(Bloomberg) – A hellish week for hedge funds will be remembered for how much damage Reddit traders have done in pursuing a handful of the best-selling names on the $ 43 trillion US stock market.

But why have institutional professionals been forced to reduce their exposure to the market at the fastest pace since the March defeat, driven by the pandemic?

One reason is that their risk models told them to do this.

As a flood of retail money triggered stocks like GameStop Corp. and AMC Entertainment Holdings Inc., trading signals that guided how smart money invested flashed red.

Known as Value at Risk, this rudimentary but widely used metric showed how vulnerable the multitude of bought and sold stocks were to losses based on historical price movements.

While day traders battled Wall Street, volatility doubled at 50 companies at Russell 3000 last week. At the same time, hedge funds’ best-selling stocks have soared that they have outperformed their favorite stocks to a level rarely seen before.

With institutional clients to be concerned about, professionals have properly eliminated positions – while retail investors, who are free from such restrictions, have attacked.

“When risk models go wrong, you decrease,” said Benn Dunn, who helps these managers monitor risk as president of Alpha Theory Advisors. “What hedge funds have been holding for a long time, they need to get rid of to reduce their exposures – to put their risk in line.”

According to Morgan Stanley’s chief broker, the drop in hedge fund exposure last Wednesday was historic, according to a rule of thumb for normal distribution of statistical data.

At 11 standard deviations from the average in data dating back to 2010, this deleveraging was the fastest since the pandemic began in March – when there was the biggest change in a decade.

Value at risk, created by JPMorgan Chase & Co. in the 1990s, tries to figure out the maximum that a fund can lose in the vast majority of cases: a maximum of $ 50 million in one day, 95% of the time. Although an individual may be free to swallow the risk of a large reduction, hedge funds that serve institutional clients like pensions are generally limited by a game plan that restricts extreme excesses.

Last week’s challenge for smart money was that reliable trading standards broke. Let’s say a stock picker has a short price on GameStop and bought on Peloton Interactive Inc. Most days, when both move in the same direction, one is a cover for the other. However, the former increased while the latter plummeted – a negative and expensive co-movement.

“If you’re sold in one and bought in something else, and the correlation decreases, that actually increases the risk,” said Melissa Brown, global head of applied research at Qontigo, which provides tools for risk analysis.

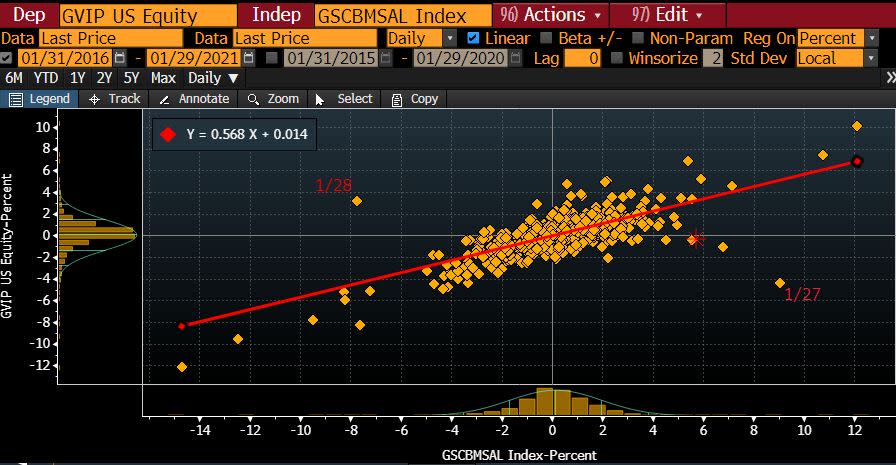

On Wednesday, an exchange-traded fund that tracks hedge fund darlings (GVIP) moved seven standard deviations from the mean with respect to a basket from Goldman Sachs Group Inc. of Russell 3000 shares with greater overdraft interest. Based on 250-day data, this is outside the statistical norm.

Of course, this is based on a normal distribution of data, which is notoriously unsustainable, especially in complex modern markets. But it does offer a simplified illustration of how the retail crowd caused unprecedented volatility in the institutional cohort.

There are several interconnected factors of deleveraging and the dust has not settled yet, as the retail team charges again for the shorter names. In addition to those forced to cut positions as higher volatility increases VaR, customer redemptions and margin calls may also have exerted pressure.

But removed, the frenzy of the week could be another sign of a worrying trend in the financial markets: less statistically likely movements are happening more often, something known as thicker tails.

“I’ve seen sales in all kinds of places,” said Dunn on Friday. “You are seeing things in the market that don’t make sense.”

For more articles like this, visit us at bloomberg.com

Subscribe now to stay up to date with the most trusted business news source.

© 2021 Bloomberg LP