A party Congress was unified out of outrage after the application Robinhood and other retail stock trading companies froze some individual trades in response to a massive spike in GameStop and AMC stock powered by Internet chat rooms. Some hedge funds had bet heavily on the downfall of these companies, and the resulting volatility and Robinhood’s willingness to impose restrictions in a way that seemed to favor big investors and punish minors angered Democrats and Republicans.

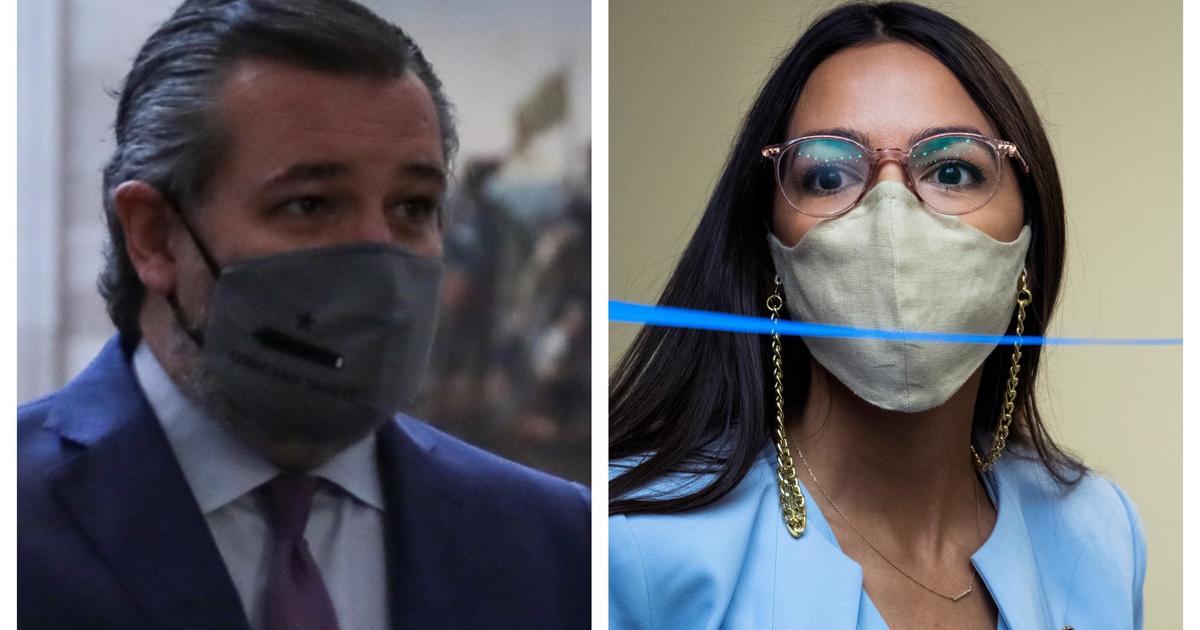

“I fully agree,” tweeted Senator Ted Cruz, one of the most conservative senators, in response to a Representative Alexandria Ocasio-Cortez’s tweet, a democratic socialist who rebuked Robinhood for deciding “to prevent retail investors from buying shares while hedge funds are freely able to trade the shares as they see fit.”

The leaders of the House and Senate committees responsible for overseeing the financial sector plan to hold hearings to examine Robinhood’s decision and the circumstances that led to changes in the market.

“We must deal with hedge funds whose unethical conduct has directly led to recent market volatility and we must examine the market in general and how it has been manipulated by hedge funds and their financial partners to benefit while others pay the price,” said Maxine Waters, chairman of the Chamber’s Financial Services Committee.

Congressman Patrick McHenry, the committee’s Republican, said in a statement that he asked Waters to call a hearing.

At the Capitol on Thursday afternoon, Cruz called for transparency and said lawmakers demanded to know why Robinhood stopped trading shares defended on Reddit by WallStreetBets and other chat rooms.

Moderate Republican Senator Pat Toomey called the retail investor freeze “very disturbing”, but he also raised concerns about how the trade frenzy would end. “By the way, this is going to end badly for most, this is a bubble, which is going to burst and will eventually drop in price,” said Toomey.

Senate Banking Committee Chairman Sherrod Brown also said he plans to hold a hearing on the matter.

“American workers have known for years that the Wall Street system is broken. They are paying the price. It is time for the SEC and Congress to make the economy work for everyone, not just for Wall Street,” his statement said.

During a television interview on Thursday, Senator Elizabeth Warren aimed directly at the United States Securities and Exchange Commission, accusing the agency of failing to articulate rules and letting the stock market become a “casino”.

“We need a SEC that comes forward, that sets out some clear rules and that is then willing to enforce those rules,” said Warren.

On Wednesday, the SEC issued a statement saying it was “monitoring ongoing market volatility” and would work with regulators to assess the situation.

On Thursday, during the White House press conference, press secretary Jen Psaki referred the SEC statement to reporters and declined to provide additional comments. On Wednesday, Psaki said members of the economic team, including Secretary Janet Yellen, were also monitoring the situation.

On Thursday night, an email from Robinhood to users of the service said it would allow “limited purchases” of GameStop and AMC titles on Friday.

Despite their common response to actions by online commerce services, tensions between political parties remained after the January 6 Capitol riots.

“I am happy to work with Republicans on this issue where there is common ground, but you almost murdered me three weeks ago, so you can stay out of it,” wrote Ocasio-Cortez in a tweet in response to Cruz’s support for his position on Robinhood.