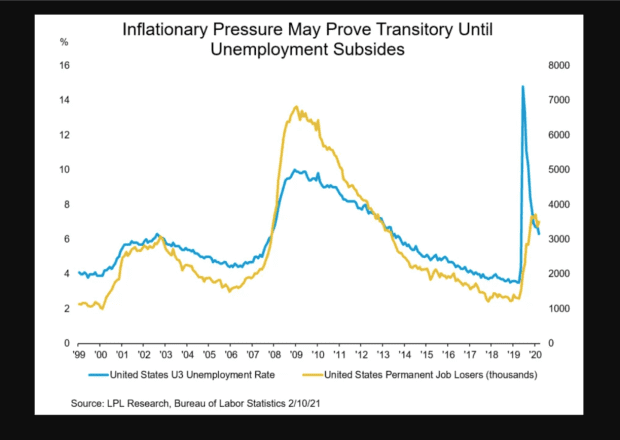

In addition to increasing stocks and bonds, home prices in the U.S. also skyrocketed during the pandemic, although the US still needs to recover nearly as many jobs from the COVID-19 crisis as it did during the worst of the global financial crisis in 2008

This graph shows that the jobs lost due to the pandemic remain close to the levels observed after the last crisis.

Job loss needs to be tamed

LPL Research, Bureau of Labor Statistics

Fed President Jerome Powell said on Wednesday that he does not expect a “big or sustained” inflation spurt, while stressing that the central bank remains focused on recovering jobs lost during the pandemic, as USA appears to make great strides in its vaccination program in late July.

Treasury Secretary Janet Yellen reiterated on Friday an appeal on Friday that the time for more and greater fiscal stimulus is now.

“In general terms, the guide is: does it cost me more to live a year from now than a year before?” Said Jeff Klingelhofer, co-director of investments at Thornburg Investment Management, about inflation in an interview with MarketWatch.

“I think what we need to look at is wage inflation,” he said, adding that the highest wages for people with the highest income have remained stable for much of the past decade. In addition, many lower-wage families hardest hit by the pandemic have been left out of the escalation of the past decade in financial asset prices and house values, he said.

“For people who have not made this trip, it seems like a perpetuation of inequality that has lasted for some time,” he said, adding that “the only way to achieve broad inflation is with a broad overheating of the economy. We have the exact opposite. The bottom third is nowhere near overheating. “

Klingelhofer said it is probably also a mistake to look at 10-year Treasury yields for signs that the economy is overheating and for inflation, since “it is not a proxy for inflation. It is just an indication of how the Fed can react, ”he said.

The yield of the 10-year Treasury TMUBMUSD10Y,

rose 28.6 basis points in the year so far to 1.199% on Friday.

But with last year’s steep price increases, is the U.S. housing market at least at risk of overheating?

“Not at current interest rates,” said John Beacham, founder and CEO of Toorak Capital, which finances apartment buildings and rental properties for a single family, including those undergoing rehabilitation and construction projects.

“Over the course of the year, more people will return to work,” said Beacham, but added that it is important for policy makers in Washington to provide a bridge for families during the pandemic, until spending on socializing, sporting events, concerts and more can seem like a time before the pandemic.

“Clearly, there will likely be an increase in short-term consumption,” he said. “But after that everything is back to normal.”

The US stock and bond markets will be virtually closed on Monday for the President’s Day holiday.

On Tuesday, the only economic information comes from the New York Federal Reserve’s Empire State manufacturing index, followed on Wednesday by a series of updates to US retail sales, industrial production, construction data and meeting minutes. of the Fed’s latest policy. Thursday and Friday bring more jobs, housing and business activity data, including sales of existing homes for January.