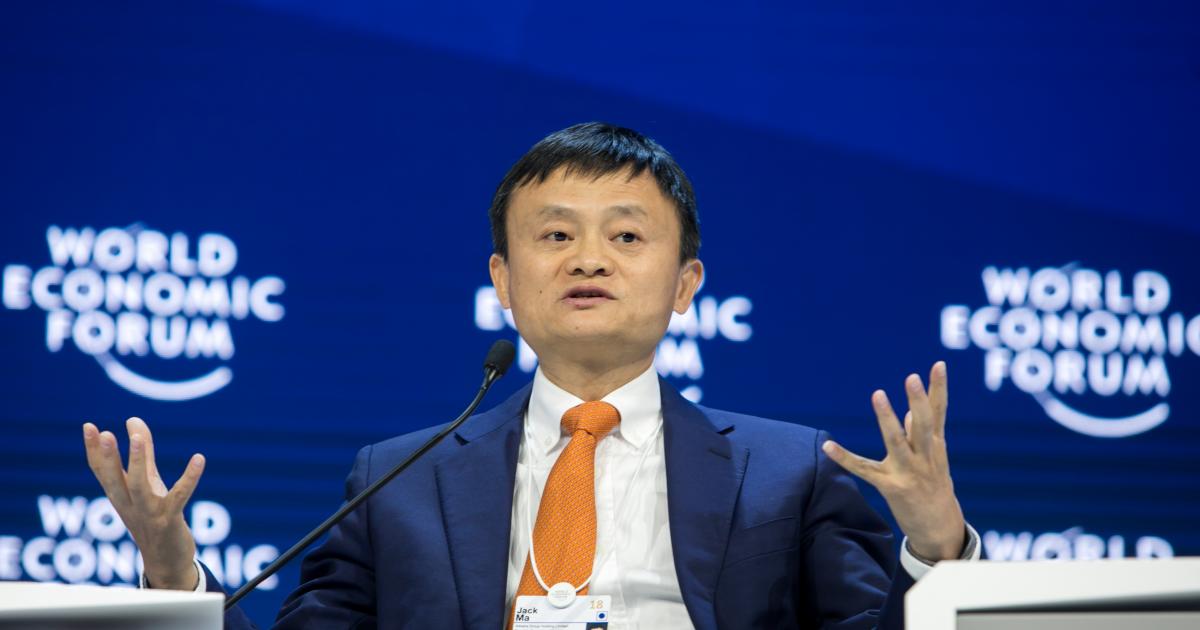

Alibaba Group Holding Ltd (NYSE: BABA) co-founder Jack Ma reappeared in public on Wednesday, causing the company’s stock to soar 5.5% in New York, but concerns remain about the Chinese company’s strained relationship with its government.

Investors are looking for more guarantees about the regulatory environment surrounding the e-commerce giant. Here’s what they’re saying:

Just showing up is not enough: William Huston, founder of Bay Street Capital Holdings, a California-based investment advisory firm, said: “We all know that just because he showed up … doesn’t necessarily explain what’s going on.” Huston’s company reduced its position on Alibaba from 8% of the portfolio to less than 1%, Reuters reported.

See also: Alibaba shoots 8.5% when Jack makes his first public appearance in months

“When you don’t know what to do in an evolving situation like this, you can’t use traditional bond analysis to make decisions. We are standing and watching, ”said David Kotok, chief investment officer at Cumberland Advisors in Florida.

Jack Ma value: Investors also value the leadership that Ma provided the Chinese conglomerate. Houston said: “One of our main criteria is leadership and we were investing in Alibaba because I really respect Jack Ma as a leader”.

Alibaba still in hot water: The reappearance of the company’s founder does not mean that Alibaba is free.

“Alibaba is not outside the doghouse, but at least it is clear that the current anti-monopoly movement is not to punish Jack Ma,” said Zhang Fushen, senior analyst at Shanghai PD Fortune Asset Management, Al Jazeera reported.

See also: Ant Financial’s IPO is Xi Jinping’s last battle with big companies

Brock Silver, managing director of Kaiyuan Capital, a Hong Kong-based private equity fund, noted that while Ma’s reappearance is a sign that his relationship with China’s regulatory authorities has stabilized, it does not mean that “the Ma’s corporate empire is worry-free, ”reported the Straits Times Singapore newspaper.

“[Ma’s] reappearance can only be a good thing. But there is no point in speculating about the viability of an Ant Group listing right now, ”said Wei Wei Chua, portfolio manager at Mirae Asset Global Investments Hong Kong, according to Straits Times. The investor was referring to the mega IPO suspended from Alibaba’s fintech arm, which fell in November.

Price action: Alibaba’s shares closed up 5.5% to $ 265.49 on Wednesday and gained 0.1% in the after-hours session in New York.

Photo courtesy: World Economic Forum via Wikimedia

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.