(Bloomberg) – It is the latest corporate strategy for Tesla Inc. companies to Square Inc.: Transfer a portion of cash reserves to cryptocurrencies as digital assets become more conventional.

Still, few have gone as far as MicroStrategy Inc. Eight months after its first investment, the software company has a stake in Bitcoins worth more than $ 5 billion.

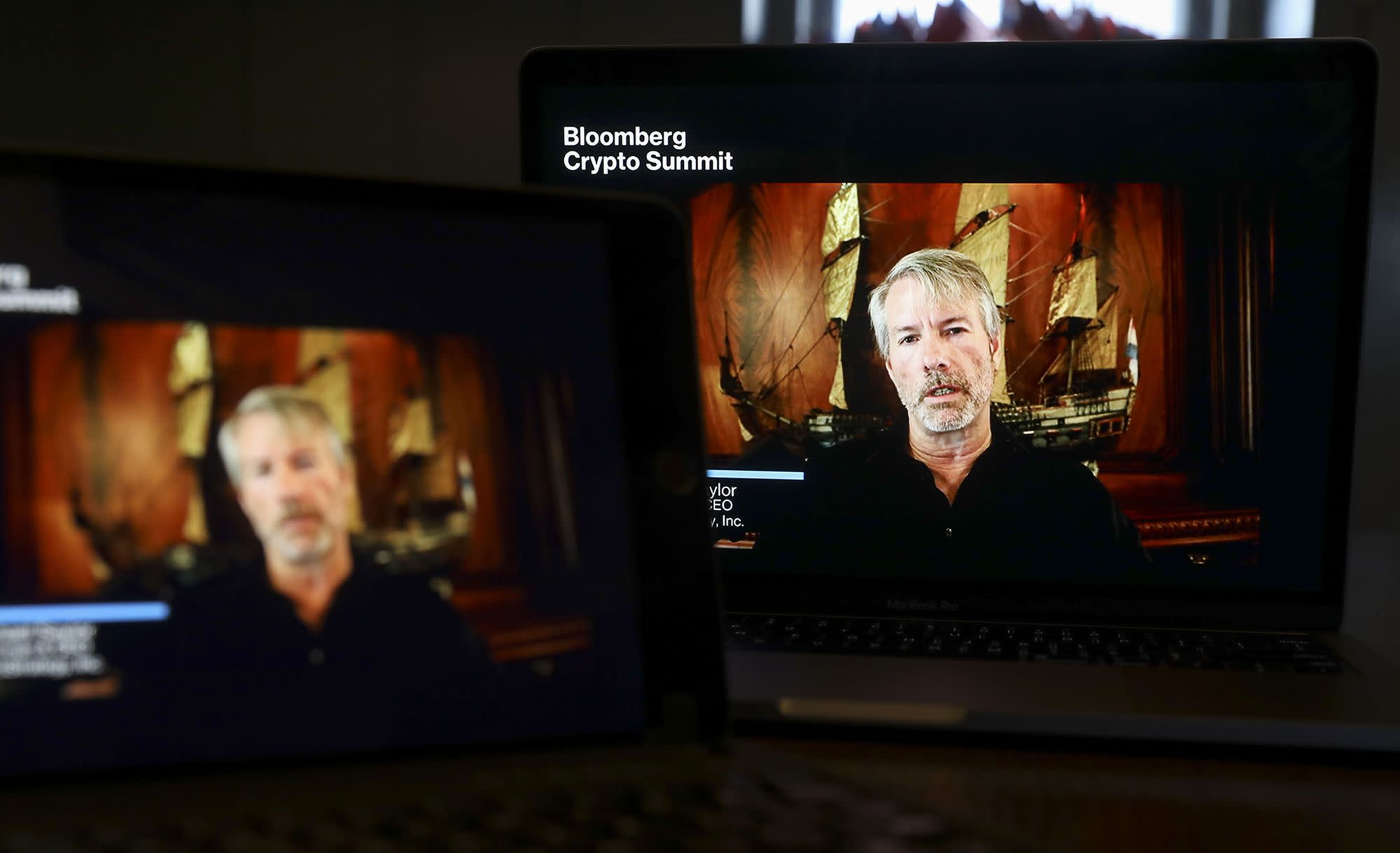

MicroStrategy’s stock has skyrocketed nearly 600% since mid-July, driving the fortune of founder Michael Saylor, a billionaire to an accounting scandal in 2000. The CEO is now worth $ 3 billion, according to the Bloomberg Billionaires Index, joining the team of the richest cryptographers in the world, a list that is not definitive as some fortunes cannot be identified or verified.

MicroStrategy’s cryptography started right after the pandemic, when the company discovered it had a cash flow problem: it was too much. After cutting advertising and laying off 400 unsuitable jobs for domestic work, the Tysons Corner company in Virginia was sitting on a $ 550 million pile with nowhere to put it. Saylor, 56, turned his attention to Bitcoin.

“People are still not sure: are we crazy or aren’t we crazy?” Saylor said. “The only way to obtain economic security is to invest in scarce assets that will not be degraded by the expansion of the currency. This is the environment that led us to decide that we should consider Bitcoin as a treasury reserve asset. “

‘Every scar’

Not everyone agrees with the strategy.

“Saylor equated Bitcoin with a bank – that’s just ridiculous,” said Marc Lichtenfeld, chief revenue strategist at Oxford Club, a financial research firm that has no stake in MicroStrategy. “When you put your money in a bank, its value doesn’t go up or down 10% a day.”

Saylor has been in conflict with investors before. In 2000, a shareholder filed a class action lawsuit against MicroStrategy, alleging that it misled investors about the company’s profits by recording revenues prematurely to inflate profits.

MicroStrategy agreed to reaffirm its revenue numbers and Saylor, once considered the wealthiest man in Washington, DC, with a fortune of $ 7 billion, lost almost everything in a matter of weeks after the shares fell 95%. He and his executive colleagues, without admitting or denying the allegations, paid the Securities and Exchange Commission $ 11 million in December 2000, including $ 1 million in fines.

“It made us careful, humble and focused,” said Saylor. “Every scar informs you, and I would not be who I am without having lived through these experiences.”

Constant Revenue

Saylor continued to run the analytical software business he founded in 1989 and oversaw annual revenue streams of around $ 500 million over the past decade, although sales have declined in recent years.

Bitcoin’s price has skyrocketed in recent months, reaching a record high of more than $ 58,000 last month, as large investors accumulated and the asset class matured.

Saylor is not concerned about Bitcoin’s volatility and said that crypto critics are lagging behind. He said he also put his own money into the digital asset, accumulating a personal equity of more than $ 1 billion.

“If you go back 10 years, how many people agreed that Facebook, Google, Apple and Amazon would own the world?” he said. “Who were the last people to accept that? Senior members of the establishment. “

Increase debt

Saylor’s appetite for acquiring Bitcoin did not stop after the company’s first purchase. When most of MicroStrategy’s cash reserves were exhausted, Saylor raised a $ 650 million corporate bond and used it to buy more.

Saylor said he would rather issue debt against future cash flow now than save to buy Bitcoin in five years, when he thinks it will be more expensive.

In February, the company raised another $ 1.05 billion in a bond offering for Bitcoin and, on March 5, announced even more purchases. On Friday, Saylor tweeted that MicroStrategy bought an additional 262 Bitcoins for $ 15 million in cash, bringing the total to around 91,326. The company’s stock closed down 2.5% to $ 784 in New York.

Read more: MicroStrategy’s CEO will consider increasing debt to buy Bitcoin

The move resulted in MicroStrategy becoming a dual-purpose company: part software maker, part Bitcoin investor. Although the company has been transparent about this change in regulatory disclosures, reconciling two distinct objectives is not something investors are used to.

“If you are a hedge fund and you want to make this type of concentrated bet, you have the right to do that,” said Lichtenfeld, but “as a software company, making this type of bet is completely irresponsible.”

‘Critical point’

Saylor said the company has always been open to investors. When MicroStrategy increased its stake in Bitcoin, it held a Dutch auction to give shareholders time to sell their shares.

“Everyone had a lot of time to digest the news and decide whether or not to go,” said Saylor.

With all the attention he has attracted, Saylor wants to do more than just defend a radical investment strategy. He has become something of a bitcoin global ambassador in recent months, appearing regularly in cryptographic podcasts and YouTube programs advocating investments in digital assets.

“This is a really critical point in human history,” he said. “We are going to build a better world as soon as people understand. We are still very far ahead. This will be the decade. “

(Updates with additional purchases in paragraph 17.)

For more articles like this, visit us at bloomberg.com

Sign up now to stay up to date with the most trusted business news source.

© 2021 Bloomberg LP