Beijing reported on Monday that China’s GDP grew 2.3% last year, avoiding the recession that hit much of the world with the spread of the coronavirus pandemic. GDP in the fourth quarter grew by 6.5%, compared to the previous year.

Of great help were the Chinese government decision to invest heavily in infrastructure projects. Industrial production grew 7.3% last month compared to the previous year. And crude steel production reached a record 1.05 billion metric tons in the year, an increase of 5% over 2019.

The country cannot sustain this type of production without the iron ore, which it needs to make steel for roads, bridges and buildings. China imported 17% more iron ore last year than in 2019.

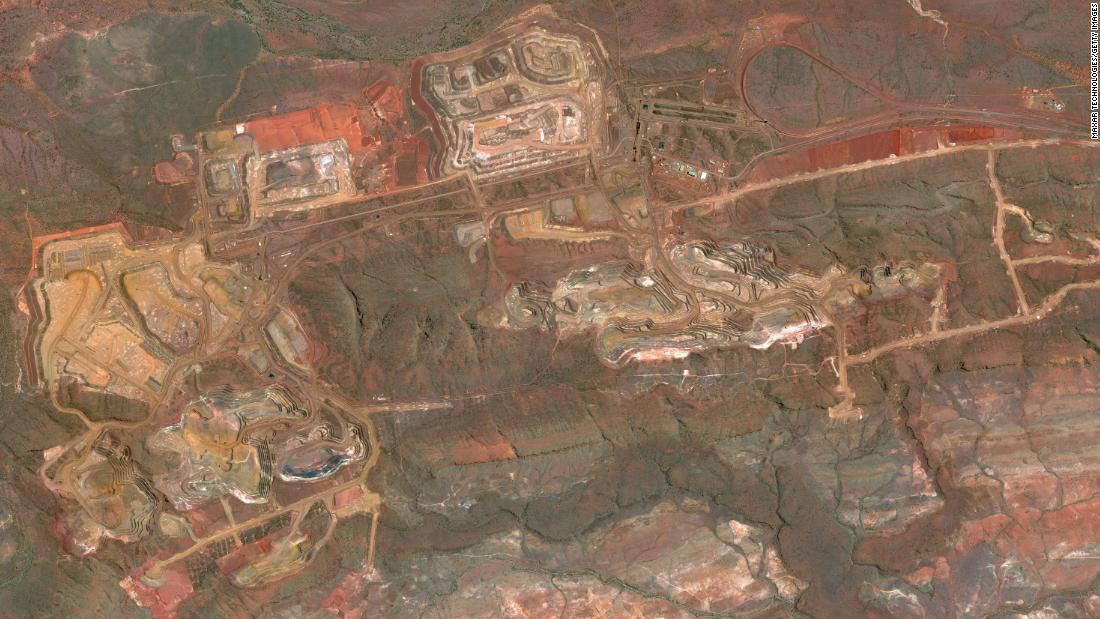

Australia is a big winner in this growing demand, accounting for about 60% of the iron ore that China imports.

“China’s impressive industrial recovery has increased demand for steel production, and Australia is a major supplier of steelmaking inputs to China,” said Sean Langcake, senior economist at Oxford Economics.

China’s dependence on Australia’s raw materials is in stark contrast to the Beijing attempts done to put pressure on Canberra. After the Australian government asked for a An international inquiry into the origins of the pandemic last year, China imposed heavy tariffs or prohibitions on imports of wine, meat, barley and apparently coal.

The country’s dependence on Australia’s iron ore, however, remains strong. Mining Giant Rio Tinto (RIVER) reported on Tuesday that shipments of the material increased 2.4% in the last quarter, helped by China’s “robust purchase”.

“In China, the industrial sector has recovered and is now at levels prior to Covid due to the rapid deployment of stimuli,” the company said in a statement.

Fortescue Metals Group (FSUGY), another major Australian iron ore miner, reported in October that strong demand from China helped the company achieve record shipments for the material. Subsequently, he informed that he signed agreements worth US $ 4 billion with the main Chinese steelmakers for the export of iron ore.

Australia is not the only country that supplies China with this vital raw material. But it is by far the biggest source, and analysts say it would be difficult to replace it if relations between the two countries worsened further.

“If iron ore shipments from Australia were restricted, China would be forced to pay a higher price for iron ore imports from elsewhere,” said Langcake.

Brazil is an option – about 20% of the iron ore that China uses comes from there. But analysts at Changjiang Futures, a Wuhan-based securities broker, point out that there are problems with this alternative. Large Brazilian mining company Valley (VALLEY), for example, has struggled with supply disruptions following a wave of coronavirus infections among its employees in the past year.

“There is still uncertainty surrounding Brazil’s supply in 2021, as its pandemic has not yet been effectively controlled and Vale SA is less mechanized than its Australian rivals,” analysts at Changjiang Futures wrote in a research note earlier this week. month.

Chinese state media also admitted that the country relies heavily on Australia for the appeal. The International Business Daily – the official newspaper of the country’s Ministry of Commerce – he suggested this in an article published in November, which pointed out that China needs to import the vast majority of the iron ore it needs to keep the economy going.

“As the Chinese economy continues to recover from the pandemic … the country’s demand for iron ore will increase further in the future,” the article said.

.Source

Related