Higher rates are beginning to overshadow the bullish mood in corporate stocks and bonds.

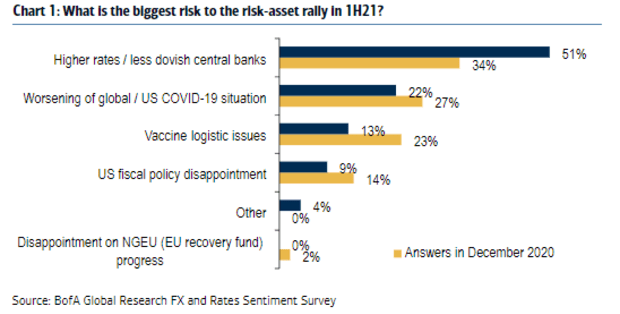

More than half of the fund managers consulted by BofA Global Research in January say that higher interest rates and a less accommodative monetary policy represent the greatest danger that could hinder the rise of risky assets in the first half of this year.

“Combined with rising speculation about reduced Fed asset purchases, given the much more significant fiscal support to come in the U.S., it makes investors perfectly aware of the risk that higher rates pose for risky assets,” said Ralf Preusser, an interest rate strategist at BofA Global Research.

This may come as no surprise, given the Federal Reserve’s huge role in support markets since last March, preventing a sharp drop in asset values precipitated by fears surrounding the economic impact of the pandemic.

However, these concerns gained ground after a sharp increase in long-term U.S. government bond yields in January, with the 10-year rate TMUBMUSD10Y,

rising more than 20 basis points since the beginning of the year. Its increase threatened to raise borrowing costs in fee-sensitive sectors of the economy and potentially undermine the relative attraction of risky assets.

So far, stocks have ignored the modest rate hike. The S&P 500 SPX,

and Dow Jones Industrial Average DJIA,

are still holding on to modest gains this month, a period that also saw stock benchmarks set a new record.

Watch: This is where the market sees the next return of the US Treasury in 10 years

Still, yields could have more room to rise and tighten financial conditions, with fears growing from another “tantrum,” a reference to how former Fed Chairman Ben Bernanke’s mere suggestion of a possible reduction in his purchases of assets caused bond yields to spiral upward.

Atlanta Fed President Raphael Bostic and some senior Fed officials alluded to the possibility of slowing the central bank’s asset purchase pace if the economy recovers faster than expected this year.

But the recent guidance from Fed Chairman Jerome Powell and other members of the Fed’s Board of Governors suggested that this conversation was premature.

Read: The US bond market may face the risk of a ‘tantrum crisis’ after the second round of the Georgia Senate, says Jefferies