(Bloomberg) – Six months after the Trump administration dealt a crushing blow to Huawei Technologies Co.’s smartphone business, the Chinese telecommunications giant is turning to less glamorous alternatives that could eventually offset the decline of its biggest revenue contributor.

Among its newest customers is a fish farm in eastern China that is twice the size of New York’s Central Park. The farm is covered with tens of thousands of solar panels equipped with Huawei inverters to protect your fish from excessive sunlight while generating power. About 370 miles west in Shanxi Province, rich in coal, wireless sensors and cameras deep in the earth, monitor oxygen levels and possible machine malfunctions at the mine – all provided by the technical titan. And next month, a brand-new electric car with its sensor handle will be launched at China’s largest auto show.

Once the world’s largest smartphone maker, the Chinese company has seen a series of U.S. sanctions almost obliterate its lucrative consumer business. With the Biden administration keeping the pressure on Huawei, billionaire founder Ren Zhengfei directed the company to increase its list of business customers in transportation, manufacturing, agriculture and other sectors. Huawei is the world’s leading supplier of inverters and is now betting on increasing these sales together with its cloud services and data analysis solutions to help the business survival of 190,000 employees.

“It is very unlikely that the United States will remove us from the Entity List,” Ren said last month at the opening of a mining innovation lab partly sponsored by Huawei. “At the moment, we just want to work harder and continue looking for new opportunities to survive.”

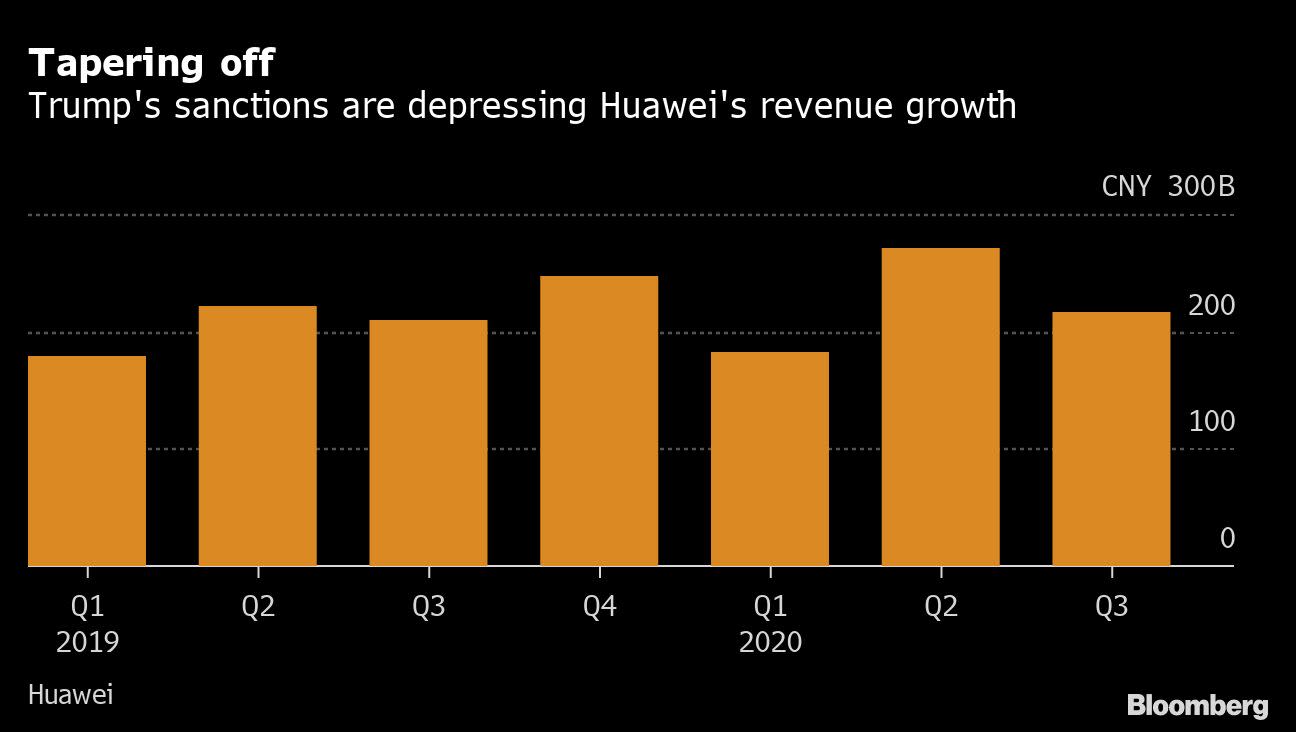

Ren said the new initiatives could make up for the fall in his cellphone business “more or less this year”, although the company has refused to provide specific numbers. Its consumer unit generated revenue of 256 billion yuan ($ 39 billion) in the first six months of 2020, more than half of the company’s total. It managed “marginal growth” in sales and profit last year, thanks to record orders for 5G base stations and strong smartphone sales in the first half.

Huawei has been exploring business opportunities in addition to telecommunications equipment and smartphones for years, but efforts have taken on a new urgency after phone shipments fell 42% in the last three months of 2020, largely due to a Trump-era order which cut its ability to obtain the most advanced semiconductors.

The Biden administration has informed some suppliers about stricter conditions on previously approved export licenses, banning items for use on or with 5G devices, according to people familiar with the move. On Friday, the United States Federal Communications Commission also added Huawei to a list of companies whose telecommunications and video equipment “pose an unacceptable risk to national security”.

Read more: How Huawei landed at the center of the global technology dispute: QuickTake

The U.S. ban has had a limited impact on Huawei’s emerging businesses, as most of the necessary components are available from Chinese suppliers, according to a person directly involved in the initiative. To meet growing demand from contractors, including Huawei, local suppliers are getting better performance from mature technologies that Washington has not banned, the person said, refusing to be identified to discuss internal issues.

The most advanced chips from Huawei’s inverters, used to convert the electrical output of solar panels, feature 28-nanometer technology, which Chinese companies are able to manufacture. Other components, such as power modules, can be made with technology of 90 nm or more. Yangzhou Yangjie Electronic Technology Co. and China Resources Microelectronics Ltd. are among the largest producers of power diodes in China.

Each inverter – slightly larger than an external central air-conditioning unit – can be sold for more than 20,000 yuan, more than Huawei’s latest state-of-the-art Mate X2 folding phone. The company is planning to launch more of its photovoltaic inverters, as pressure from Beijing for carbon emissions at the world’s second largest economic peak by 2030 to generate investments in renewable energy.

Like its solar inverter business, the chips needed for Huawei’s automotive systems are less sophisticated than cell phone processors and can be partially purchased from European suppliers, according to a person familiar with the matter. This allowed Huawei to double its position in the auto industry, transferring engineers from other business units to work on sensors for autonomous cars and power units for electric vehicles.

While the company denied that it plans to launch EVs under its own brand, Huawei has worked with several manufacturers to test its autonomous driving and driver-car interaction technologies. Its entertainment features can be found in Mercedes-Benz cars and the company has teamed up with domestic electric car makers, such as BAIC BluePark New Energy Technology Co., to develop smart car systems. The first model in partnership with the Chinese EV manufacturer, the Arcfox αS HBT, will be presented at Auto Shanghai 2021 in April.

Another initiative called 5GtoB involves the deployment of Huawei’s 5G technology in areas ranging from healthcare to aircraft manufacturing. The company helped China build the world’s largest 5G network, supplying more than half of the 720,000 base stations operating across the country. Now it is trying to use the country’s 5G connectivity to help companies hit by the pandemic to automate factory lines – joining tech giants like Xiaomi Corp. and Alibaba Group Holding Ltd. in an attempt to modernize manufacturing – and digitize sectors that were previously labor intensive, such as mining.

Huawei has signed more than 1,000 5GtoB agreements in more than 20 sectors with the help of operators and telecommunications partners, according to rotating president Ken Hu. Online education, entertainment and transportation are among the sectors he plans to explore, he said. In January, the company gave smartphone czar Richard Yu a new role in running its rapidly growing cloud and AI business.

“The adoption of 5G in mining, medical services and manufacturing is becoming clearer and some of the applications are being used across the country,” said Liu Liehong, deputy minister of industry and information technology, at an industry event in Shanghai last month.

Ren is personally leading the expansion into mining, meeting with local officials and inspecting coal mines in Shanxi province. “Most information technology companies do not think of mining as a field where they can make market discoveries, but we do,” the billionaire told reporters last month. “China has about 5,300 coal mines and 2,700 ore mines. If we can serve these more than 8,000 mines well, we can expand our services to mines outside of China. ”

Read more: China’s coal industry struggles to survive in a greener world

While Huawei is betting that inverters, electronic mining solutions and smart car software can make up for the decline of smartphones, its long-term future – and its ability to continue fueling the launch of 5G in China – remains hazy. Its subsidiary HiSilicon had been the country’s most capable chipset designer, making the high-end processors that power the company’s smartphones and wireless base stations, before Washington cut off access to the latest chip design software and contracted manufacturers, such as Taiwan Semiconductor Manufacturing Co.

For now, the company has told its wireless customers that it has enough communication chips to support the construction of base stations in 2021. But it is unclear how long these stocks can last and what options Huawei has when those stocks eventually run out. . Wireless operators have been cautious about building 5G and there is “a lot of uncertainty” whether Huawei will be able to continue providing equipment over the long term, wrote Jefferies analyst Edison Lee in a note earlier this month.

“The ongoing political friction has cast shadows on the business operations of Huawei and other Chinese companies for the foreseeable future and strategic investment in emerging technologies is the key to sustainable growth of Huawei’s business,” said Charlie Dai, principal analyst at Forrester Research Inc.

(Updates with the FCC designation in the seventh paragraph, analyst comment in the penultimate paragraph)

For more articles like this, visit us at bloomberg.com

Sign up now to stay up to date with the most trusted business news source.

© 2021 Bloomberg LP