It was a difficult year for all intents and purposes. But for Bitcoin, 2020 was a wonderful time.

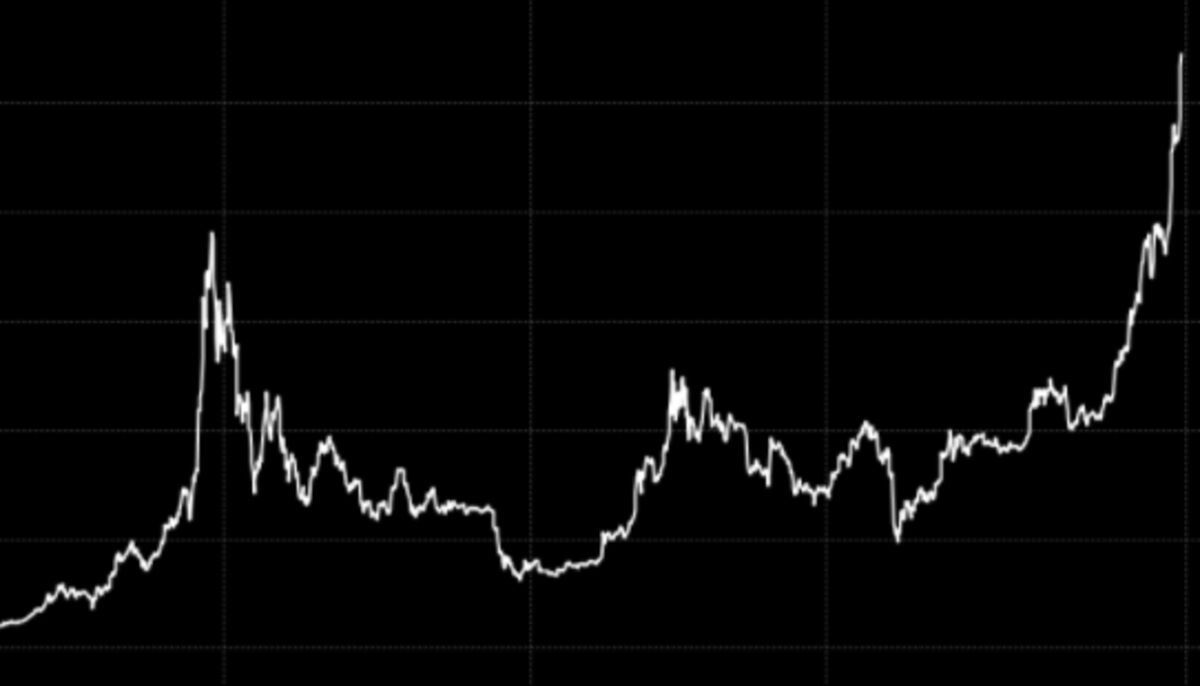

The cryptocurrency almost quadrupled, exceeding $ 20,000 for the first time, as it reached record after record. The diehards applauded it as a hedge against inflation in an era of unprecedented generosity by the central bank. Wall Street veterans of Paul Tudor Jones for Stanley Druckenmiller blessed him as an alternative asset, contributing to the recovery. And companies like MicroStrategy Inc. and Square Inc. have shifted cash reserves to cryptography in search of better returns than near zero interest rates provide.

While none of these reasons for buying Bitcoin is compatible with its origins as an alternative to fiat currencies, they point to a growing acceptance of cryptography as a class of its own assets. And that made the fanatical community make another victory lap in its search for legitimacy.

“What’s happening now – and it’s happening faster than anyone could imagine – is that Bitcoin is shifting from a marginal to a mainstream asset,” said Matt Hougan, chief investment officer at Bitwise Asset Management. “If it is becoming popular, there is so much money on the sidelines that it will have to enter and establish a position that makes me very optimistic for 2021.”

But with Bitcoin attracting more attention, it could also receive more scrutiny from regulators, says Guy Hirsch, managing director for the U.S. of the eToro online trading platform. “Despite this meteoric rise, there are some storm clouds on the horizon,” he said, including the precipitation of several last-minute actions by the outgoing Trump administration, among others.

Devotees say that, in a way, the year devastated by the pandemic proved to be the perfect environment for the digital currency. Warnings of unbridled printing of money by global central banks – some of which have begun to reveal their own interests in digital assets – have raised fears of eventual inflation, while interest rates fell to minimum levels. This prompted some investors to seek returns and protect themselves with cryptocurrencies, pushing their price to more than $ 28,000 from about $ 7,200 in early January.

Predicting where this will go is a difficult exercise. Many left the coin to die after their 2017 rally resulted in an accident the following year, a period of time sometimes referred to as the “crypto winter. ”But it increased more than 300% in 2020 and many investors say it can continue to win next year. A Deutsche Bank survey found that most see the end of 2021 higher, with 41% of respondents projecting a target between $ 20,000- $ 49,999 and 12% seeing it exceed $ 100,000, according to Jim Reid, the company’s strategist .

Previously: Treasury proposes crackdown on virtual currency transfers

What else is on the radar? For Meltem Demirors, director of strategy for digital asset manager CoinShares, there are some concerns about what Joe Biden’s new administration might mean for the cryptographic space.

“Generally, I think we have had challenges with the Dems – they prefer more regulation, more supervision,” said Demirors. “I’m a little concerned about the direction things are going,” especially with regard to antitrust lawsuits and the erosion of Internet privacy. Still, the industry has some allies, said Demirors, including Patrick McHenry, of North Carolina, and Warren Davidson, of Ohio, who, she said, are advocates of preserving consumer financial privacy.

In the future, many strategists and investors say, the sector may see more scrutiny and tighter regulation with Biden at the White House.

Much will, of course, depend on who will hold key management positions. Janet Yellen, who was appointed to serve as Treasury secretary in the Biden administration, in recent years he has warned investors about Bitcoin, saying it was a “highly speculative asset” and “not a stable store of value”. A representative did not immediately return a request for comment.

Meanwhile, Bloomberg News reported that Gary Gensler could be appointed to replace Jay Clayton on the United States Securities and Exchange Commission. Clayton’s departure from the regulator is good news for crypto fans who have seen him take a hard line over the years, suing to interrupt initial coin offers, rejecting applications for Bitcoin exchange-traded funds and launching a report of last hour lawsuit against Ripple Labs Inc. Gensler, who served as chairman of the Commodity Futures Trading Commission during the Obama administration, is a graduate advisor for the MIT Media Lab Digital Currency Initiative and teaches about blockchain technology and digital currencies.

According to eToro’s Hirsch, there is uncertainty about how the Biden government will approach cryptocurrencies, but the nominations are notable “because Yellen is notoriously anti-encryption and Gensler is known to be pro-encryption”.

“Without knowing how the authorities will seek to more robustly regulate cryptography in the coming years, it is difficult for markets to continue to grow at the same pace they are now, especially if, as some fear, regulations designed to restrict innovation rather than stimulate it. it is enacted, ”said Hirsch. “Again, clarity is the name of the game.”

– With the help of Claire Ballentine, Katherine Greifeld, Benjamin Bain, Saleha Mohsin and Sarah Ponczek