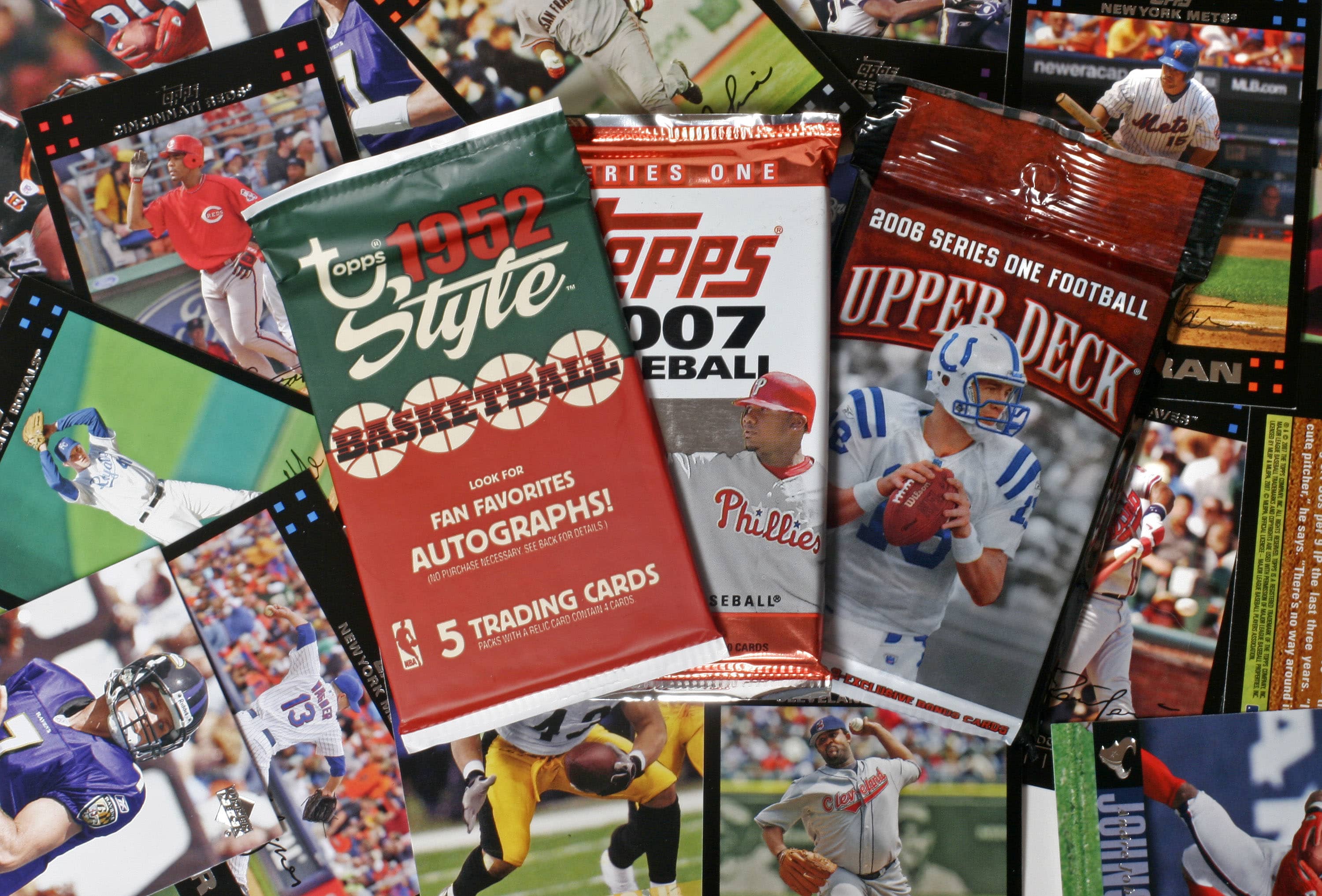

Topps collectible cards are organized for a photograph in Richmond, Virginia.

Jay Paul | Bloomberg | Getty Images

Topps, best known for its baseball cards and Bazooka candy line, agreed to go public through a merger with Mudrick Capital Acquisition Corporation II, a special-purpose acquisition company, which values Topps at $ 1 , 3 billion.

Former Disney CEO Michael Eisner will remain in the presidency of Topps. Mudrick Capital and the funds and accounts managed by GAMCO Investors and Wells Capital Management are expected to invest an additional $ 250 million in SPAC.

The deal is expected to close at the end of the second or beginning of the third quarter. The combined company will be called Topps and will be marketed on Nasdaq under the symbol “TOPP”. The New York Times Dealbook was the first to report the deal.

Topps’ net sales increased 23% in 2020, to $ 567 million, a record for the company. Although Topps is best known for its collectible sports cards, it has branched out into interactive mobile apps to connect collectors and recently expanded to non-fungible tokens, a new type of digital asset. Ownership of an NFT is registered on a blockchain, similar to the networks that support cryptocurrencies. Each NFT is unique and cannot be duplicated, just as if you had an original painting or a rare baseball card.

Other companies, like Taco Bell and Atari, also joined the NFT movement. Funko, which makes collectible vinyl figurines, recently bought an NFT startup to help it navigate the new trend. But executives told Dealbook that Topps’ business was not due to its recent expansion in NFTs, although sports-related NFTs have increased. At the end of February, Dapper Labs said consumers had already spent more than $ 230 million buying and trading highlights from the National Basketball Association.

Topps also has a gift card business called Topps Digital Services, where it works with companies like Netflix, Airbnb and Nike. Its candy segment includes iconic brands like Bazooka, Ring Pop and Baby Bottle Pop.

Tune in to CNBC at 8:15 am ET for an interview with Michael Eisner, former Disney CEO and current president of Topps, and Jason Mudrick, founder and chief investment officer of Mudrick Capital Management.