ARK Investment, one of the fastest growing fund managers in 2020, saw its main company enter a bear market, highlighting a quick sale of growing technology-related stocks amid a persistent rise in interest rates.

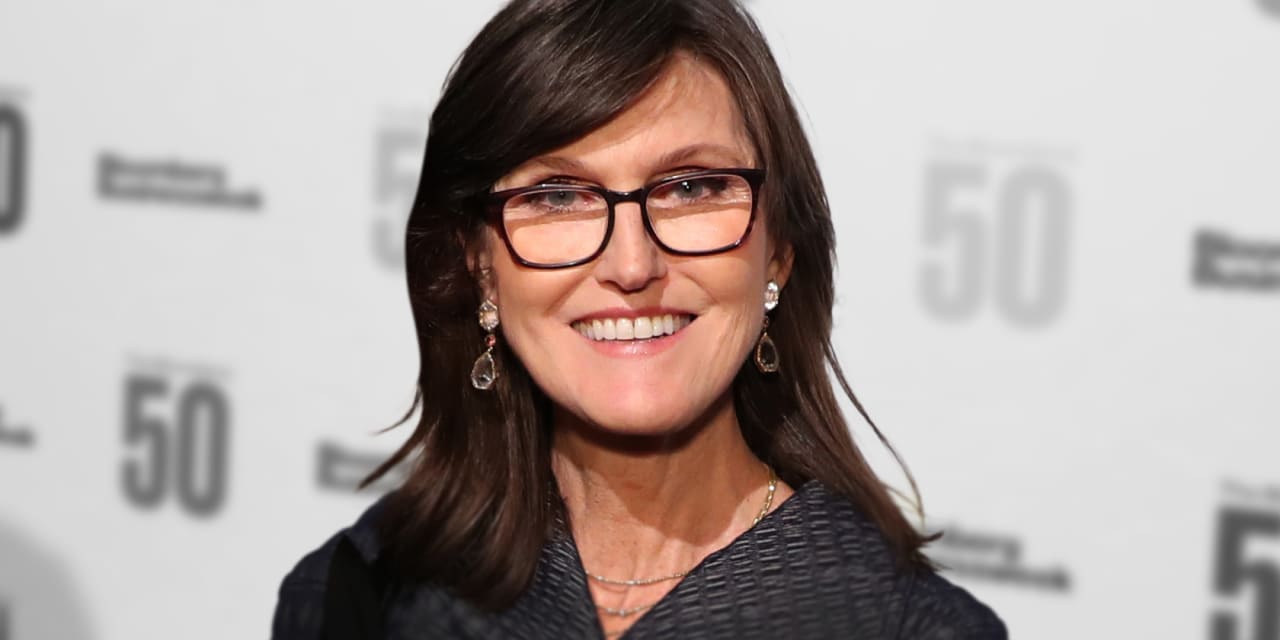

Led by the company’s CEO and founder, Cathie Wood, the ARK Innovation ARKK exchange-traded fund,

fell 6.3% on Wednesday, leaving it 20% below its $ 156.58 peak set on February 12, meeting the definition of a bear market commonly used by market technicians.

ARK Innovation ETF has assets of $ 24.6 billion, but its focus is on companies that are on the rise, including Tesla Inc. TSLA,

Square Inc. SQ,

Teladoc Health Inc. TDOC,

Zillow Group Z,

and Roku Inc. ROKU,

have proven to be a gift – and, ultimately, a disgrace – to the bottom.

The fund’s decline comes with the Nasdaq Composite COMP,

fell 2.7% to record the worst two-day skid for the high-tech index since September 8, according to Dow Jones Market Data.

Investors have avoided technology in favor of so-called value stocks, those that are considered undervalued, in relation to growth stocks, which have records or prospects for overcoming their peers.

An increase in the yield of the 10-year Treasury bills TMUBMUSD10Y,

to about 1.47% on Wednesday, it supported the rotation of technology and technology-related companies for energy and finance, which are expected to perform better as the economy recovers from the COVID-19 pandemic.

The names of the technologies are more vulnerable to a retraction in a regime of higher interest rates because these stocks do not tend to offer an income and operate in areas considered overvalued by some measures.

Wood is known for driving investments in growing names and disruptive innovations. Last year, ARK saw the assets of its seven exchange-traded funds explode more than ten times.

But now investors are questioning how the bullish fund manager will respond to richer returns and a shift to undervalued companies, as vaccine launches and the expectation of COVID aid packages help boost the stakes for less-loved sectors. from the market.

Wood told CNBC recently that she is not disturbed by yields and is anticipating a downturn, promising to double in some bets, even though rates remain high, providing a “reality check” for her strategies. It reportedly increased its stake in Zoom Video Communications ZM,

who has benefited from the work at home trend recently.

To see: Analysts say Zoom Video can continue to thrive in a vaccinated world

The reports also indicated that she bought more Tesla when the shares of the electric vehicle maker plummeted.

Ark Innovation’s shares have fallen 8.6% so far this week, maintaining a gain of less than 1% year-to-date. In comparison, the Dow Jones Industrial Average DJIA,

rose 2.2% so far in 2021, the S&P 500 SPX index,

rose 1.7% and the Nasdaq Composite Index COMP,

increased 0.8% after being hammered in the last sessions.