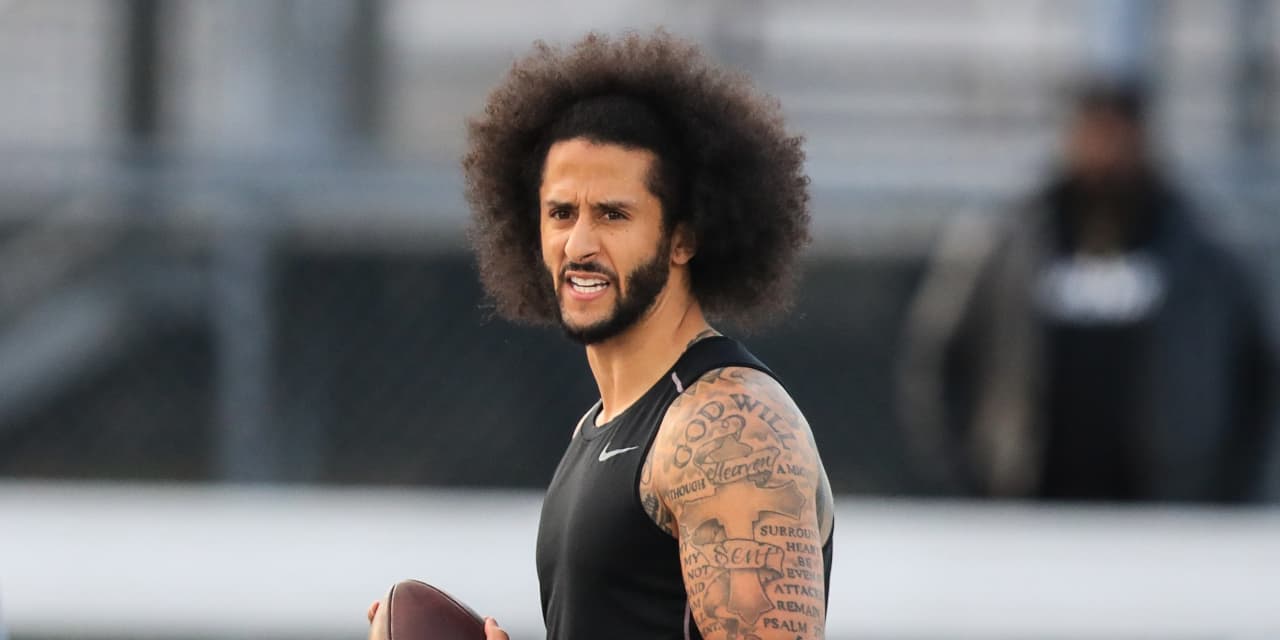

Former NFL quarterback Colin Kaepernick is the last to create a special purpose acquisition company, seeking to raise up to $ 287.5 million in an initial public offering.

According to a document with the Securities and Exchange Commission, Kaepernick – the former San Francisco 49ers defender who knelt during the national anthem to protest systemic racism and has not played in the NFL since 2016 – is the co-sponsor and co – President of Mission Advancement Corp., working in partnership with The Najafi Cos., a private equity firm.

Mission Advancement will focus on issues of justice and racial diversity and aims to acquire a consumer business with a business value of around $ 1 billion.

“The mission of the Najafi / Kaepernick partnership is to identify, acquire and promote a company with the objective of creating significant financial and social value”, states the document. “We believe that Mr. Kaepernick’s substantial business experience combined with his long-term leadership on issues of racial equity and justice will support our success in identifying a potential target company and adding transformational value to the combined entity.”

The process noted that Kaepernick worked with global brands like Nike NKE,

Disney DIS,

Netflix NFLX,

Apple AAPL,

Beats by Dre, Medium, Electronic Arts EA,

Amazon AMZN,

Audible and Ben & Jerry’s in recent years.

As an indication of its mission, the company’s board of directors is 100% black, indigenous and black, being mostly female. Directors include Google marketing executive Attica Jaques, former Apple executive Omar Johnson, and Birchbox co-founder and CEO Katia Beauchamp.

SPACs are blank check companies that have exploded in popularity in recent years. They are essentially empty-front companies looking for a company to acquire and go public, in a process faster than a traditional IPO. So far this year, there have been 131 SPACs that have raised a total of $ 39.9 billion, according to SPAC Research. This is already about half of the SPACs in the entire year 2020.

23andMe Inc. said last week that it will go public through a merger with a SPAC owned by Richard Branson, and the hedge fund Elliott Management is considering creating a SPAC.

Billionaire investor Sam Zell said on Tuesday that the SPAC craze reminds him of the late 1990s. “This is rampant speculation again, much like the dot-com boom,” he told CNBC in an interview.

Although he said that SPACs can be very effective, Zell said he fears that many will be built on unstable financial fundamentals.