The frantic action of stock prices like GameStop Corp. it has led many retail brokers in the past few days to impose a series of restrictions on commercial activity.

But there are still several ways for investors to gain exposure to the GameStop GME,

and other companies like AMC Entertainment Holdings, AMC,

even some analysts warn investors to be more than a dose of caution.

“People who own them or are considering buying them should be aware of the risk they are taking,” Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research, told MarketWatch by email.

Read: Here are the biggest pressures on the stock market, including GameStop and AMC

“If they think GME is going to go up, then it’s their decision, even though we have a sell recommendation for the shares. People think of index ETFs as static, but clearly they are not, ”he said.

See now: Pelosi says Congress will be part of GameStop’s scrutiny

Rosenbluth’s comments serve as a call to raise awareness among investors, including what they own. They come in the middle of a fight between individual investors and Wall Street hedge funds that lasts for days, causing ripple effects in the markets.

On Wednesday, GameStop closed at a record $ 347.51 after rising 135%, while AMC’s stock quadrupled in price. The unusual price movement has left people inside and outside Wall Street concerned that a group of investors encouraged by conversations in chat forums like Reddit may be wreaking havoc on the market.

“Investors looking for ETF diversification benefits need to be

attentive to what is inside to avoid taking undue risks, ”wrote Rosenbluth, CFRA.

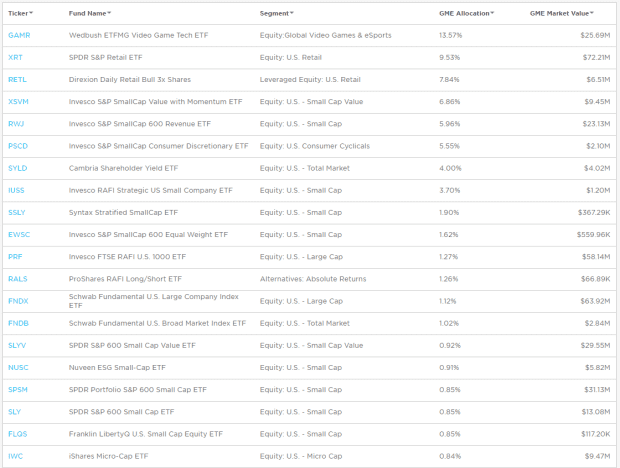

For example, he noted that the popular SPDR S&P Retail Fund XRT fund,

which is usually referred to by its XRT symbol, had a huge jump on GameStop as a proportion of its holdings, through its stratospheric climb, representing 20% of the fund.

ETF.com

“XRT with equal weights is now being dominated by GME,” wrote Rosenbluth in a note.

CFRA also says that Wedbush ETFMG Video Games Tech ETF GAMR,

has a 14% position on GameStop.

Another thing to consider, Rosenbluth said, is that when looking for ETFs to gain exposure to GameStop, or other popular stocks highlighted by online forums, some ETFs are now under-exposed to GameStop, and others due, after their sudden growth.

GameStop’s market cap was $ 17 billion at the last check, after reaching a maximum market value of about $ 24 billion on Wednesday, an impressive increase from its $ 1.3 billion estimate. to the beginning of 2021.

Other ETFs with GameStop exposure include Direxion Daily Retail Bull 3x Shares RETL,

Invesco S&P SmallCap Value with Momentum ETF XSVM,

Invesco S&P SmallCap 600 Revenue ETF RWJ,

and Invesco S&P SmallCap Consumer Discretionary ETF PSCD,

ETF.com

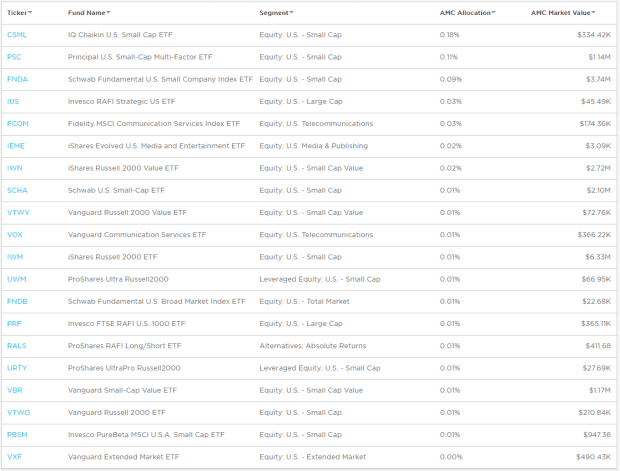

For AMC Entertainment Holdings, there are 27 ETFs that have exposure, with IQ Chaikin US Small Cap ETF CSML,

Principal US Small-Cap Multi-Factor ETF PSC,

Fundamental Schwab US Small Company Index FNDA,

and Invesco RAFI Strategic US ETF IUSS,

representing the major funds, according to ETF.com.

In Thursday’s trading, markets mainly tried to get rid of a considerable slowdown on Wednesday, partly inspired by concerns about the indirect effects of wild trade AMC, GameStop and others.

The DJIA of the Dow Jones Industrial Average,

and the S&P 500 SPX index,

were climbing and on track to recover much of the losses from their worst fall in one day in three months.