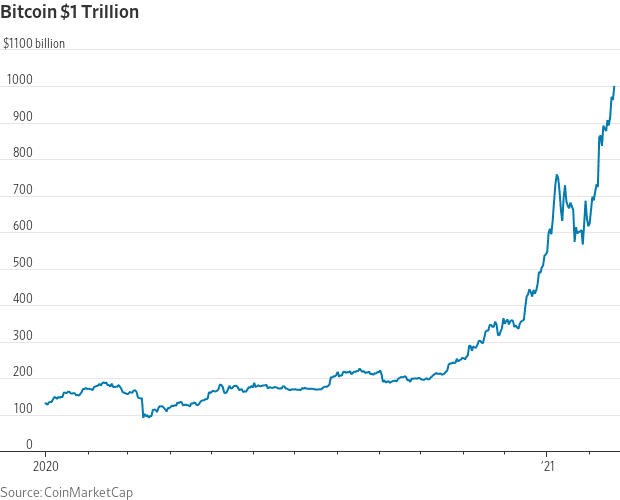

Bitcoin was building a new story on Friday and generating a ton of buzz on Wall Street and Main Street, as well as on social media platforms, while the world’s number one cryptocurrency staged a sharp rise that took its market value well above $ 1 trillion.

At the last check, a single bitcoin was traded close to a record $ 54,827.69, an increase of 5%, and was pushing the cryptography that was written in code in 2009 to a total market capitalization of $ 1 trillion.

Dow Jones market data via CoinMarketCap

The stratospheric rise of the digital asset created by a person or persons known as Satoshi Nakamoto has caused investors to put the historical movement in perspective on Twitter.

A tweet focused on the Nakamoto email that led to the birth of the digital asset, created in the wake of the 2008-09 financial crisis. Nakamoto is credited for writing the software that created the decentralized currency as a challenge to the perception that central banks were printing fiat currency, like DXY dollars,

and EURUSD euros,

with reckless abandon to cover the cracks in the financial system caused by the subprime mortgage crisis.

A trillion dollar added value is important for the blockchain-backed asset, which was worth fractions of a penny at first, but even in its early days it caught the attention of the financial world, as this Twitter tweet associated with the crypto trading platform Krakken transmits, referring to Mike Myers’ character, Dr. Evil:

Bitcoin prices are on the rise. They rose almost 90% in 2021. In comparison, GC00 gold,

rival of the digital asset as a store of value, has decreased by more than 6% since the beginning of the year.

Meanwhile, the Dow Jones Industrial Average DJIA,

is above 3% so far this year, the S&P 500 SPX index,

rose more than 4%, and the Nasdaq Composite Index COMP,

returned almost 8%.

Bitcoin’s rise since its inception is perhaps even more impressive than its recent execution, as the graph below shows.

Cameron Winklevoss, who with his twin brother Tyler made the growth of the cryptocurrency market a mission, tweeted about bitcoin’s evolution from white paper to a $ 1 trillion idea.

The Harvard-educated twins bought $ 11 million in bitcoins in 2013, according to a New York Times report, and that is worth billions now.

A tweet from Tyler Winklevoss hit hedge fund billionaire Ken Griffin, who at CNBC on Friday said he didn’t pay much attention to digital assets like bitcoin. “I just don’t spend a lot of time thinking about cryptocurrencies … I don’t see the economic basis of cryptocurrencies,” Griffin told CNBC’s “Squawk Box”. “I understand how to value a stock – the net present value of earnings – I understand how to think about exchange rates around the world,” said the founder of Citadel LLC.

Jim Bianco, president of Bianco Research, likened the bitcoin movement to Tesla’s epic race towards a trillion dollar market value. In a way, this comparison is considered appropriate because it was the electric vehicle manufacturer’s announcement last week that it was investing $ 1.5 billion in bitcoin and would end up accepting cryptocurrency for its products, which probably contributed significantly to the latter increase in the price of bitcoin.

Tesla’s stock TSLA,

has been seen as a speculative asset in its own right, similar to bitcoin, and CEO Elon Musk is seen as embodying many of the libertarian trends that underpinned the creation of cryptography 12 years ago.

And if it’s hard to really think about the scale of a $ 1 trillion asset, here’s an illustration that can put you in perspective.

To be sure, bitcoin at its total value of $ 1 trillion, representing about 60% of the value of all cryptos tracked by CoinMarketCap, still pales in comparison to gold, which boasted a total market value of around US $ 9 trillion, including jewelry and gold as exchange-traded funds.

Anthony Pompliano, co-founder and partner at Morgan Creek Digital Assets, speculated, however, that bitcoin could surpass gold in 2029.